- Hong Kong

- /

- Retail Distributors

- /

- SEHK:370

China Best Group Holding Limited (HKG:370) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

Unfortunately for some shareholders, the China Best Group Holding Limited (HKG:370) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

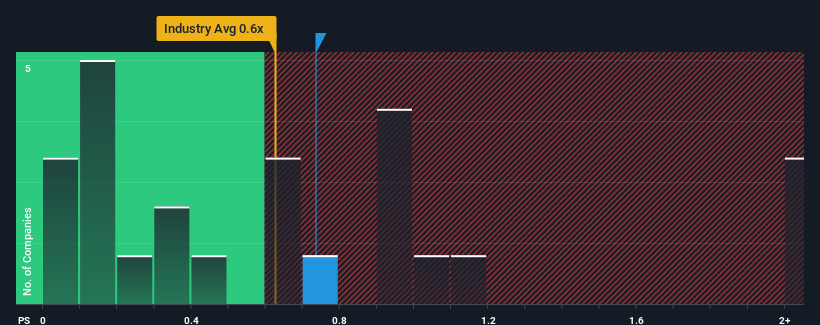

Although its price has dipped substantially, there still wouldn't be many who think China Best Group Holding's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Hong Kong's Retail Distributors industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for China Best Group Holding

What Does China Best Group Holding's Recent Performance Look Like?

As an illustration, revenue has deteriorated at China Best Group Holding over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for China Best Group Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is China Best Group Holding's Revenue Growth Trending?

In order to justify its P/S ratio, China Best Group Holding would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 50%. This means it has also seen a slide in revenue over the longer-term as revenue is down 57% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 19% shows it's an unpleasant look.

With this information, we find it concerning that China Best Group Holding is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

China Best Group Holding's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We find it unexpected that China Best Group Holding trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you settle on your opinion, we've discovered 4 warning signs for China Best Group Holding (2 are significant!) that you should be aware of.

If you're unsure about the strength of China Best Group Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Robotics Group Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:370

Hong Kong Robotics Group Holding

An investment holding company, trades in electronic appliances in the People’s Republic of China, Singapore, and Hong Kong.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.