- Hong Kong

- /

- Real Estate

- /

- SEHK:6626

Yuexiu Services Group Limited (HKG:6626) Stocks Shoot Up 32% But Its P/E Still Looks Reasonable

Yuexiu Services Group Limited (HKG:6626) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 39%.

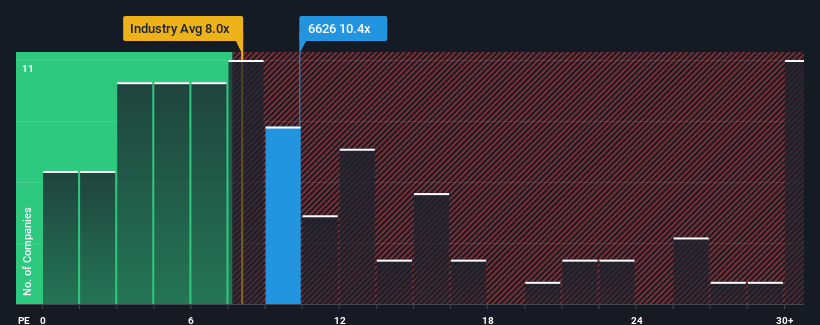

Although its price has surged higher, you could still be forgiven for feeling indifferent about Yuexiu Services Group's P/E ratio of 10.4x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Yuexiu Services Group has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Yuexiu Services Group

How Is Yuexiu Services Group's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Yuexiu Services Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. EPS has also lifted 20% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 13% each year over the next three years. That's shaping up to be similar to the 12% per annum growth forecast for the broader market.

With this information, we can see why Yuexiu Services Group is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Yuexiu Services Group's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Yuexiu Services Group's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - Yuexiu Services Group has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Yuexiu Services Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6626

Yuexiu Services Group

An investment holding company, provides non-commercial and commercial property management services in Mainland China and Hong Kong.

Flawless balance sheet and fair value.

Market Insights

Community Narratives