- Hong Kong

- /

- Specialty Stores

- /

- SEHK:3836

Here's What We Learned About The CEO Pay At China Harmony Auto Holding Limited (HKG:3836)

This article will reflect on the compensation paid to Fenglei Liu who has served as CEO of China Harmony Auto Holding Limited (HKG:3836) since 2015. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for China Harmony Auto Holding

How Does Total Compensation For Fenglei Liu Compare With Other Companies In The Industry?

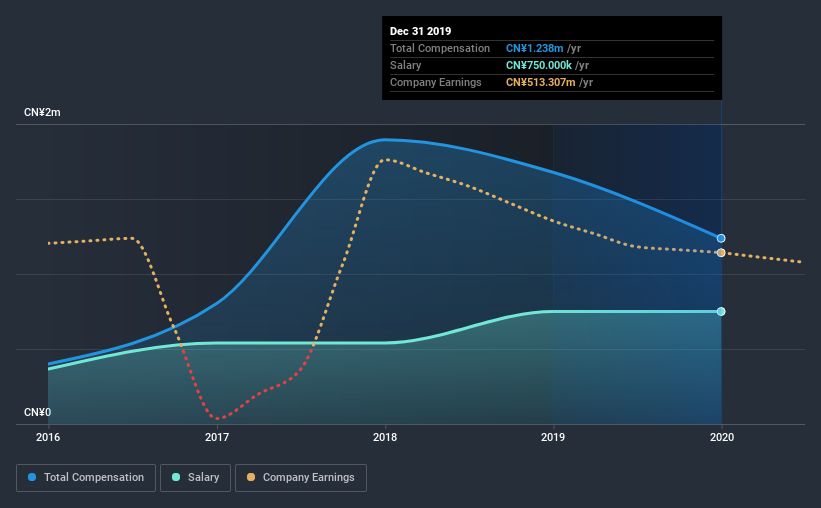

According to our data, China Harmony Auto Holding Limited has a market capitalization of HK$6.0b, and paid its CEO total annual compensation worth CN¥1.2m over the year to December 2019. We note that's a decrease of 26% compared to last year. Notably, the salary which is CN¥750.0k, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between HK$3.1b and HK$12b, we discovered that the median CEO total compensation of that group was CN¥1.9m. That is to say, Fenglei Liu is paid under the industry median. Furthermore, Fenglei Liu directly owns HK$3.0m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥750k | CN¥750k | 61% |

| Other | CN¥488k | CN¥928k | 39% |

| Total Compensation | CN¥1.2m | CN¥1.7m | 100% |

On an industry level, roughly 90% of total compensation represents salary and 9.6% is other remuneration. In China Harmony Auto Holding's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at China Harmony Auto Holding Limited's Growth Numbers

Over the last three years, China Harmony Auto Holding Limited has shrunk its earnings per share by 1.1% per year. Its revenue is up 5.4% over the last year.

Its a bit disappointing to see that the company has failed to grow its EPS. The fairly low revenue growth fails to impress given that the EPS is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has China Harmony Auto Holding Limited Been A Good Investment?

Given the total shareholder loss of 5.2% over three years, many shareholders in China Harmony Auto Holding Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we noted earlier, China Harmony Auto Holding pays its CEO lower than the norm for similar-sized companies belonging to the same industry. EPS growth has failed to impress us, and the same can be said about shareholder returns. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

Shareholders may want to check for free if China Harmony Auto Holding insiders are buying or selling shares.

Important note: China Harmony Auto Holding is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading China Harmony Auto Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3836

China Harmony Auto Holding

An investment holding company, engages in the sale of automobiles in Mainland China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives