- Hong Kong

- /

- Retail Distributors

- /

- SEHK:370

The China Best Group Holding (HKG:370) Share Price Is Down 57% So Some Shareholders Are Wishing They Sold

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of China Best Group Holding Limited (HKG:370) have had an unfortunate run in the last three years. Sadly for them, the share price is down 57% in that time.

See our latest analysis for China Best Group Holding

China Best Group Holding isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, China Best Group Holding's revenue dropped 6.9% per year. That is not a good result. The share price decline of 25% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

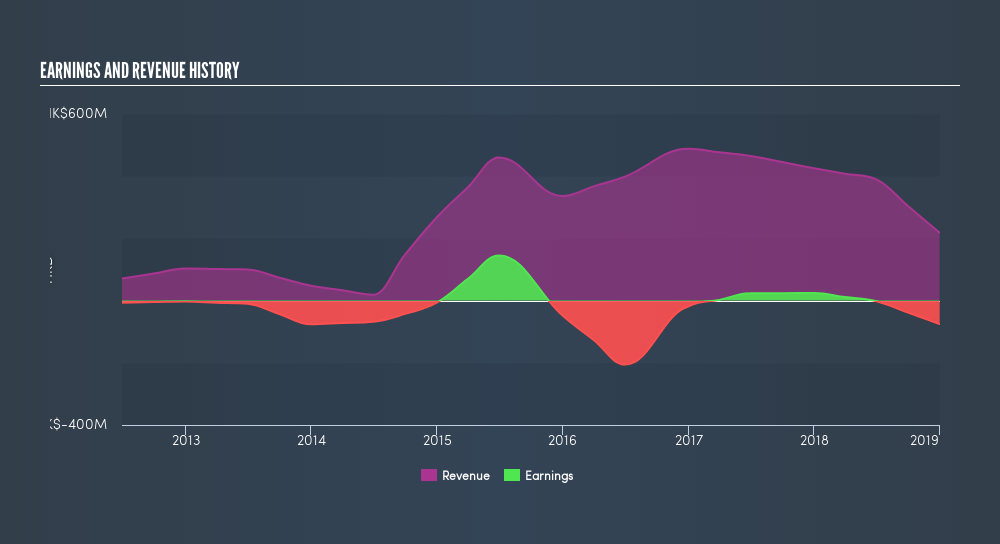

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

It's good to see that China Best Group Holding has rewarded shareholders with a total shareholder return of 8.6% in the last twelve months. That's better than the annualised return of 5.9% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:370

Hong Kong Robotics Group Holding

An investment holding company, trades in electronic appliances in the People’s Republic of China, Singapore, and Hong Kong.

Mediocre balance sheet very low.

Similar Companies

Market Insights

Community Narratives