- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1817

Risks Still Elevated At These Prices As Mulsanne Group Holding Limited (HKG:1817) Shares Dive 37%

Mulsanne Group Holding Limited (HKG:1817) shares have retraced a considerable 37% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

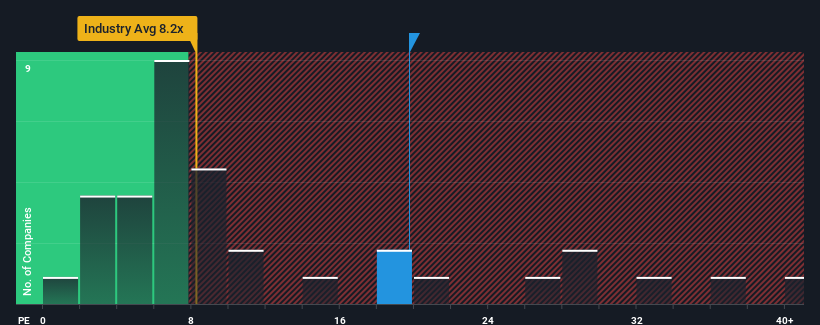

Even after such a large drop in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may still consider Mulsanne Group Holding as a stock to avoid entirely with its 19.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's exceedingly strong of late, Mulsanne Group Holding has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Mulsanne Group Holding

What Are Growth Metrics Telling Us About The High P/E?

Mulsanne Group Holding's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 218% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Mulsanne Group Holding is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Mulsanne Group Holding's P/E

A significant share price dive has done very little to deflate Mulsanne Group Holding's very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Mulsanne Group Holding revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Mulsanne Group Holding, and understanding these should be part of your investment process.

You might be able to find a better investment than Mulsanne Group Holding. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1817

Mulsanne Group Holding

An investment holding company, engages in the design, marketing, and sale of apparel products for men in Mainland China and Macau.

Fair value with questionable track record.

Market Insights

Community Narratives