- Hong Kong

- /

- Real Estate

- /

- SEHK:989

Here's Why Hua Yin International Holdings Limited's (HKG:989) CEO Compensation Is The Least Of Shareholders Concerns

Key Insights

- Hua Yin International Holdings' Annual General Meeting to take place on 18th of September

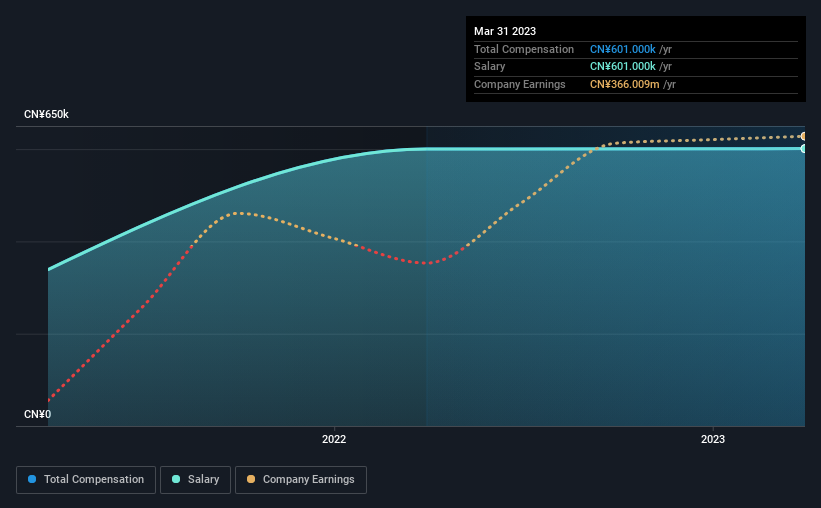

- Total pay for CEO Junjie Li includes CN¥601.0k salary

- The overall pay is 75% below the industry average

- Over the past three years, Hua Yin International Holdings' EPS grew by 121% and over the past three years, the total loss to shareholders 49%

Performance at Hua Yin International Holdings Limited (HKG:989) has been rather uninspiring recently and shareholders may be wondering how CEO Junjie Li plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 18th of September. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Hua Yin International Holdings

How Does Total Compensation For Junjie Li Compare With Other Companies In The Industry?

According to our data, Hua Yin International Holdings Limited has a market capitalization of HK$1.4b, and paid its CEO total annual compensation worth CN¥601k over the year to March 2023. This means that the compensation hasn't changed much from last year. Notably, the salary of CN¥601k is the entirety of the CEO compensation.

For comparison, other companies in the Hong Kong Real Estate industry with market capitalizations ranging between HK$783m and HK$3.1b had a median total CEO compensation of CN¥2.4m. In other words, Hua Yin International Holdings pays its CEO lower than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥601k | CN¥600k | 100% |

| Other | - | - | - |

| Total Compensation | CN¥601k | CN¥600k | 100% |

Speaking on an industry level, nearly 77% of total compensation represents salary, while the remainder of 23% is other remuneration. Speaking on a company level, Hua Yin International Holdings prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Hua Yin International Holdings Limited's Growth

Over the past three years, Hua Yin International Holdings Limited has seen its earnings per share (EPS) grow by 121% per year. Its revenue is up 252% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hua Yin International Holdings Limited Been A Good Investment?

Few Hua Yin International Holdings Limited shareholders would feel satisfied with the return of -49% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Hua Yin International Holdings rewards its CEO solely through a salary, ignoring non-salary benefits completely. The fact that shareholders are sitting on a loss is certainly disheartening. This contrasts to the strong EPS growth recently however, and suggests that there may be other factors at play driving down the share price. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 3 warning signs for Hua Yin International Holdings that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking to trade Hua Yin International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hua Yin International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:989

Hua Yin International Holdings

An investment holding company, engages in the property development and management business in the People’s Republic of China.

Low and slightly overvalued.

Market Insights

Community Narratives