- Hong Kong

- /

- Specialty Stores

- /

- SEHK:248

Such Is Life: How HKC International Holdings (HKG:248) Shareholders Saw Their Shares Drop 60%

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. To wit, the HKC International Holdings Limited (HKG:248) share price managed to fall 60% over five long years. We certainly feel for shareholders who bought near the top. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

Check out our latest analysis for HKC International Holdings

Given that HKC International Holdings only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over five years, HKC International Holdings grew its revenue at 1.1% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 17% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

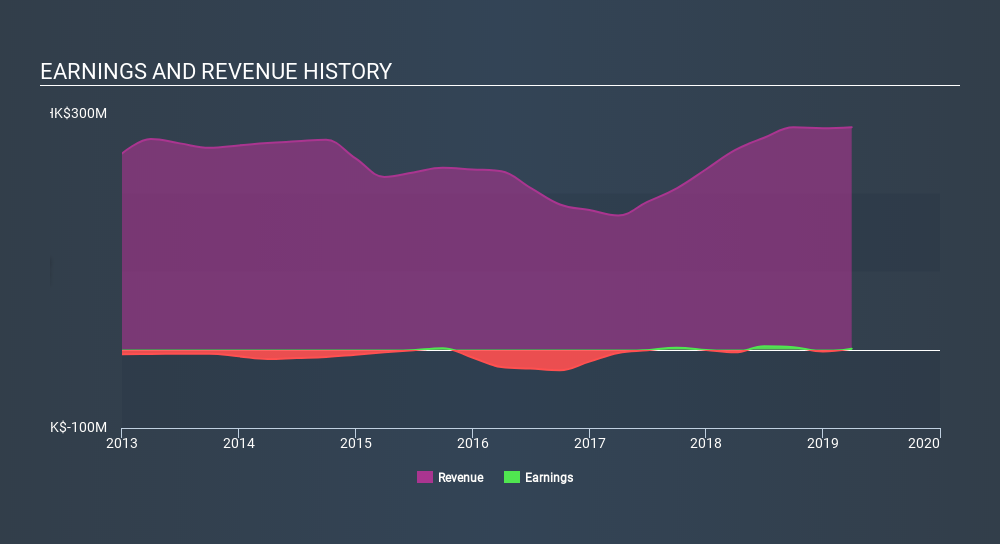

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at HKC International Holdings's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 1.9% in the last year, HKC International Holdings shareholders lost 9.7% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 16% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you would like to research HKC International Holdings in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: HKC International Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:248

HKC International Holdings

An investment holding company, provides information communication technology solutions in Hong Kong, Mainland China, Singapore, and other countries in South East Asia.

Good value with imperfect balance sheet.

Market Insights

Community Narratives