- Hong Kong

- /

- Real Estate

- /

- SEHK:3688

Is Top Spring International Holdings Limited (HKG:3688) At Risk Of Cutting Its Dividend?

Dividend paying stocks like Top Spring International Holdings Limited (HKG:3688) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

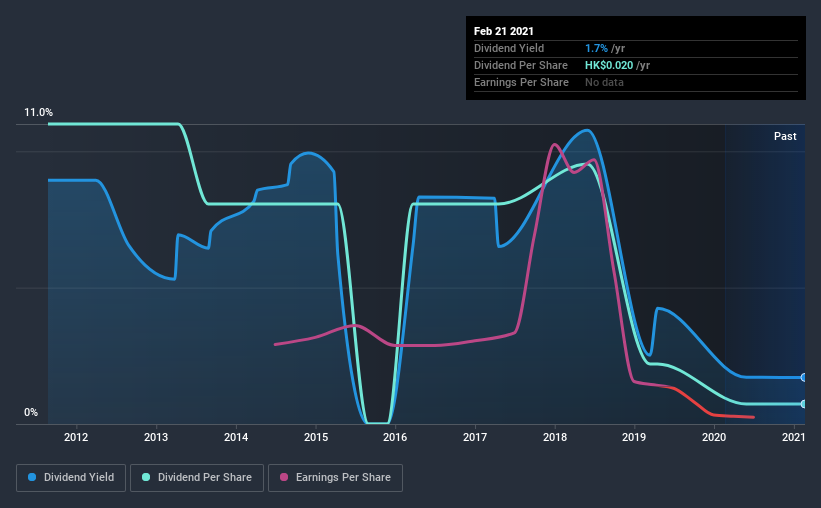

Investors might not know much about Top Spring International Holdings's dividend prospects, even though it has been paying dividends for the last nine years and offers a 1.7% yield. A 1.7% yield is not inspiring, but the longer payment history has some appeal. Some simple analysis can reduce the risk of holding Top Spring International Holdings for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Top Spring International Holdings!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Although it reported a loss over the past 12 months, Top Spring International Holdings currently pays a dividend. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Last year, Top Spring International Holdings paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

We update our data on Top Spring International Holdings every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Top Spring International Holdings paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was HK$0.3 in 2012, compared to HK$0.02 last year. The dividend has fallen 93% over that period.

A shrinking dividend over a nine-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Top Spring International Holdings' earnings per share have shrunk at 28% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Top Spring International Holdings' dividend is not well covered by free cash flow, plus it paid a dividend while being unprofitable. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Using these criteria, Top Spring International Holdings looks quite suboptimal from a dividend investment perspective.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for Top Spring International Holdings that investors should take into consideration.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade Top Spring International Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Top Spring International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3688

Top Spring International Holdings

An investment holding company, operates as a real estate property developer in the People's Republic of China.

Good value slight.

Similar Companies

Market Insights

Community Narratives