- Hong Kong

- /

- Real Estate

- /

- SEHK:127

These 4 Measures Indicate That Chinese Estates Holdings (HKG:127) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Chinese Estates Holdings Limited (HKG:127) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Chinese Estates Holdings

What Is Chinese Estates Holdings's Net Debt?

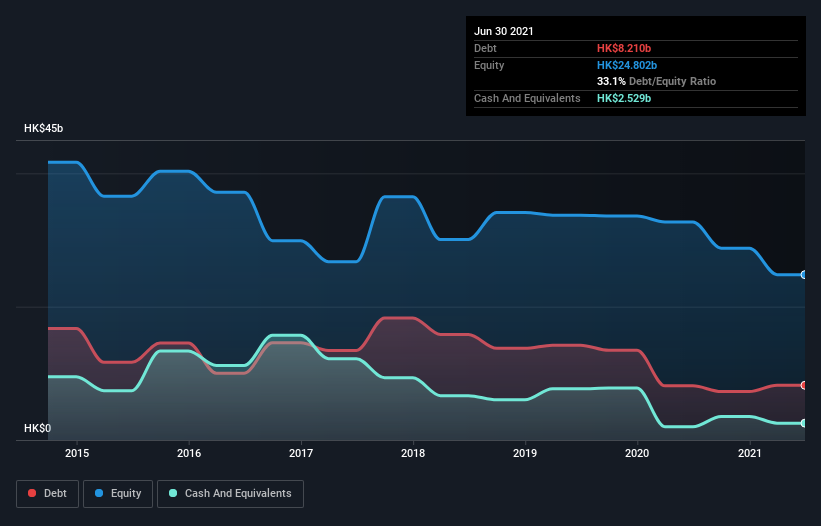

The chart below, which you can click on for greater detail, shows that Chinese Estates Holdings had HK$8.21b in debt in June 2021; about the same as the year before. On the flip side, it has HK$2.53b in cash leading to net debt of about HK$5.68b.

How Strong Is Chinese Estates Holdings' Balance Sheet?

According to the last reported balance sheet, Chinese Estates Holdings had liabilities of HK$7.58b due within 12 months, and liabilities of HK$2.25b due beyond 12 months. Offsetting this, it had HK$2.53b in cash and HK$643.1m in receivables that were due within 12 months. So it has liabilities totalling HK$6.67b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's HK$4.85b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Chinese Estates Holdings has a debt to EBITDA ratio of 4.0, which signals significant debt, but is still pretty reasonable for most types of business. But its EBIT was about 13.5 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. Notably, Chinese Estates Holdings's EBIT launched higher than Elon Musk, gaining a whopping 444% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Chinese Estates Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Chinese Estates Holdings actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Chinese Estates Holdings's interest cover was a real positive on this analysis, as was its conversion of EBIT to free cash flow. In contrast, our confidence was undermined by its apparent struggle to handle its total liabilities. When we consider all the elements mentioned above, it seems to us that Chinese Estates Holdings is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Chinese Estates Holdings (1 is concerning!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:127

Chinese Estates Holdings

Chinese Estates Group (the "Group") is one of the leading property developers in Hong Kong.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026