3 Asian Penny Stocks With Market Caps Under US$500M To Watch

Reviewed by Simply Wall St

Amid easing trade tensions and hopes for interest rate cuts, Asian markets have shown resilience, with notable gains in major indices like Japan's Nikkei 225 and China's CSI 300. In this context, the term 'penny stocks' may seem outdated, but these smaller or newer companies continue to offer intriguing opportunities due to their affordability and growth potential. This article will explore three such penny stocks that stand out for their financial strength and potential for significant returns.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.04 | THB3.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.63 | HK$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.63 | SGD255.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.19 | HK$1.99B | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.95 | THB1.4B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.64 | THB9.37B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.76 | SGD1.03B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 973 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

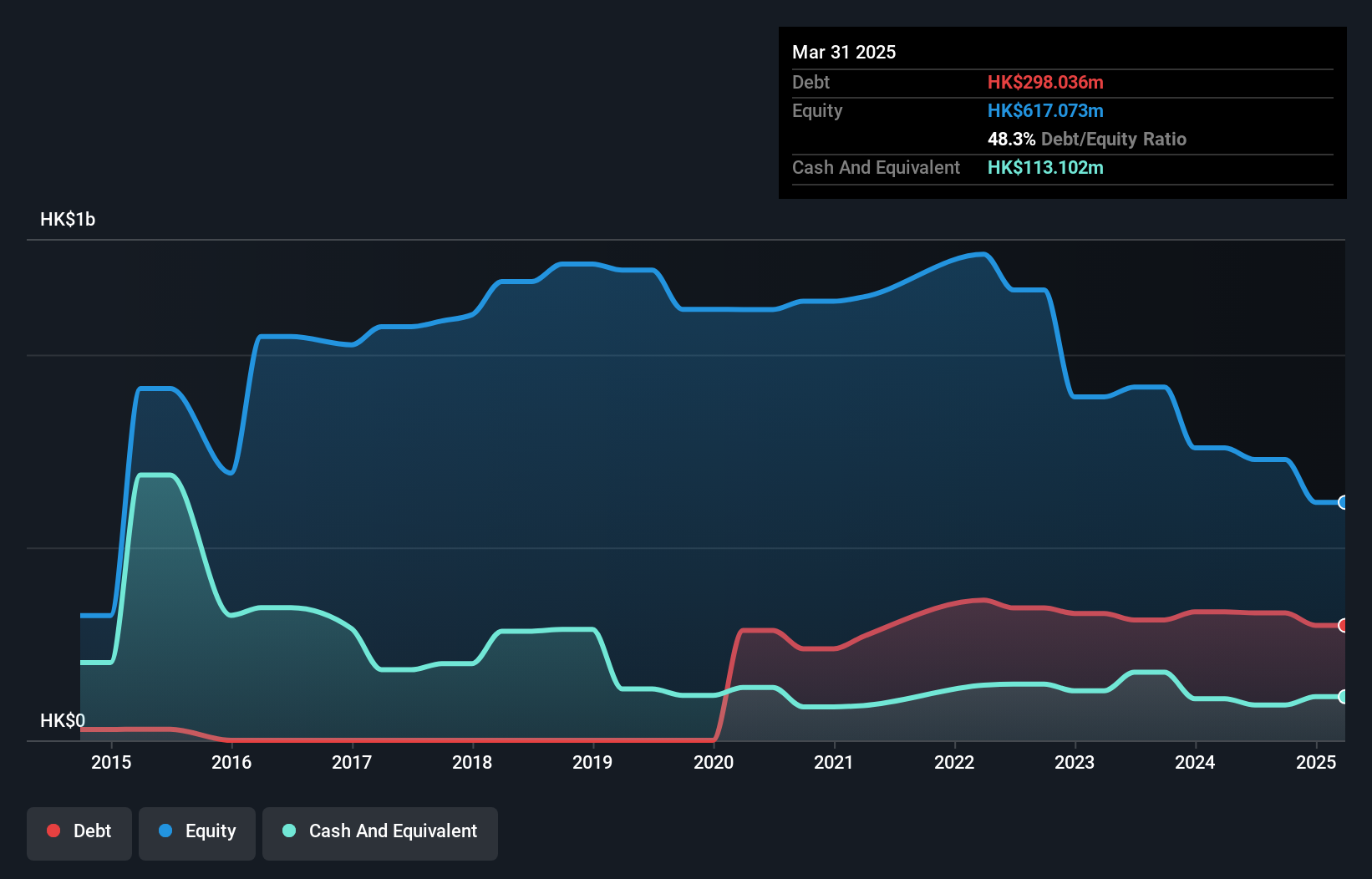

Hong Kong Robotics Group Holding (SEHK:370)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Kong Robotics Group Holding Limited is an investment holding company that trades in electronic appliances across the People’s Republic of China, Singapore, and Hong Kong, with a market cap of HK$3.30 billion.

Operations: The company's revenue is primarily derived from building construction contracting (HK$72.24 million), with additional contributions from geothermal energy (HK$11.43 million), customised technical support (HK$11.11 million), centralised heating (HK$9.95 million), property investment (HK$6.28 million), and money lending (HK$5.08 million).

Market Cap: HK$3.3B

Hong Kong Robotics Group Holding Limited, with a market cap of HK$3.30 billion, is currently unprofitable but maintains a positive cash runway for over three years due to its free cash flow. The company reported sales of HK$116.08 million for the year ending March 2025, down from the previous year, with significant losses increasing at an annual rate of 16.2%. Recent executive changes include the appointment of Mr. Ng Cheuk Him as CFO and Company Secretary following Mr. Ho Yu's resignation. Despite auditor concerns about its going concern status, a procurement agreement for security robots worth RMB 300 million offers potential revenue growth opportunities.

- Dive into the specifics of Hong Kong Robotics Group Holding here with our thorough balance sheet health report.

- Explore historical data to track Hong Kong Robotics Group Holding's performance over time in our past results report.

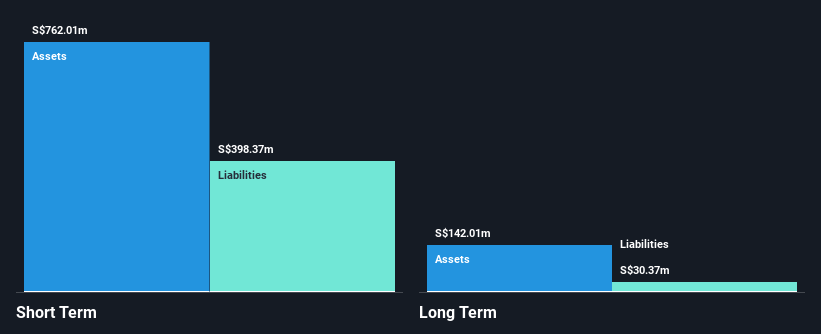

BRC Asia (SGX:BEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BRC Asia Limited, with a market cap of SGD1.03 billion, specializes in the prefabrication of steel reinforcement for concrete across various countries including Singapore, Australia, and others internationally.

Operations: The company generates its revenue from two main segments: Trading, which accounts for SGD255.23 million, and Fabrication and Manufacturing, contributing SGD1.18 billion.

Market Cap: SGD1.03B

BRC Asia Limited, with a market cap of SGD1.03 billion, is involved in the prefabrication of steel reinforcement and has demonstrated strong financial health. Its earnings grew by 10.3% last year, surpassing industry averages, although below its five-year growth rate. The company maintains high-quality earnings and a satisfactory net debt to equity ratio of 19.6%, with debt well covered by operating cash flow at 35.1%. Recent contracts worth SGD570 million for Singapore Changi Airport's Terminal 5 highlight BRC's key role in infrastructure projects. However, the dividend track record remains unstable despite recent affirmations of an interim dividend payment.

- Get an in-depth perspective on BRC Asia's performance by reading our balance sheet health report here.

- Understand BRC Asia's earnings outlook by examining our growth report.

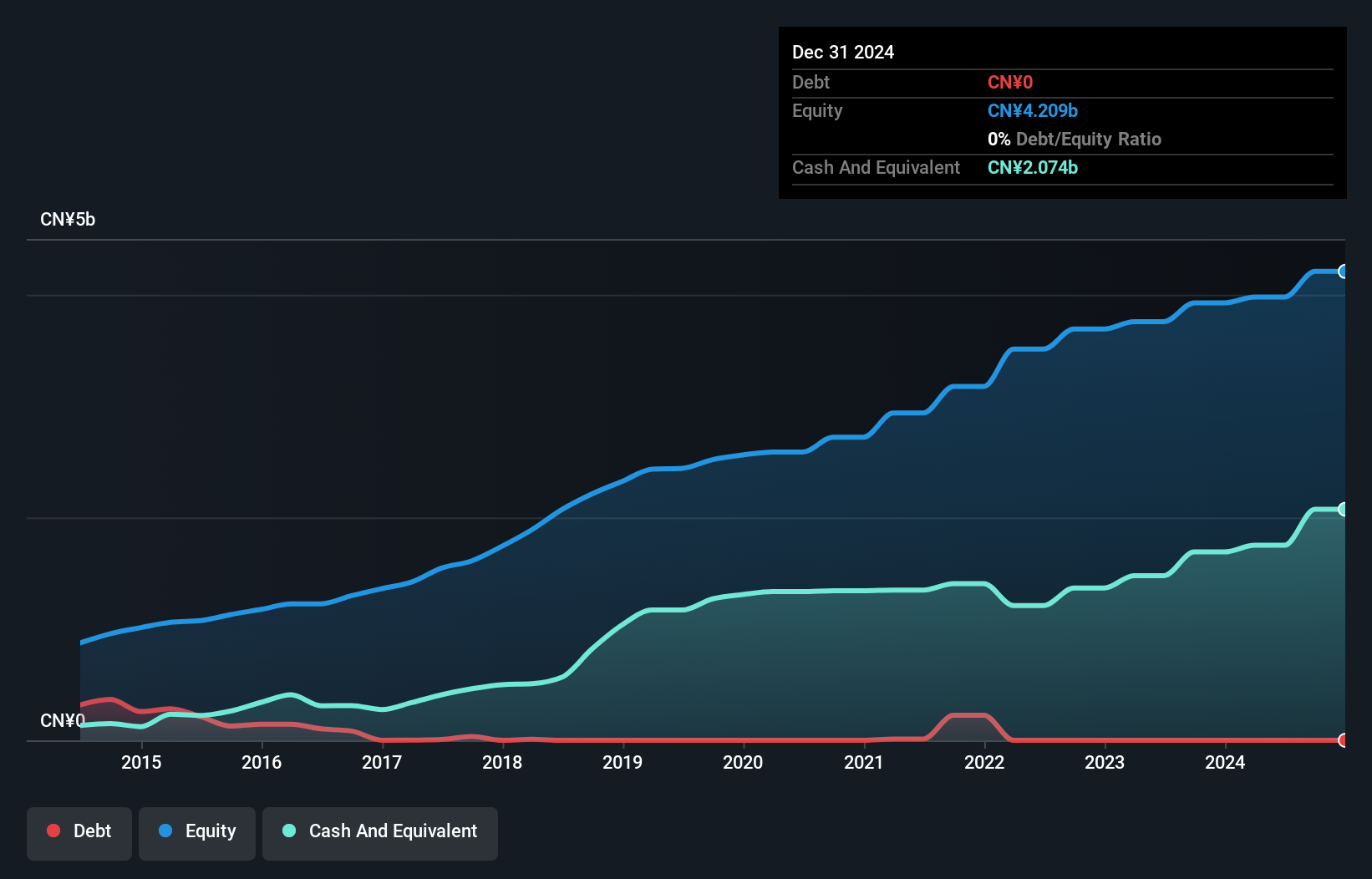

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals across the People’s Republic of China and internationally, with a market cap of SGD715.04 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, which generated CN¥4.32 billion, followed by Heating Power at CN¥194.94 million and Waste Treatment at CN¥27.89 million.

Market Cap: SGD715.04M

China Sunsine Chemical Holdings Ltd., with a market cap of SGD715.04 million, showcases financial robustness as it operates debt-free and maintains high-quality earnings. The company reported CN¥1.69 billion in sales for the first half of 2025, with net income rising to CN¥242.7 million from the previous year, reflecting strong profit growth of 30.3%. Its short-term assets significantly exceed liabilities, indicating solid liquidity management. Despite an unstable dividend history, recent announcements include a tax-exempt interim dividend and a special dividend marking its industry anniversary, underscoring shareholder value focus amidst stable weekly volatility of 5%.

- Unlock comprehensive insights into our analysis of China Sunsine Chemical Holdings stock in this financial health report.

- Evaluate China Sunsine Chemical Holdings' prospects by accessing our earnings growth report.

Seize The Opportunity

- Click through to start exploring the rest of the 970 Asian Penny Stocks now.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QES

China Sunsine Chemical Holdings

An investment holding company, manufactures and sells specialty chemicals in the People’s Republic of China, rest of Asia, America, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion