- Hong Kong

- /

- Real Estate

- /

- SEHK:989

Hua Yin International Holdings Limited (HKG:989) Might Not Be As Mispriced As It Looks After Plunging 35%

To the annoyance of some shareholders, Hua Yin International Holdings Limited (HKG:989) shares are down a considerable 35% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 88% share price decline.

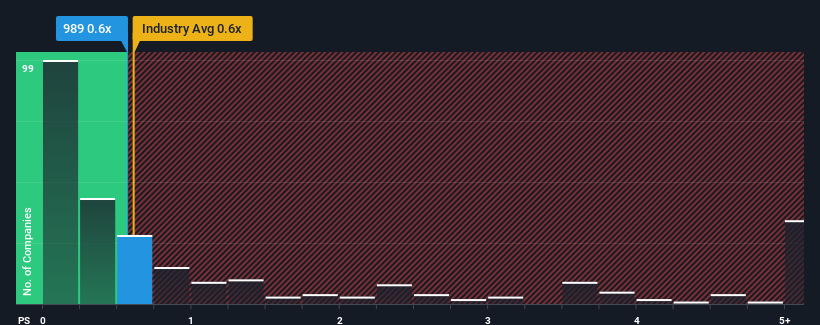

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hua Yin International Holdings' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hua Yin International Holdings

How Hua Yin International Holdings Has Been Performing

Hua Yin International Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Hua Yin International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hua Yin International Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 96% last year. Pleasingly, revenue has also lifted 67% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.7% shows it's noticeably more attractive.

With this information, we find it interesting that Hua Yin International Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Hua Yin International Holdings' P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Hua Yin International Holdings looks to be in line with the rest of the Real Estate industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't quite envision Hua Yin International Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Hua Yin International Holdings (3 can't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hua Yin International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:989

Hua Yin International Holdings

An investment holding company, engages in the property development and management business in the People’s Republic of China.

Low and slightly overvalued.

Market Insights

Community Narratives