- Hong Kong

- /

- Real Estate

- /

- SEHK:726

Even after rising 17% this past week, DIT Group (HKG:726) shareholders are still down 85% over the past three years

It's nice to see the DIT Group Limited (HKG:726) share price up 17% in a week. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 85% in that time. Arguably, the recent bounce is to be expected after such a bad drop. Only time will tell if the company can sustain the turnaround. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

On a more encouraging note the company has added HK$59m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for DIT Group

DIT Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, DIT Group's revenue dropped 30% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 23% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

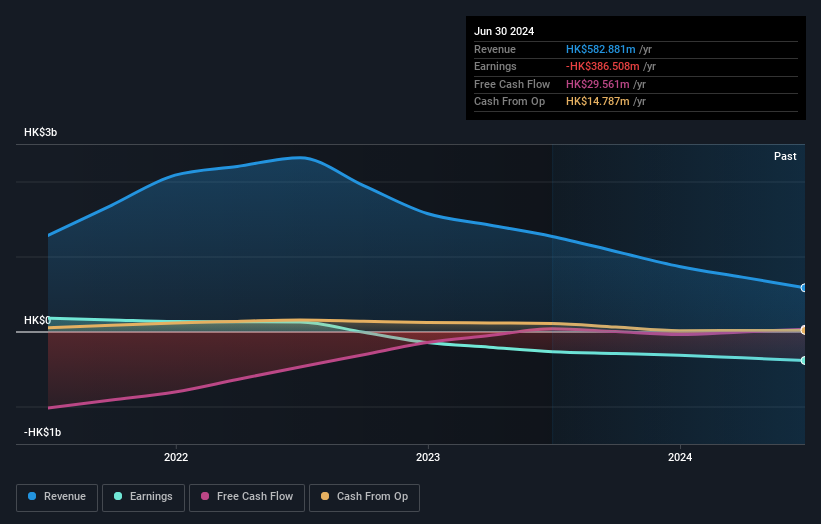

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at DIT Group's financial health with this free report on its balance sheet.

A Different Perspective

DIT Group shareholders are down 19% for the year, but the market itself is up 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for DIT Group you should be aware of, and 2 of them are a bit concerning.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:726

DIT Group

Engages in the provision of prefabricated construction work, decoration and landscaping services in the People’s Republic of China.

Mediocre balance sheet low.

Market Insights

Community Narratives