Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies China Jinmao Holdings Group Limited (HKG:817) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for China Jinmao Holdings Group

What Is China Jinmao Holdings Group's Net Debt?

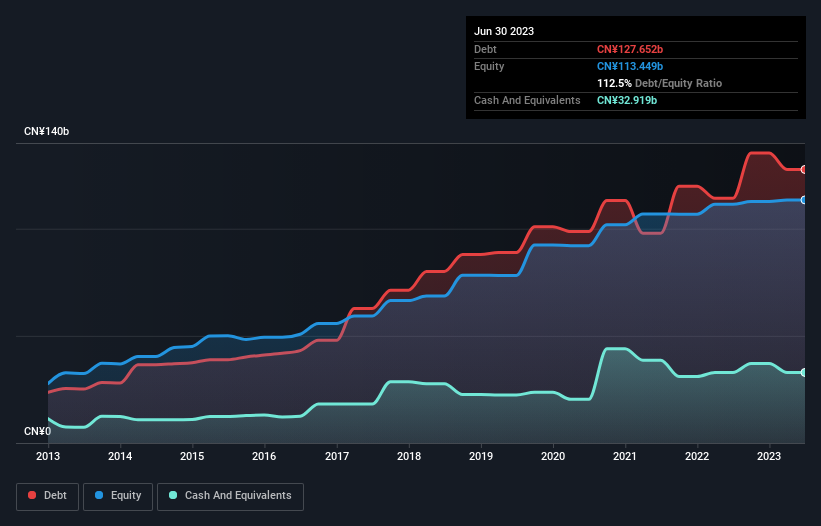

You can click the graphic below for the historical numbers, but it shows that as of June 2023 China Jinmao Holdings Group had CN¥127.7b of debt, an increase on CN¥114.2b, over one year. However, it also had CN¥32.9b in cash, and so its net debt is CN¥94.7b.

How Healthy Is China Jinmao Holdings Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that China Jinmao Holdings Group had liabilities of CN¥190.6b due within 12 months and liabilities of CN¥127.1b due beyond that. Offsetting these obligations, it had cash of CN¥32.9b as well as receivables valued at CN¥26.7b due within 12 months. So its liabilities total CN¥258.1b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥8.75b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, China Jinmao Holdings Group would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

As it happens China Jinmao Holdings Group has a fairly concerning net debt to EBITDA ratio of 21.2 but very strong interest coverage of 26.9. So either it has access to very cheap long term debt or that interest expense is going to grow! Importantly, China Jinmao Holdings Group's EBIT fell a jaw-dropping 58% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine China Jinmao Holdings Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, China Jinmao Holdings Group recorded free cash flow worth 56% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both China Jinmao Holdings Group's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its interest cover is a good sign, and makes us more optimistic. We're quite clear that we consider China Jinmao Holdings Group to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with China Jinmao Holdings Group (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:817

China Jinmao Holdings Group

Engages in the property development business in Mainland China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives