- Hong Kong

- /

- Real Estate

- /

- SEHK:1755

S-Enjoy Service Group (HKG:1755) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like S-Enjoy Service Group (HKG:1755). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for S-Enjoy Service Group

How Fast Is S-Enjoy Service Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that S-Enjoy Service Group's EPS has grown 36% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

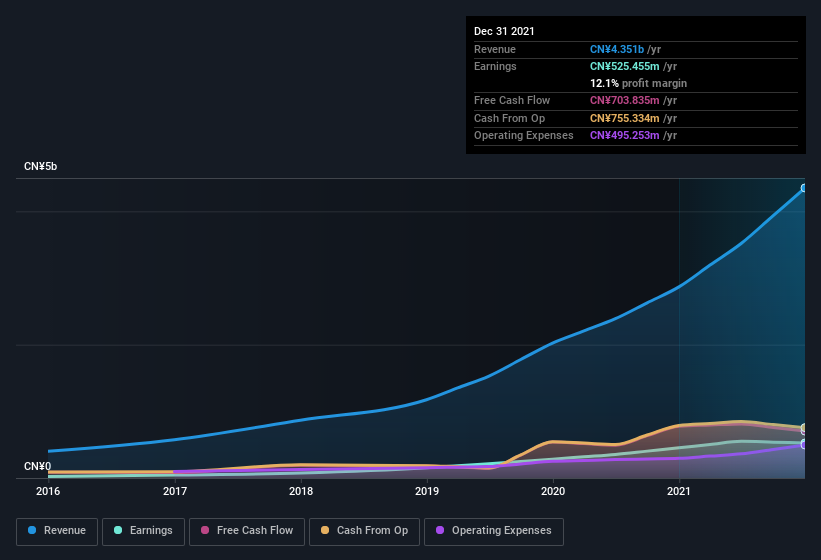

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note S-Enjoy Service Group achieved similar EBIT margins to last year, revenue grew by a solid 52% to CN¥4.4b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of S-Enjoy Service Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are S-Enjoy Service Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First and foremost; there we saw no insiders sell S-Enjoy Service Group shares in the last year. Even better, though, is that the Chairman, Xiaoming Qi, bought a whopping CN¥1.8m worth of shares, paying about CN¥10.16 per share, on average. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

On top of the insider buying, we can also see that S-Enjoy Service Group insiders own a large chunk of the company. Indeed, with a collective holding of 69%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. at the current share price. This is an incredible endorsement from them.

Should You Add S-Enjoy Service Group To Your Watchlist?

For growth investors, S-Enjoy Service Group's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. Still, you should learn about the 2 warning signs we've spotted with S-Enjoy Service Group.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of S-Enjoy Service Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1755

S-Enjoy Service Group

An investment holding company, provides property management and related value-added services for property developers in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives