- Hong Kong

- /

- Real Estate

- /

- SEHK:688

Is Now The Time To Put China Overseas Land & Investment (HKG:688) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like China Overseas Land & Investment (HKG:688), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for China Overseas Land & Investment

How Quickly Is China Overseas Land & Investment Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years China Overseas Land & Investment grew its EPS by 7.3% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

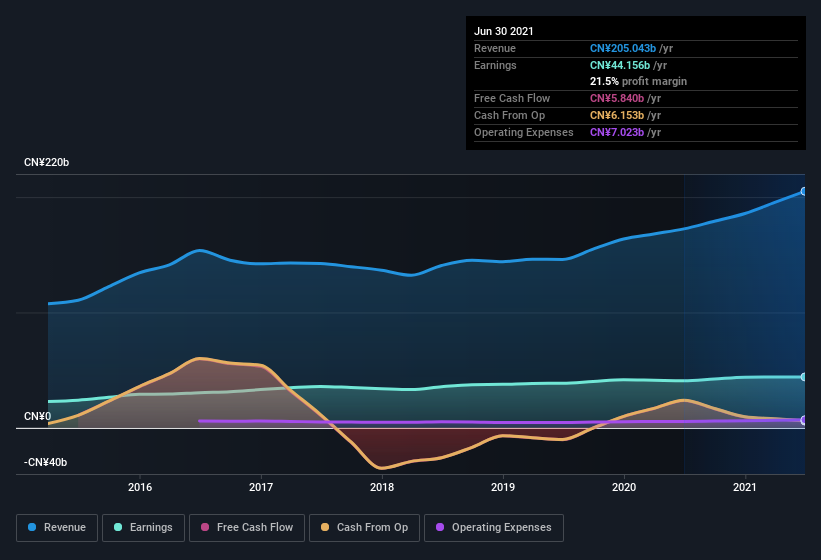

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). On the one hand, China Overseas Land & Investment's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for China Overseas Land & Investment?

Are China Overseas Land & Investment Insiders Aligned With All Shareholders?

Since China Overseas Land & Investment has a market capitalization of HK$275b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Indeed, they hold CN¥142m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.05% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is China Overseas Land & Investment Worth Keeping An Eye On?

One important encouraging feature of China Overseas Land & Investment is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China Overseas Land & Investment , and understanding them should be part of your investment process.

Although China Overseas Land & Investment certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development and investment, and other operations in the People’s Republic of China and the United Kingdom.

Excellent balance sheet and fair value.