- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1759

The Returns On Capital At Sino Gas Holdings Group (HKG:1759) Don't Inspire Confidence

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after investigating Sino Gas Holdings Group (HKG:1759), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Sino Gas Holdings Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

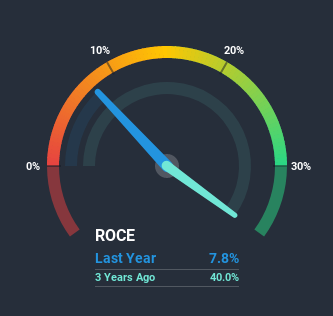

0.078 = HK$33m ÷ (HK$628m - HK$206m) (Based on the trailing twelve months to December 2020).

Therefore, Sino Gas Holdings Group has an ROCE of 7.8%. In absolute terms, that's a low return but it's around the Specialty Retail industry average of 9.0%.

View our latest analysis for Sino Gas Holdings Group

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Sino Gas Holdings Group has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

In terms of Sino Gas Holdings Group's historical ROCE movements, the trend isn't fantastic. Around four years ago the returns on capital were 38%, but since then they've fallen to 7.8%. On the other hand, the company has been employing more capital without a corresponding improvement in sales in the last year, which could suggest these investments are longer term plays. It may take some time before the company starts to see any change in earnings from these investments.

On a related note, Sino Gas Holdings Group has decreased its current liabilities to 33% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

In Conclusion...

Bringing it all together, while we're somewhat encouraged by Sino Gas Holdings Group's reinvestment in its own business, we're aware that returns are shrinking. And in the last year, the stock has given away 23% so the market doesn't look too hopeful on these trends strengthening any time soon. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

On a final note, we found 4 warning signs for Sino Gas Holdings Group (1 is concerning) you should be aware of.

While Sino Gas Holdings Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Sino Gas Holdings Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1759

Sino Gas Holdings Group

Engages in the retail and wholesale of liquefied petroleum gas (LPG), compressed natural gas (CNG), and liquefied natural gas (LNG) in the People’s Republic of China.

Low with imperfect balance sheet.

Market Insights

Community Narratives