- Hong Kong

- /

- Real Estate

- /

- SEHK:6098

Optimistic Investors Push Country Garden Services Holdings Company Limited (HKG:6098) Shares Up 28% But Growth Is Lacking

Country Garden Services Holdings Company Limited (HKG:6098) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

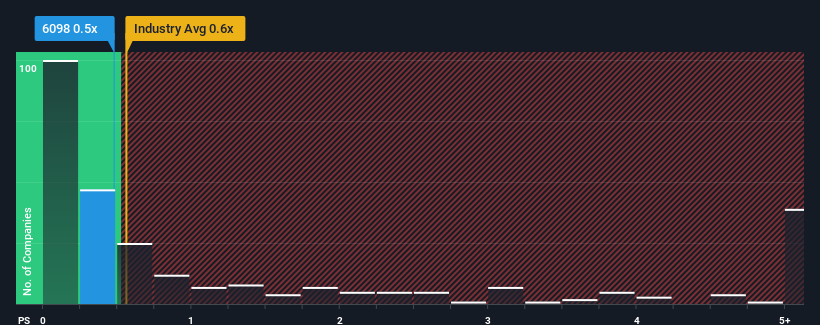

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Country Garden Services Holdings' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Country Garden Services Holdings

How Country Garden Services Holdings Has Been Performing

There hasn't been much to differentiate Country Garden Services Holdings' and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Country Garden Services Holdings will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Country Garden Services Holdings.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Country Garden Services Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 105% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 1.6% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 3.8% each year growth forecast for the broader industry.

With this in mind, we find it intriguing that Country Garden Services Holdings' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Country Garden Services Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Country Garden Services Holdings' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Country Garden Services Holdings.

If you're unsure about the strength of Country Garden Services Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6098

Country Garden Services Holdings

An investment holding company, provides property management services to property owners, residents, and property developers in Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026