- Hong Kong

- /

- Real Estate

- /

- SEHK:1622

Shareholders Will Probably Not Have Any Issues With Redco Properties Group Limited's (HKG:1622) CEO Compensation

The performance at Redco Properties Group Limited (HKG:1622) has been rather lacklustre of late and shareholders may be wondering what CEO Ruoqing Huang is planning to do about this. At the next AGM coming up on 25 June 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Redco Properties Group

How Does Total Compensation For Ruoqing Huang Compare With Other Companies In The Industry?

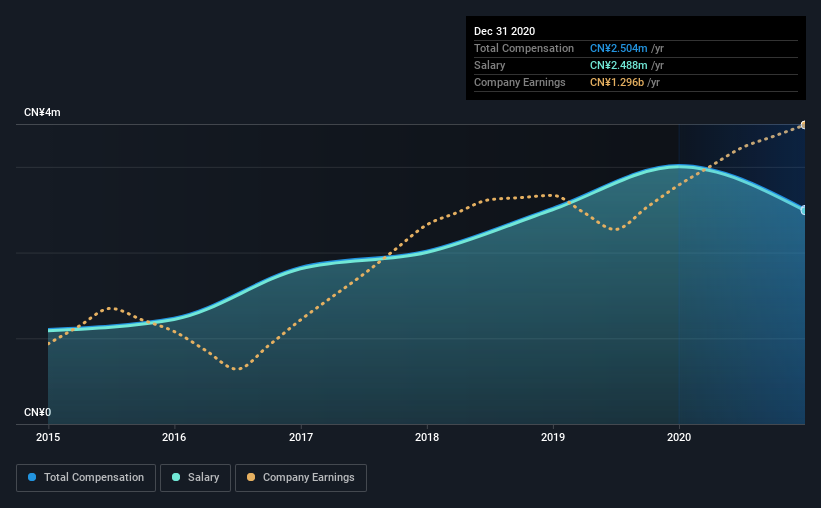

At the time of writing, our data shows that Redco Properties Group Limited has a market capitalization of HK$9.2b, and reported total annual CEO compensation of CN¥2.5m for the year to December 2020. Notably, that's a decrease of 17% over the year before. We note that the salary portion, which stands at CN¥2.49m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between HK$3.1b and HK$12b had a median total CEO compensation of CN¥3.7m. In other words, Redco Properties Group pays its CEO lower than the industry median. Moreover, Ruoqing Huang also holds HK$2.5b worth of Redco Properties Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥2.5m | CN¥3.0m | 99% |

| Other | CN¥16k | CN¥16k | 1% |

| Total Compensation | CN¥2.5m | CN¥3.0m | 100% |

On an industry level, roughly 69% of total compensation represents salary and 31% is other remuneration. Investors will find it interesting that Redco Properties Group pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Redco Properties Group Limited's Growth

Redco Properties Group Limited has seen its earnings per share (EPS) increase by 15% a year over the past three years. In the last year, its revenue is up 44%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Redco Properties Group Limited Been A Good Investment?

The return of -33% over three years would not have pleased Redco Properties Group Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Ruoqing receives almost all of their compensation through a salary. The fact that shareholders have earned a negative share price return is certainly disconcerting. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which shouldn't be ignored) in Redco Properties Group we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1622

Redco Properties Group

An investment holding company, engages in the property development and investment activities in the People’s Republic of China and Hong Kong.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion