- Hong Kong

- /

- Real Estate

- /

- SEHK:3380

What Is The Ownership Structure Like For Logan Group Company Limited (HKG:3380)?

Every investor in Logan Group Company Limited (HKG:3380) should be aware of the most powerful shareholder groups. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

With a market capitalization of HK$64b, Logan Group is rather large. We'd expect to see institutional investors on the register. Companies of this size are usually well known to retail investors, too. Our analysis of the ownership of the company, below, shows that institutional investors have not yet purchased much of the company. Let's take a closer look to see what the different types of shareholders can tell us about Logan Group.

Check out our latest analysis for Logan Group

What Does The Institutional Ownership Tell Us About Logan Group?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

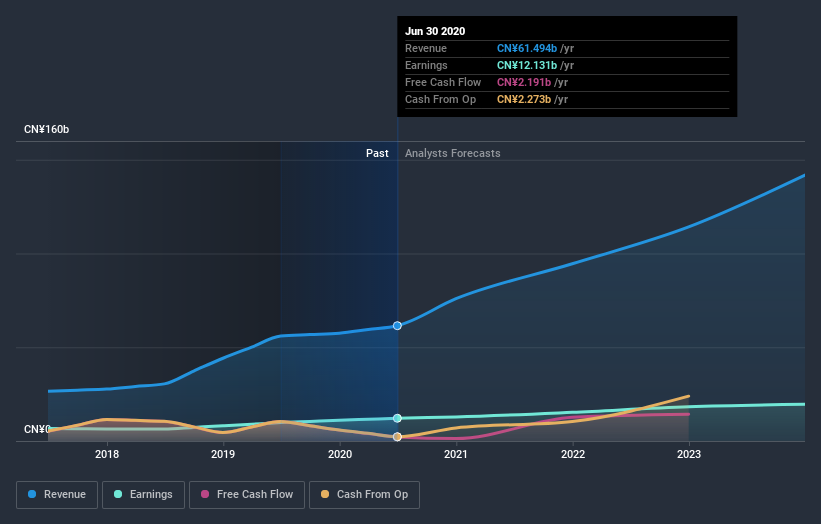

Institutions have a very small stake in Logan Group. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. So if the company itself can improve over time, we may well see more institutional buyers in the future. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Logan Group is not owned by hedge funds. Hoi Ting Kei is currently the company's largest shareholder with 77% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. Meanwhile, the second and third largest shareholders, hold 0.8% and 0.6%, of the shares outstanding, respectively.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Logan Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems that insiders own more than half the Logan Group Company Limited stock. This gives them a lot of power. Insiders own HK$50b worth of shares in the HK$64b company. That's extraordinary! Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if they have been selling down their stake.

General Public Ownership

With a 18% ownership, the general public have some degree of sway over Logan Group. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Logan Group better, we need to consider many other factors. For instance, we've identified 2 warning signs for Logan Group (1 is potentially serious) that you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Logan Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3380

Logan Group

An investment holding company, engages in property development and operation in the People’s Republic of China.

Imperfect balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion