- Hong Kong

- /

- Real Estate

- /

- SEHK:688

China Overseas Land (SEHK:688) Faces 55% Drop in Sales—What Does This Mean for Its Growth Story?

Reviewed by Sasha Jovanovic

- China Overseas Land & Investment Limited announced that in October 2025, contracted property sales fell to approximately RMB 18.66 billion, marking a 55.1% decrease year-on-year, with sales area down by 40%.

- This significant sales slowdown also contributed to a 21.3% year-on-year decline in accumulated contracted sales for the first ten months of 2025, highlighting pressure on the company's property development business.

- We will explore how the sharp drop in contracted sales shapes China Overseas' investment narrative amid ongoing challenges in the real estate market.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is China Overseas Land & Investment's Investment Narrative?

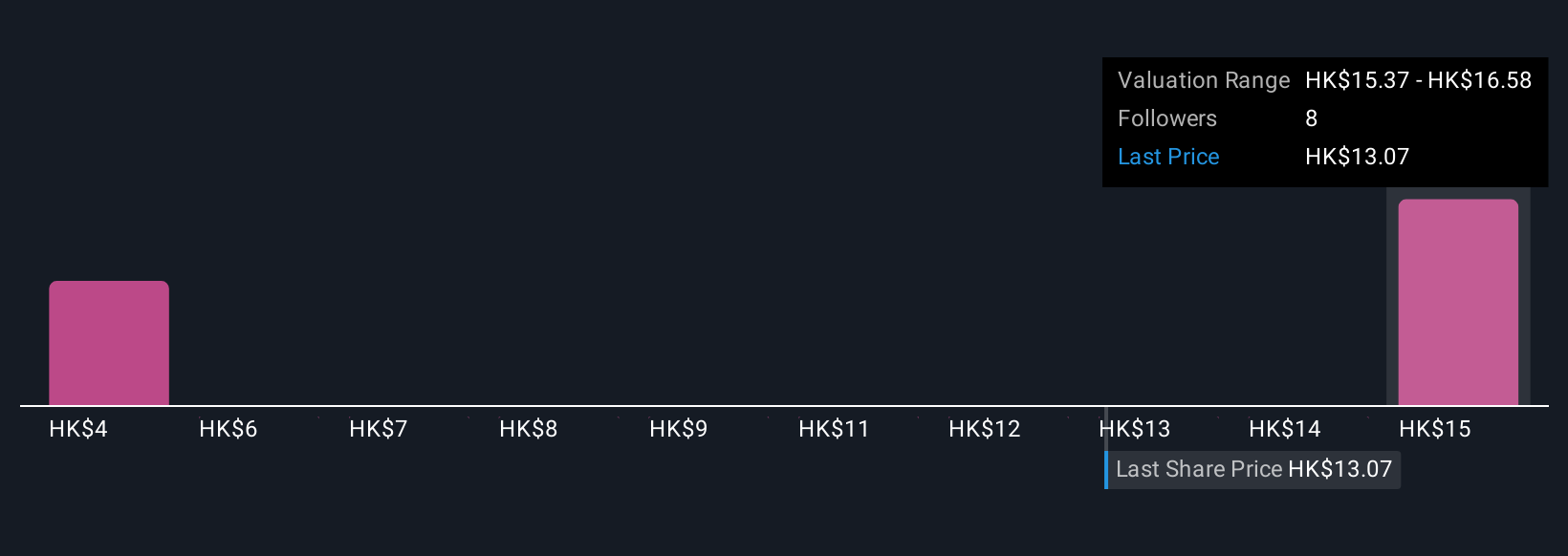

For investors considering China Overseas Land & Investment, the central premise is confidence in a sustained recovery or stabilization in China’s property sector and the company’s ability to weather current headwinds. The steep 55 percent drop in October sales, coupled with a 21 percent year-to-date decline, has added urgency to familiar risks: slower earnings growth, weaker profit margins, and potential pressure on dividends. While the recent share price showed some resilience immediately after the news, the scale of contracted sales decline could impact near-term earnings catalysts and suggests that previous forecasts and consensus price targets may need to be reassessed. Investors who saw the company’s low price-to-earnings ratio and analyst consensus as strong value signals now face heightened uncertainty around the timing and strength of a sales rebound, making short-term visibility an important variable to watch.

But against valuation optimism, the risk of prolonged weak sales cannot be ignored. China Overseas Land & Investment's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on China Overseas Land & Investment - why the stock might be worth as much as 21% more than the current price!

Build Your Own China Overseas Land & Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Overseas Land & Investment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Overseas Land & Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Overseas Land & Investment's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development, commercial property operations, and other businesses in the People’s Republic of China and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives