- Hong Kong

- /

- Real Estate

- /

- SEHK:9993

Radiance Holdings (Group)'s (HKG:9993) Dividend Is Being Reduced To HK$0.16

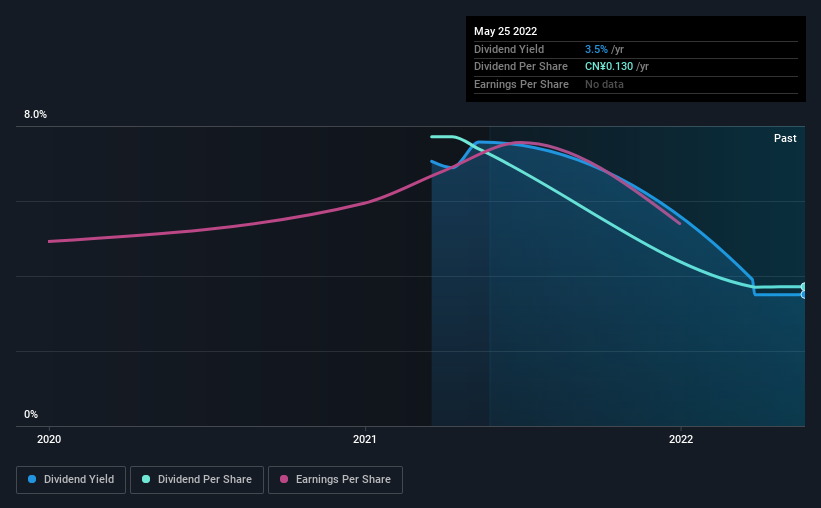

Radiance Holdings (Group) Company Limited (HKG:9993) has announced it will be reducing its dividend payable on the 23rd of September to HK$0.16. This payment takes the dividend yield to 3.7%, which only provides a modest boost to overall returns.

Check out our latest analysis for Radiance Holdings (Group)

Radiance Holdings (Group)'s Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, Radiance Holdings (Group) was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, EPS could fall by 9.2% if the company can't turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the payout ratio could be 22%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Radiance Holdings (Group) Doesn't Have A Long Payment History

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Is Doubtful

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Radiance Holdings (Group)'s earnings per share is down 9.2% over the past year. While this is not ideal, one year is a short time in business, and we wouldn't want to get too hung up on this. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

Our Thoughts On Radiance Holdings (Group)'s Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for Radiance Holdings (Group) you should be aware of, and 1 of them is significant. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9993

Radiance Holdings (Group)

An investment holding company, engages in property development business in Mainland China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026