- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1817

Mulsanne Group Holding's(HKG:1817) Share Price Is Down 30% Over The Past Year.

Mulsanne Group Holding Limited (HKG:1817) shareholders should be happy to see the share price up 27% in the last month. But in truth the last year hasn't been good for the share price. In fact the stock is down 30% in the last year, well below the market return.

See our latest analysis for Mulsanne Group Holding

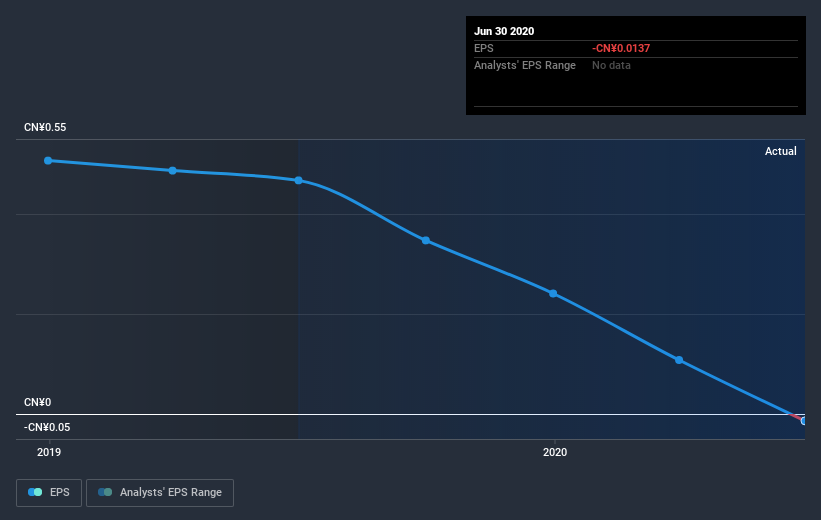

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Mulsanne Group Holding saw its earnings per share drop below zero. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. Of course, if the company can turn the situation around, investors will likely profit.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Mulsanne Group Holding's key metrics by checking this interactive graph of Mulsanne Group Holding's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 11% in the last year, Mulsanne Group Holding shareholders might be miffed that they lost 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 5.9%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Mulsanne Group Holding better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Mulsanne Group Holding , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Mulsanne Group Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1817

Mulsanne Group Holding

An investment holding company, engages in the design, marketing, and sale of apparel products for men in Mainland China and Macau.

Fair value with questionable track record.

Market Insights

Community Narratives