- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:232

If You Had Bought AVIC International Holding (HK) (HKG:232) Stock Five Years Ago, You'd Be Sitting On A 92% Loss, Today

AVIC International Holding (HK) Limited (HKG:232) shareholders should be happy to see the share price up 13% in the last month. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Indeed, the share price is down a whopping 92% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for AVIC International Holding (HK)

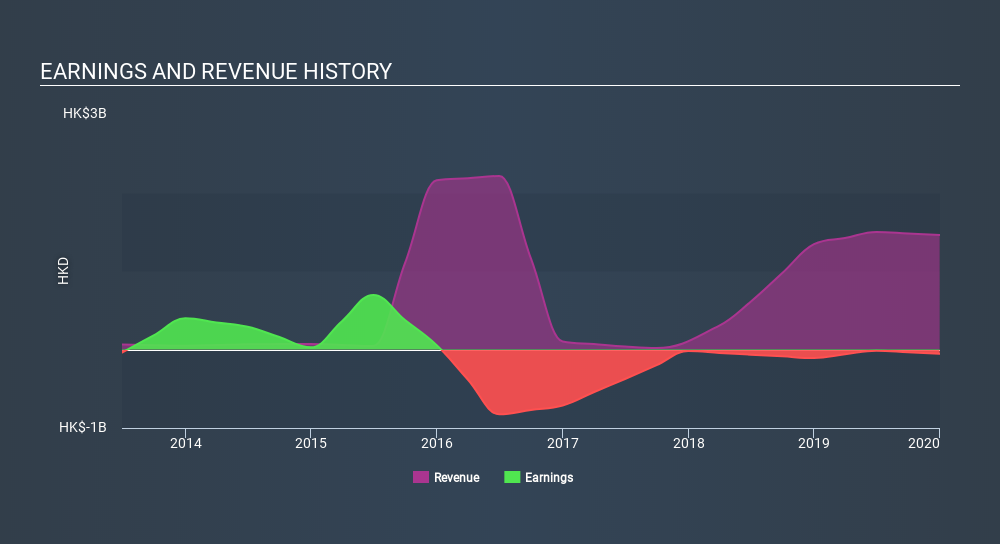

Because AVIC International Holding (HK) made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, AVIC International Holding (HK) saw its revenue increase by 13% per year. That's a pretty good rate for a long time period. So it is unexpected to see the stock down 39% per year in the last five years. The market can be a harsh master when your company is losing money and revenue growth disappoints.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling AVIC International Holding (HK) stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between AVIC International Holding (HK)'s total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. AVIC International Holding (HK) hasn't been paying dividends, but its TSR of -91% exceeds its share price return of -92%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market lost about 17% in the twelve months, AVIC International Holding (HK) shareholders did even worse, losing 56%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 38% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for AVIC International Holding (HK) (of which 1 is concerning!) you should know about.

We will like AVIC International Holding (HK) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:232

Continental Aerospace Technologies Holding

An investment holding company, engages in the design, development, production, and sale of general aviation aircraft piston engines and spare parts in the United States, Europe, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives