- Hong Kong

- /

- Real Estate

- /

- SEHK:81

China Overseas Grand Oceans Group (HKG:81) Has Announced A Dividend Of CN¥0.11

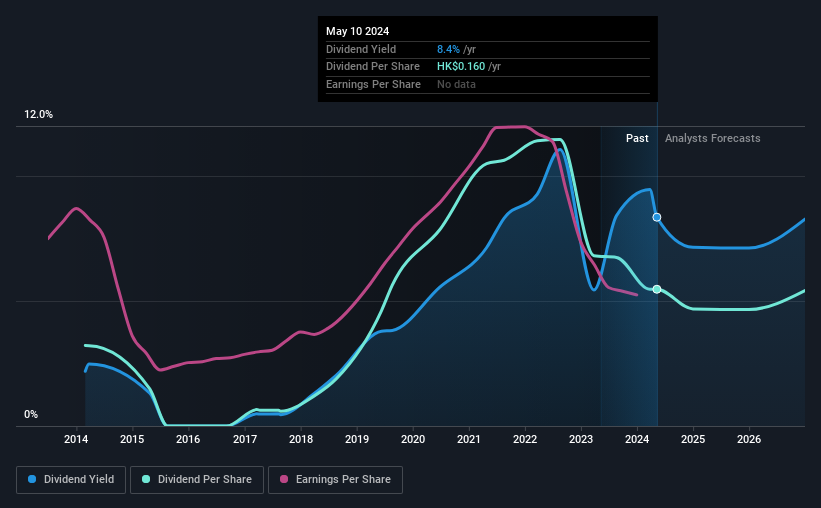

China Overseas Grand Oceans Group Limited's (HKG:81) investors are due to receive a payment of CN¥0.11 per share on 16th of July. However, the dividend yield of 8.4% is still a decent boost to shareholder returns.

Check out our latest analysis for China Overseas Grand Oceans Group

China Overseas Grand Oceans Group's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. However, prior to this announcement, China Overseas Grand Oceans Group's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to fall by 5.8%. Assuming the dividend continues along recent trends, we believe the payout ratio could be 31%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the dividend has gone from CN¥0.0867 total annually to CN¥0.147. This works out to be a compound annual growth rate (CAGR) of approximately 5.5% a year over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past three years, it looks as though China Overseas Grand Oceans Group's EPS has declined at around 20% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 4 warning signs for China Overseas Grand Oceans Group (of which 1 is a bit concerning!) you should know about. Is China Overseas Grand Oceans Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:81

China Overseas Grand Oceans Group

An investment holding company, invests in, develops, and leases real estate properties in the People’s Republic of China and Hong Kong.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives