- Hong Kong

- /

- Real Estate

- /

- SEHK:2107

First Service Holding (HKG:2107) Has Announced That It Will Be Increasing Its Dividend To HK$0.068

First Service Holding Limited (HKG:2107) has announced that it will be increasing its dividend on the 12th of July to HK$0.068. This makes the dividend yield 8.4%, which is above the industry average.

View our latest analysis for First Service Holding

First Service Holding Doesn't Earn Enough To Cover Its Payments

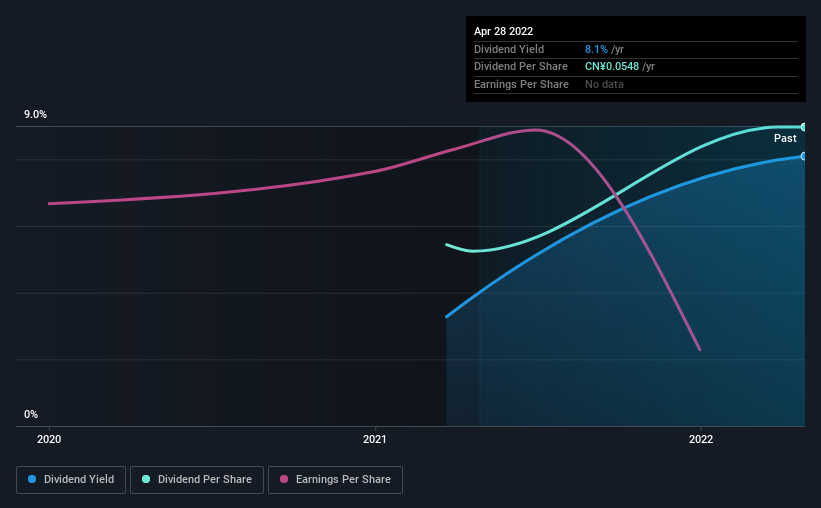

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, First Service Holding's profits didn't cover the dividend, but the company was generating enough cash instead. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

EPS is set to fall by 70.0% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 637%, which could put the dividend under pressure if earnings don't start to improve.

First Service Holding Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. First Service Holding has seen EPS fall by 70% over the last 12 months. Such a large drop can indicate that the business has run into some trouble and might end up in the dividend having to be reduced. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think First Service Holding's payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 3 warning signs for First Service Holding that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2107

First Service Holding

Provides property management services, green living solutions, and value-added services in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026