- Hong Kong

- /

- Real Estate

- /

- SEHK:755

Shanghai Zendai Property Limited's (HKG:755) 42% Share Price Surge Not Quite Adding Up

Despite an already strong run, Shanghai Zendai Property Limited (HKG:755) shares have been powering on, with a gain of 42% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 6.3% isn't as attractive.

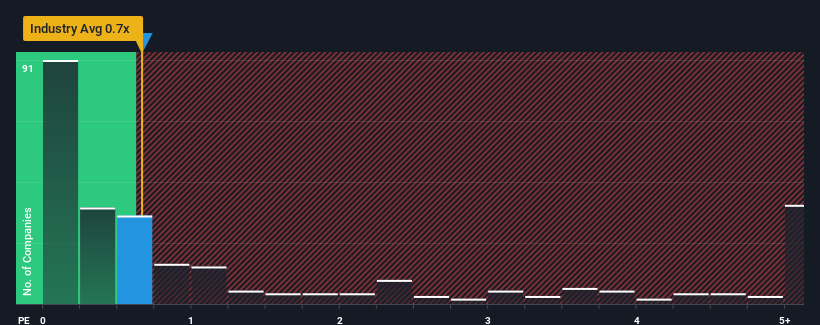

In spite of the firm bounce in price, it's still not a stretch to say that Shanghai Zendai Property's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Real Estate industry in Hong Kong, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Shanghai Zendai Property

What Does Shanghai Zendai Property's P/S Mean For Shareholders?

For example, consider that Shanghai Zendai Property's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shanghai Zendai Property's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Shanghai Zendai Property?

The only time you'd be comfortable seeing a P/S like Shanghai Zendai Property's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 4.2% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 92% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.0% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Shanghai Zendai Property's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What We Can Learn From Shanghai Zendai Property's P/S?

Shanghai Zendai Property appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We find it unexpected that Shanghai Zendai Property trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 5 warning signs we've spotted with Shanghai Zendai Property (including 2 which are a bit unpleasant).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:755

DevGreat Group

An investment holding company, engages in property development, property investment, and property management and agency activities in the People’s Republic of China.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026