- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1268

Did You Miss China MeiDong Auto Holdings's (HKG:1268) Whopping 699% Share Price Gain?

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the China MeiDong Auto Holdings Limited (HKG:1268) share price is up a whopping 699% in the last three years, a handsome return for long term holders. It's also good to see the share price up 37% over the last quarter.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for China MeiDong Auto Holdings

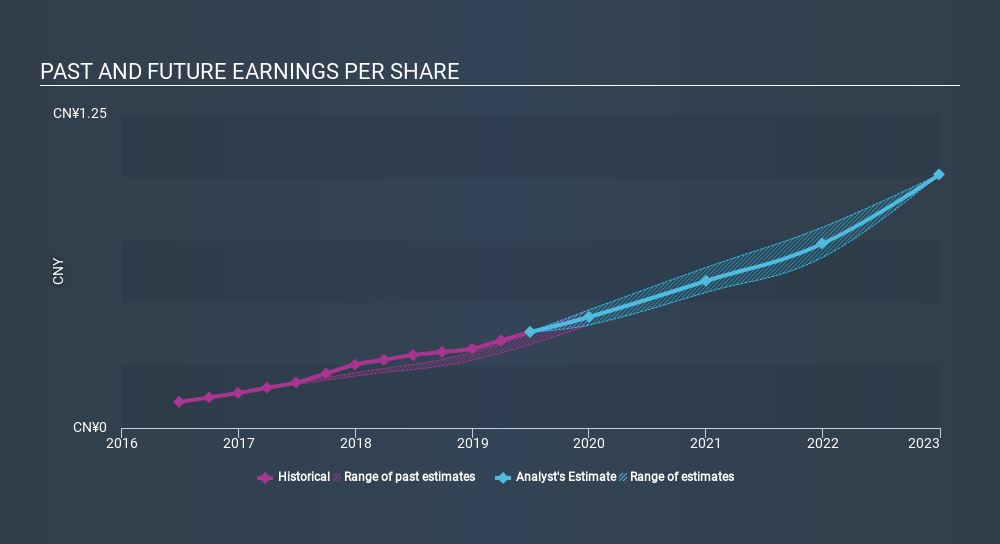

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, China MeiDong Auto Holdings achieved compound earnings per share growth of 54% per year. In comparison, the 100% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that China MeiDong Auto Holdings has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on China MeiDong Auto Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of China MeiDong Auto Holdings, it has a TSR of 809% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that China MeiDong Auto Holdings shareholders have received a total shareholder return of 248% over the last year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 50% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that China MeiDong Auto Holdings is showing 3 warning signs in our investment analysis , you should know about...

But note: China MeiDong Auto Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1268

China MeiDong Auto Holdings

An investment holding company, operates as an automobile dealer in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives