- Hong Kong

- /

- Real Estate

- /

- SEHK:1778

Will Weakness in Colour Life Services Group Co., Limited's (HKG:1778) Stock Prove Temporary Given Strong Fundamentals?

It is hard to get excited after looking at Colour Life Services Group's (HKG:1778) recent performance, when its stock has declined 6.3% over the past three months. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Specifically, we decided to study Colour Life Services Group's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Colour Life Services Group

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Colour Life Services Group is:

13% = CN¥547m ÷ CN¥4.2b (Based on the trailing twelve months to June 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.13 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Colour Life Services Group's Earnings Growth And 13% ROE

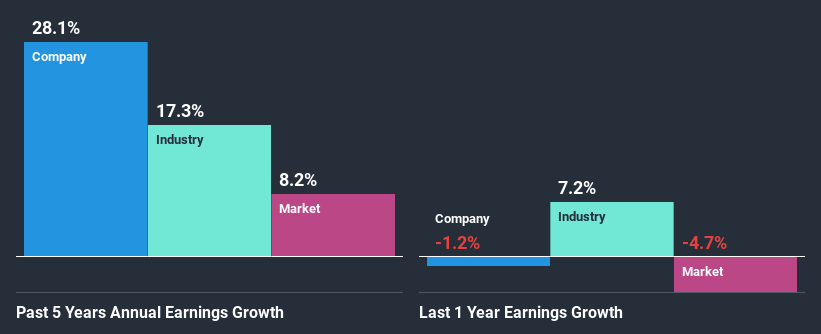

At first glance, Colour Life Services Group seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 9.9%. This probably laid the ground for Colour Life Services Group's significant 28% net income growth seen over the past five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared Colour Life Services Group's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 17% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Colour Life Services Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Colour Life Services Group Making Efficient Use Of Its Profits?

Colour Life Services Group's three-year median payout ratio is a pretty moderate 36%, meaning the company retains 64% of its income. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Colour Life Services Group is reinvesting its earnings efficiently.

Additionally, Colour Life Services Group has paid dividends over a period of six years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 27% over the next three years. However, the company's ROE is not expected to change by much despite the lower expected payout ratio.

Summary

Overall, we are quite pleased with Colour Life Services Group's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Colour Life Services Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1778

Colour Life Services Group

Provides property management and community services in the People's Republic of China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026