- Hong Kong

- /

- Real Estate

- /

- SEHK:1516

Investors Still Aren't Entirely Convinced About Sunac Services Holdings Limited's (HKG:1516) Earnings Despite 34% Price Jump

Sunac Services Holdings Limited (HKG:1516) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 81% share price drop in the last twelve months.

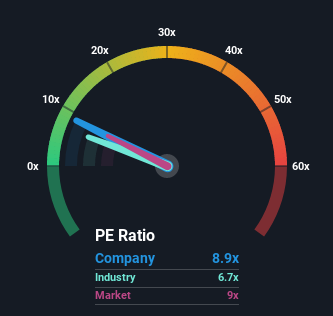

Although its price has surged higher, it's still not a stretch to say that Sunac Services Holdings' price-to-earnings (or "P/E") ratio of 8.9x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Sunac Services Holdings as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Sunac Services Holdings

Is There Some Growth For Sunac Services Holdings?

There's an inherent assumption that a company should be matching the market for P/E ratios like Sunac Services Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 64% last year. Pleasingly, EPS has also lifted 874% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 26% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 15% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Sunac Services Holdings' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Sunac Services Holdings' P/E

Its shares have lifted substantially and now Sunac Services Holdings' P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sunac Services Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Sunac Services Holdings that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1516

Sunac Services Holdings

An investment holding company, provides property development, cultural tourism city construction and operation, and property management services in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives