- Hong Kong

- /

- Specialty Stores

- /

- SEHK:178

Optimistic Investors Push Sa Sa International Holdings Limited (HKG:178) Shares Up 41% But Growth Is Lacking

Sa Sa International Holdings Limited (HKG:178) shareholders would be excited to see that the share price has had a great month, posting a 41% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.9% over the last year.

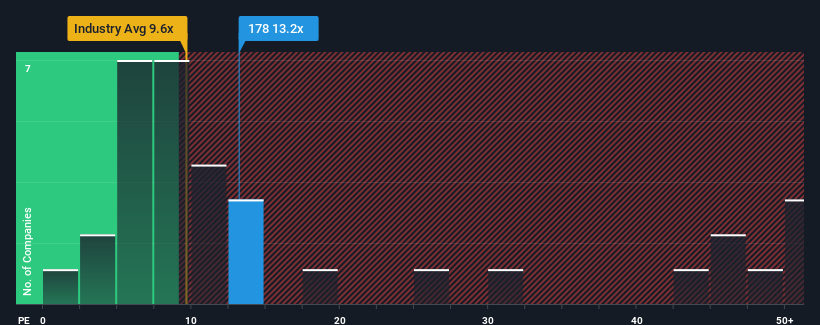

Since its price has surged higher, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 10x, you may consider Sa Sa International Holdings as a stock to potentially avoid with its 13.2x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Sa Sa International Holdings as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Sa Sa International Holdings

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Sa Sa International Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 276% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 5.8% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is noticeably more attractive.

With this information, we find it concerning that Sa Sa International Holdings is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Sa Sa International Holdings' shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sa Sa International Holdings currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for Sa Sa International Holdings that you need to take into consideration.

You might be able to find a better investment than Sa Sa International Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:178

Sa Sa International Holdings

An investment holding company, engages in the retail and wholesale of cosmetic products in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives