- Hong Kong

- /

- Real Estate

- /

- SEHK:6989

Excellence Commercial Property & Facilities Management Group's (HKG:6989) Shareholders Will Receive A Smaller Dividend Than Last Year

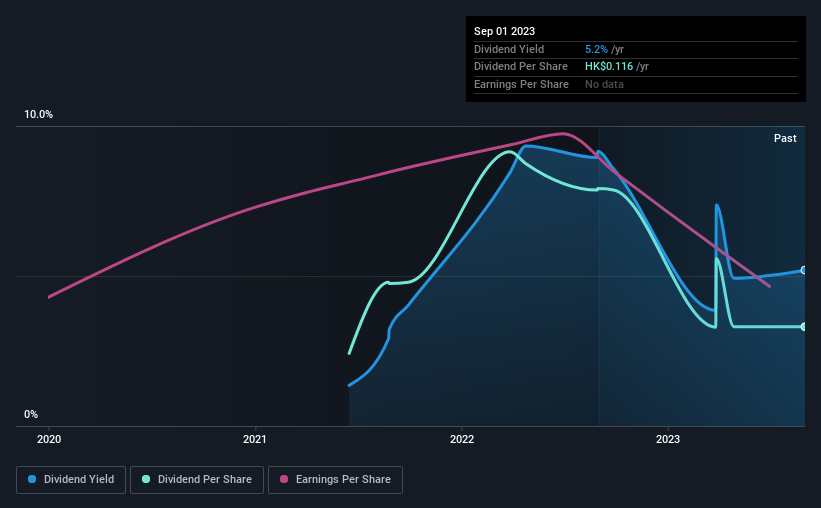

Excellence Commercial Property & Facilities Management Group Limited (HKG:6989) has announced that on 29th of November, it will be paying a dividend ofCN¥0.1218, which a reduction from last year's comparable dividend. The dividend yield will be in the average range for the industry at 5.2%.

Check out our latest analysis for Excellence Commercial Property & Facilities Management Group

Excellence Commercial Property & Facilities Management Group's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Excellence Commercial Property & Facilities Management Group's was paying out quite a large proportion of earnings and 77% of free cash flows. This is usually an indication that the focus of the company is returning cash to shareholders rather than reinvesting it for growth.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 28%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Excellence Commercial Property & Facilities Management Group's Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. The dividend has gone from an annual total of CN¥0.0784 in 2021 to the most recent total annual payment of CN¥0.107. This means that it has been growing its distributions at 17% per annum over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings has been rising at 2.8% per annum over the last three years, which admittedly is a bit slow. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments are bit high to be considered sustainable, and the track record isn't the best. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Excellence Commercial Property & Facilities Management Group that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Excellence Commercial Property & Facilities Management Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6989

Excellence Commercial Property & Facilities Management Group

Provides commercial real estate services in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.