- Hong Kong

- /

- Real Estate

- /

- SEHK:989

This Is Why Hua Yin International Holdings Limited's (HKG:989) CEO Compensation Looks Appropriate

Key Insights

- Hua Yin International Holdings' Annual General Meeting to take place on 19th of September

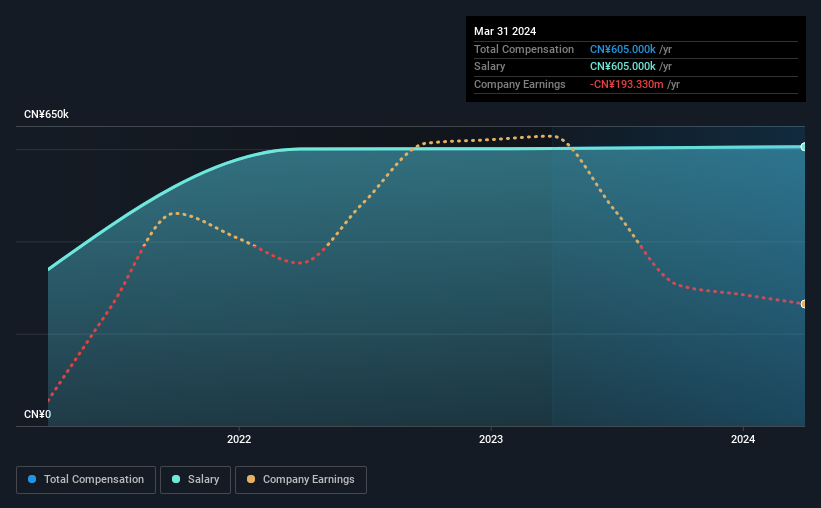

- Total pay for CEO Junjie Li includes CN¥605.0k salary

- Total compensation is 68% below industry average

- Over the past three years, Hua Yin International Holdings' EPS grew by 33% and over the past three years, the total loss to shareholders 95%

The performance at Hua Yin International Holdings Limited (HKG:989) has been rather lacklustre of late and shareholders may be wondering what CEO Junjie Li is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 19th of September. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Hua Yin International Holdings

Comparing Hua Yin International Holdings Limited's CEO Compensation With The Industry

At the time of writing, our data shows that Hua Yin International Holdings Limited has a market capitalization of HK$144m, and reported total annual CEO compensation of CN¥605k for the year to March 2024. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CN¥605k.

For comparison, other companies in the Hong Kong Real Estate industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.9m. Accordingly, Hua Yin International Holdings pays its CEO under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥605k | CN¥601k | 100% |

| Other | - | - | - |

| Total Compensation | CN¥605k | CN¥601k | 100% |

On an industry level, roughly 76% of total compensation represents salary and 24% is other remuneration. At the company level, Hua Yin International Holdings pays Junjie Li solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Hua Yin International Holdings Limited's Growth

Hua Yin International Holdings Limited has seen its earnings per share (EPS) increase by 33% a year over the past three years. Its revenue is down 71% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hua Yin International Holdings Limited Been A Good Investment?

The return of -95% over three years would not have pleased Hua Yin International Holdings Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Hua Yin International Holdings rewards its CEO solely through a salary, ignoring non-salary benefits completely. The fact that shareholders have earned a negative share price return is certainly disconcerting. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key question may be why the fundamentals have not yet been reflected into the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Hua Yin International Holdings (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Hua Yin International Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:989

China Changbaishan International Holdings

An investment holding company, engages in the property development and management business in the People’s Republic of China.

Slight risk with weak fundamentals.

Market Insights

Community Narratives