- Hong Kong

- /

- Real Estate

- /

- SEHK:688

Will China Overseas Land & Investment's (SEHK:688) Recent Sales Uptick Offset Ongoing Annual Declines?

Reviewed by Sasha Jovanovic

- China Overseas Land & Investment reported a 7.2% year-on-year increase in contracted property sales for September 2025, reaching approximately RMB 20.17 billion, while cumulative contracted sales from January to September 2025 fell 14.3% compared to the previous year.

- The company also acquired four new land parcels in major cities, signaling ongoing investment appetite even as annual contracted sales remain below last year’s levels.

- We’ll explore how the recent boost in monthly contracted sales could influence China Overseas Land & Investment’s broader investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is China Overseas Land & Investment's Investment Narrative?

To be a shareholder of China Overseas Land & Investment, one needs to have confidence in the company’s ability to manage through challenging cycles in China’s property market, while seeking value from its disciplined land acquisitions and strong position among state-owned developers. The recent 7.2% uptick in September contracted sales is a positive signal and could help stabilize sentiment around short-term earnings targets ahead of the Q3 results. However, cumulative year-on-year sales are still down double digits, suggesting that the rebound is not yet broad-based. This improvement might soften concerns over immediate sales momentum and bring attention back to the pace of project completion and the company’s ability to turn subscribed into contracted sales, both key near-term catalysts. Headwinds such as declining earnings, lower margins, and slow revenue growth remain, but the stock’s modest valuation and the latest sales numbers may slightly reduce perceived risk of steeper declines in coming quarters, if sustained. Still, dividend sustainability and sector-wide volatility shouldn’t be overlooked.

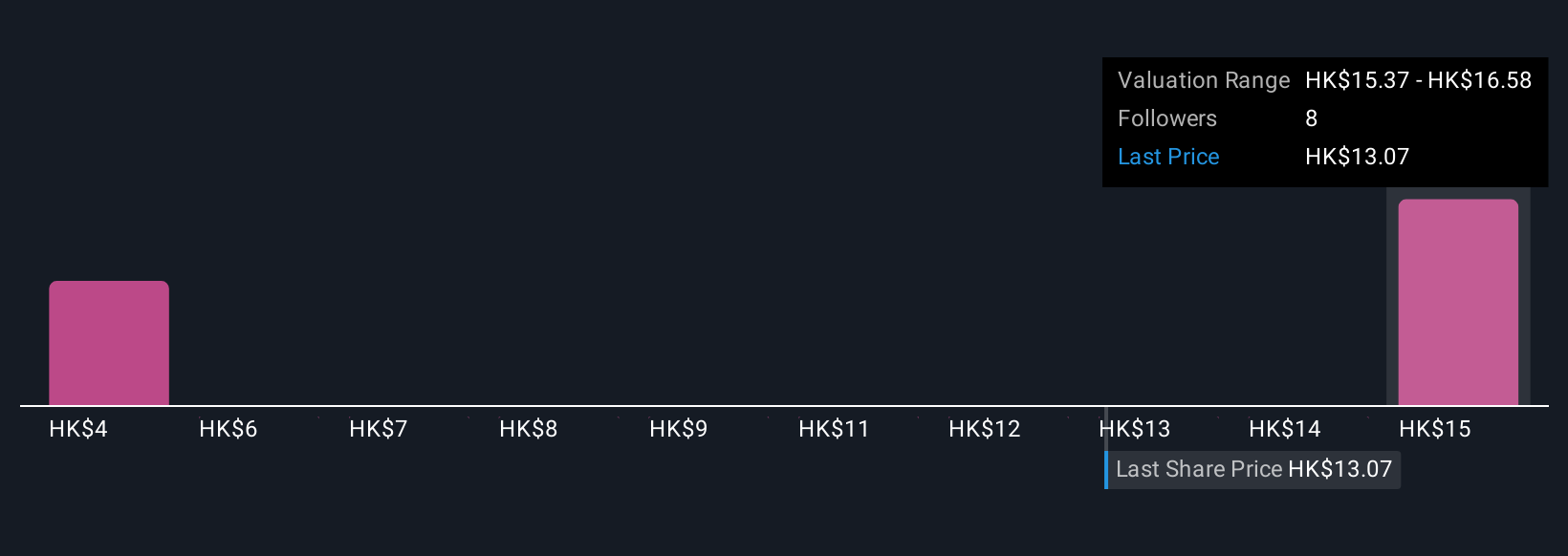

But, with sales still lagging last year, becoming complacent on risk could be costly. China Overseas Land & Investment's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on China Overseas Land & Investment - why the stock might be a potential multi-bagger!

Build Your Own China Overseas Land & Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Overseas Land & Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Overseas Land & Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Overseas Land & Investment's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development, commercial property operations, and other businesses in the People’s Republic of China and the United Kingdom.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives