- Hong Kong

- /

- Specialty Stores

- /

- SEHK:2209

3 Promising Penny Stocks With Market Caps Under US$500M

Reviewed by Simply Wall St

As global markets continue to march toward record highs, driven by optimism around tariffs and AI developments, investors are increasingly looking for opportunities in smaller-cap stocks. Penny stocks, while often associated with higher risk, can still offer significant potential when backed by strong financials and clear growth prospects. This article will explore three such penny stocks that stand out due to their balance sheet strength and promising potential for future gains.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.75 | £176.46M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.40 | £82.39M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.82 | THB2.19B | ★★★★☆☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Innate Pharma (ENXTPA:IPH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Innate Pharma S.A. is a biotechnology company focused on developing immunotherapies for cancer patients in France and internationally, with a market cap of €146.34 million.

Operations: The company's revenue segment is derived entirely from its biotechnology operations, amounting to €33.79 million.

Market Cap: €146.34M

Innate Pharma S.A., with a market cap of €146.34 million, is advancing its clinical pipeline with the initiation of a Phase 1 trial for IPH4502, targeting Nectin-4 in solid tumors. Despite being unprofitable and experiencing increased debt levels over five years, the company maintains more cash than total debt and has sufficient short-term assets to cover liabilities. Recent private placements have bolstered its financial position without significant shareholder dilution. The management team is experienced, guiding Innate through volatile share prices while aiming for revenue growth projected at 24.78% annually.

- Dive into the specifics of Innate Pharma here with our thorough balance sheet health report.

- Evaluate Innate Pharma's prospects by accessing our earnings growth report.

YesAsia Holdings (SEHK:2209)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YesAsia Holdings Limited is an investment holding company involved in the procurement, sale, and trading of Asian fashion and lifestyle products, including beauty, cosmetics, accessories, and entertainment items, with a market cap of HK$1.42 billion.

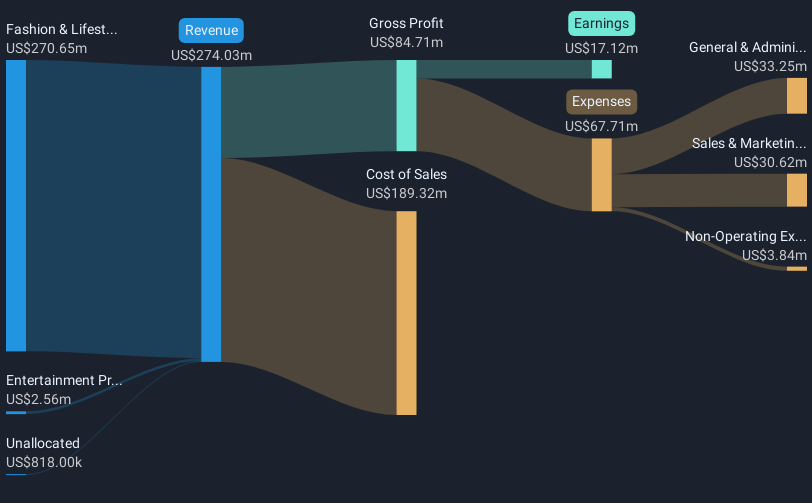

Operations: The company's revenue is primarily generated from two segments: Entertainment Products, contributing $2.56 million, and Fashion & Lifestyle and Beauty Products, which account for $270.65 million.

Market Cap: HK$1.42B

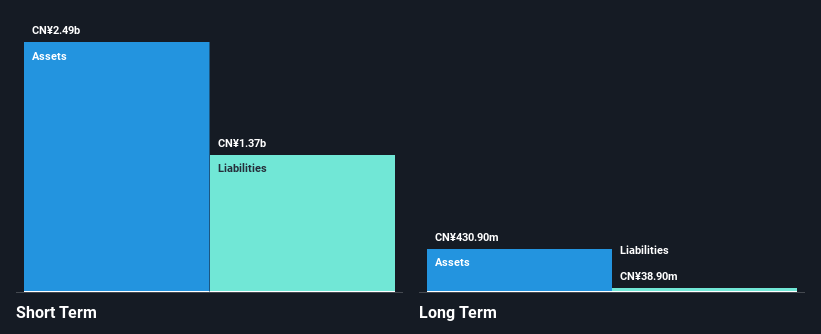

YesAsia Holdings Limited, with a market cap of HK$1.42 billion, has recently provided guidance indicating significant financial growth. The company expects a historical high net profit of at least US$19 million for the year ending December 2024, driven by increased sales in beauty products through its YesStyle Platforms and AsianBeautyWholesale. Revenue is anticipated to reach US$345.7 million, marking substantial growth from the prior year. Despite its volatile share price and recent insider selling, YesAsia stands out with no debt and strong asset coverage over liabilities. Its management team boasts extensive experience, supporting strategic expansion efforts globally.

- Navigate through the intricacies of YesAsia Holdings with our comprehensive balance sheet health report here.

- Learn about YesAsia Holdings' future growth trajectory here.

Sipai Health Technology (SEHK:314)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sipai Health Technology Co., Ltd. is a medical technology and health management company operating in the People's Republic of China, with a market cap of HK$3.62 billion.

Operations: The company generates revenue from three primary segments: Specialty Pharmacy Business (CN¥4.10 billion), Health Insurance Services Business (CN¥163.20 million), and Physician Research Assistance Business (CN¥378.65 million).

Market Cap: HK$3.62B

Sipai Health Technology, with a market cap of HK$3.62 billion, operates across three revenue-generating segments: Specialty Pharmacy (CN¥4.10 billion), Health Insurance Services (CN¥163.20 million), and Physician Research Assistance (CN¥378.65 million). Despite being unprofitable, the company has reduced losses by 22.4% annually over five years and maintains a positive cash flow with a runway exceeding three years due to its substantial short-term assets surpassing liabilities. Recently, Sipai initiated a share buyback program to enhance net assets and earnings per share, reflecting strategic efforts to bolster shareholder value amidst stable volatility and no debt burden.

- Jump into the full analysis health report here for a deeper understanding of Sipai Health Technology.

- Review our historical performance report to gain insights into Sipai Health Technology's track record.

Where To Now?

- Reveal the 5,708 hidden gems among our Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2209

YesAsia Holdings

An investment holding company, engages in the procurement, sale, and trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives