- Hong Kong

- /

- Real Estate

- /

- SEHK:313

Here's Why Richly Field China Development Limited's (HKG:313) CEO Compensation Is The Least Of Shareholders Concerns

The performance at Richly Field China Development Limited (HKG:313) has been rather lacklustre of late and shareholders may be wondering what CEO Yi Feng Li is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 25 August 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Richly Field China Development

Comparing Richly Field China Development Limited's CEO Compensation With the industry

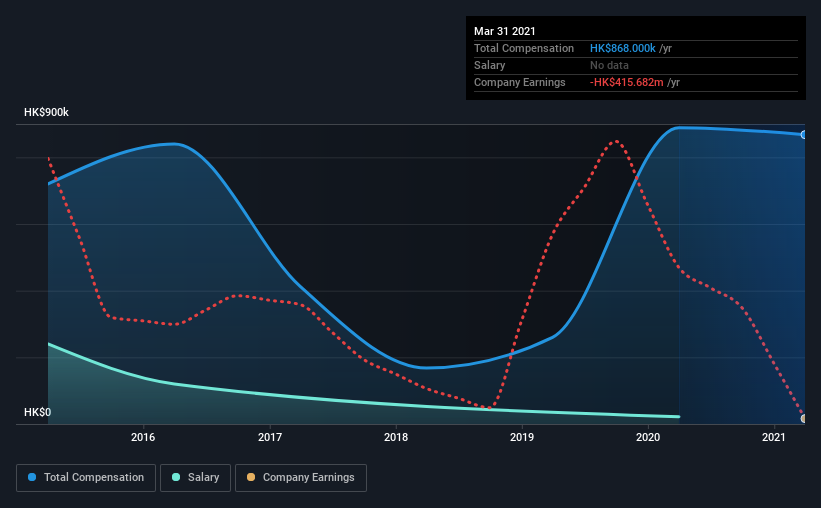

At the time of writing, our data shows that Richly Field China Development Limited has a market capitalization of HK$303m, and reported total annual CEO compensation of HK$868k for the year to March 2021. That is, the compensation was roughly the same as last year. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$22k.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.9m. This suggests that Yi Feng Li is paid below the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$22k | HK$120k | 3% |

| Other | HK$846k | HK$769k | 97% |

| Total Compensation | HK$868k | HK$889k | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. A high-salary is usually a no-brainer when it comes to attracting the best executives, but Richly Field China Development paid Yi Feng Li a nominal salary to the CEO over the past 12 months, instead focusing on non-salary compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Richly Field China Development Limited's Growth

Richly Field China Development Limited's earnings per share (EPS) grew 19% per year over the last three years. It saw its revenue drop 77% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Richly Field China Development Limited Been A Good Investment?

The return of -80% over three years would not have pleased Richly Field China Development Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Richly Field China Development primarily uses non-salary benefits to reward its CEO. The loss to shareholders over the past three years is certainly concerning. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for Richly Field China Development (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Switching gears from Richly Field China Development, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:313

Richly Field China Development

An investment holding company, engages in outlets commercial operation and development business in the People’s Republic of China.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives