- Hong Kong

- /

- Real Estate

- /

- SEHK:755

Investors ignore increasing losses at Shanghai Zendai Property (HKG:755) as stock jumps 15% this past week

The last three months have been tough on Shanghai Zendai Property Limited (HKG:755) shareholders, who have seen the share price decline a rather worrying 31%. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 74%.

The past week has proven to be lucrative for Shanghai Zendai Property investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for Shanghai Zendai Property

Given that Shanghai Zendai Property didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Shanghai Zendai Property's revenue grew by 242%. That's well above most other pre-profit companies. While the share price gain of 74% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Shanghai Zendai Property in some detail. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

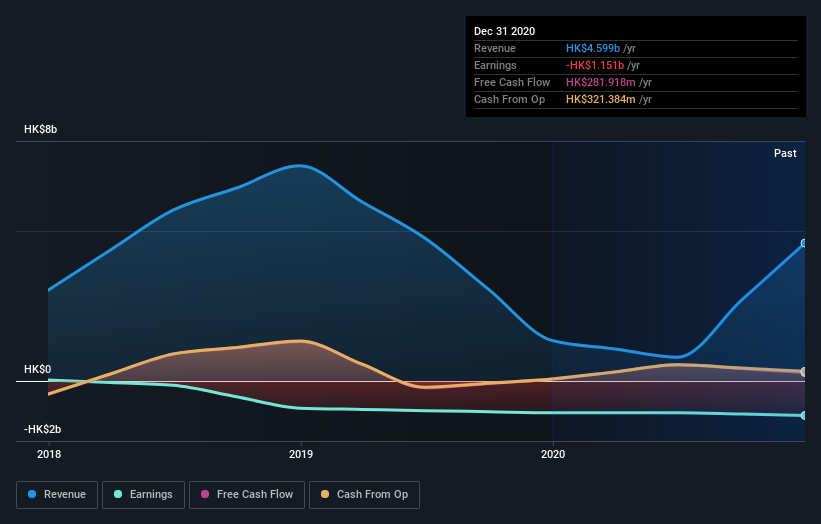

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Shanghai Zendai Property's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Shanghai Zendai Property has rewarded shareholders with a total shareholder return of 74% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Shanghai Zendai Property better, we need to consider many other factors. Take risks, for example - Shanghai Zendai Property has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:755

DevGreat Group

An investment holding company, engages in property development, property investment, and property management and agency activities in the People’s Republic of China.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)