- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1929

Here's Why I Think Chow Tai Fook Jewellery Group (HKG:1929) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Chow Tai Fook Jewellery Group (HKG:1929). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Chow Tai Fook Jewellery Group

How Fast Is Chow Tai Fook Jewellery Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Chow Tai Fook Jewellery Group managed to grow EPS by 14% per year, over three years. That's a good rate of growth, if it can be sustained.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Chow Tai Fook Jewellery Group is growing revenues, and EBIT margins improved by 3.7 percentage points to 12%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

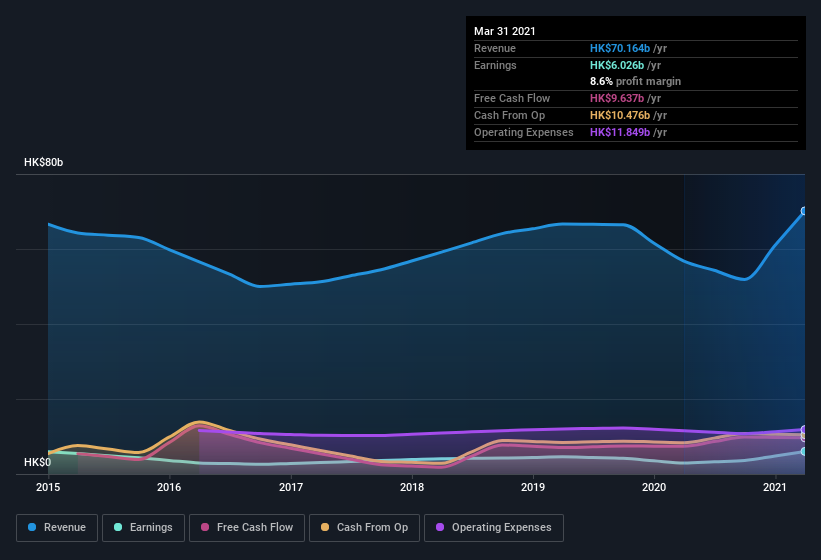

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Chow Tai Fook Jewellery Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Chow Tai Fook Jewellery Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Chow Tai Fook Jewellery Group shares, in the last year. So it's definitely nice that GM & Executive Director Chi-Keung Suen bought HK$308k worth of shares at an average price of around HK$15.40.

Is Chow Tai Fook Jewellery Group Worth Keeping An Eye On?

One positive for Chow Tai Fook Jewellery Group is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Chow Tai Fook Jewellery Group seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. We should say that we've discovered 1 warning sign for Chow Tai Fook Jewellery Group that you should be aware of before investing here.

The good news is that Chow Tai Fook Jewellery Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1929

Chow Tai Fook Jewellery Group

An investment holding company, manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives