- Hong Kong

- /

- Real Estate

- /

- SEHK:488

What Kind Of Shareholders Hold The Majority In Lai Sun Development Company Limited's (HKG:488) Shares?

The big shareholder groups in Lai Sun Development Company Limited (HKG:488) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

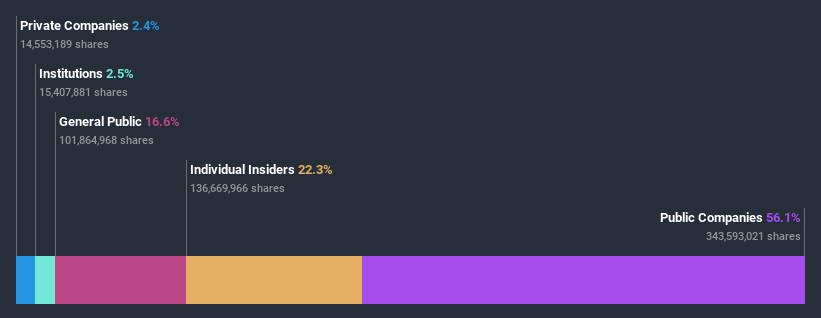

Lai Sun Development is not a large company by global standards. It has a market capitalization of HK$3.8b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions are not really that prevalent on the share registry. Let's delve deeper into each type of owner, to discover more about Lai Sun Development.

View our latest analysis for Lai Sun Development

What Does The Institutional Ownership Tell Us About Lai Sun Development?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

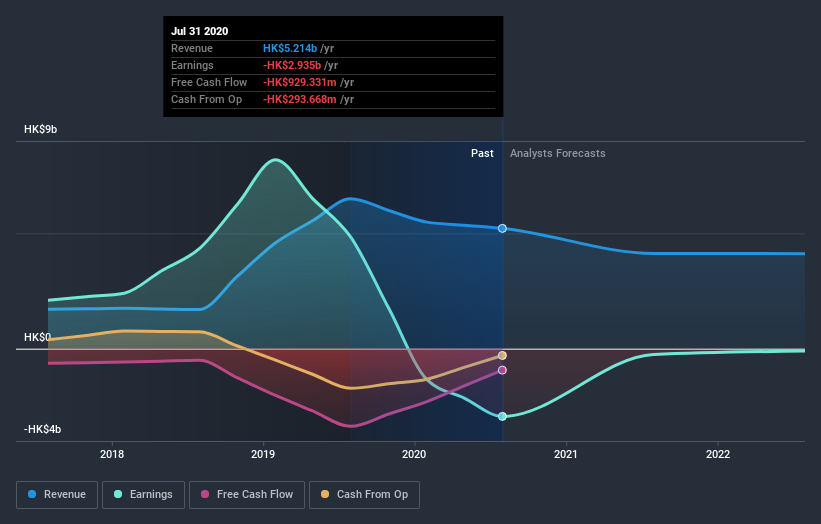

Since institutions own only a small portion of Lai Sun Development, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Lai Sun Development is not owned by hedge funds. Lai Sun Garment (International) Limited is currently the largest shareholder, with 56% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. The second and third largest shareholders are Siu Yuk Yu and Cheuk Yi Yu, with an equal amount of shares to their name at 11%.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Lai Sun Development

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Lai Sun Development Company Limited. It has a market capitalization of just HK$3.8b, and insiders have HK$850m worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, with a 17% stake in the company, will not easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

It appears to us that public companies own 56% of Lai Sun Development. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Lai Sun Development better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Lai Sun Development you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Lai Sun Development or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:488

Lai Sun Development

Invests in, develops, leases, and sells real estate properties in Hong Kong, Mainland China, Macau, the United Kingdom, Vietnam, and internationally.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion