- Hong Kong

- /

- Real Estate

- /

- SEHK:2107

Is Now The Time To Put First Service Holding (HKG:2107) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like First Service Holding (HKG:2107). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for First Service Holding

First Service Holding's Improving Profits

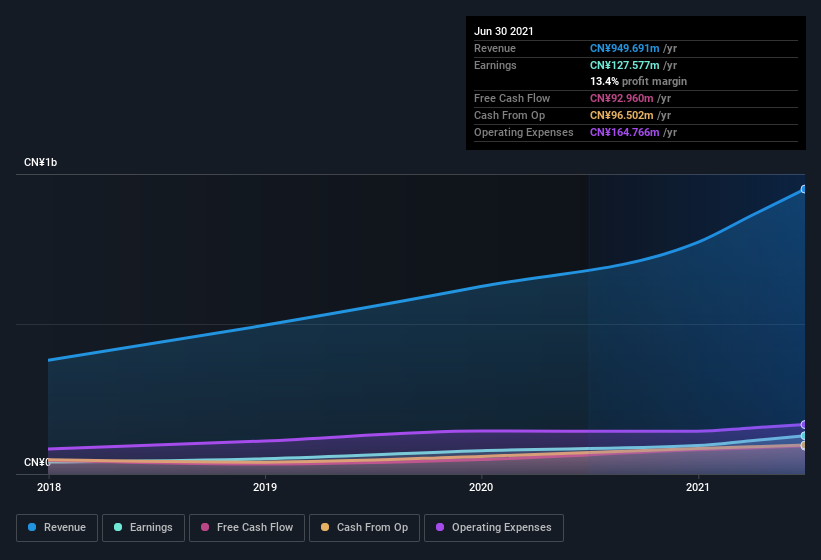

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. First Service Holding boosted its trailing twelve month EPS from CN¥0.11 to CN¥0.13, in the last year. That's a 15% gain; respectable growth in the broader scheme of things.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that First Service Holding is growing revenues, and EBIT margins improved by 5.0 percentage points to 17%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since First Service Holding is no giant, with a market capitalization of HK$1.8b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are First Service Holding Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that First Service Holding insiders spent a whopping CN¥9.8m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the Chairman of the Board, Peng Zhang, who made the biggest single acquisition, paying HK$1.0m for shares at about HK$1.28 each.

On top of the insider buying, we can also see that First Service Holding insiders own a large chunk of the company. Indeed, with a collective holding of 54%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have CN¥965m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is First Service Holding Worth Keeping An Eye On?

One important encouraging feature of First Service Holding is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with First Service Holding , and understanding it should be part of your investment process.

The good news is that First Service Holding is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2107

First Service Holding

Provides property management services, green living solutions, and value-added services in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success