- Hong Kong

- /

- Real Estate

- /

- SEHK:10

Discover October 2024's Best Undervalued Small Caps With Insider Buys

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures and the U.S. stock indices reach record highs, small-cap stocks have shown mixed performance, with the Russell 2000 Index slightly down for the week. Despite this volatility, opportunities remain for discerning investors who can identify undervalued small-cap companies with strong insider buying signals. When evaluating potential investments in this environment, it's crucial to consider companies that not only show signs of being undervalued but also demonstrate confidence from insiders through their buying activities.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 22.0x | 1.0x | 40.85% | ★★★★★★ |

| Thryv Holdings | NA | 0.7x | 26.80% | ★★★★★☆ |

| Rogers Sugar | 15.6x | 0.6x | 47.36% | ★★★★☆☆ |

| MYR Group | 34.4x | 0.5x | 42.13% | ★★★★☆☆ |

| Studsvik | 19.6x | 1.2x | 43.97% | ★★★★☆☆ |

| Essentra | 718.7x | 1.4x | 38.07% | ★★★★☆☆ |

| Genus | 166.8x | 2.0x | -0.87% | ★★★★☆☆ |

| German American Bancorp | 13.6x | 4.5x | 47.72% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -217.33% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Hang Lung Group (SEHK:10)

Simply Wall St Value Rating: ★★★★☆☆

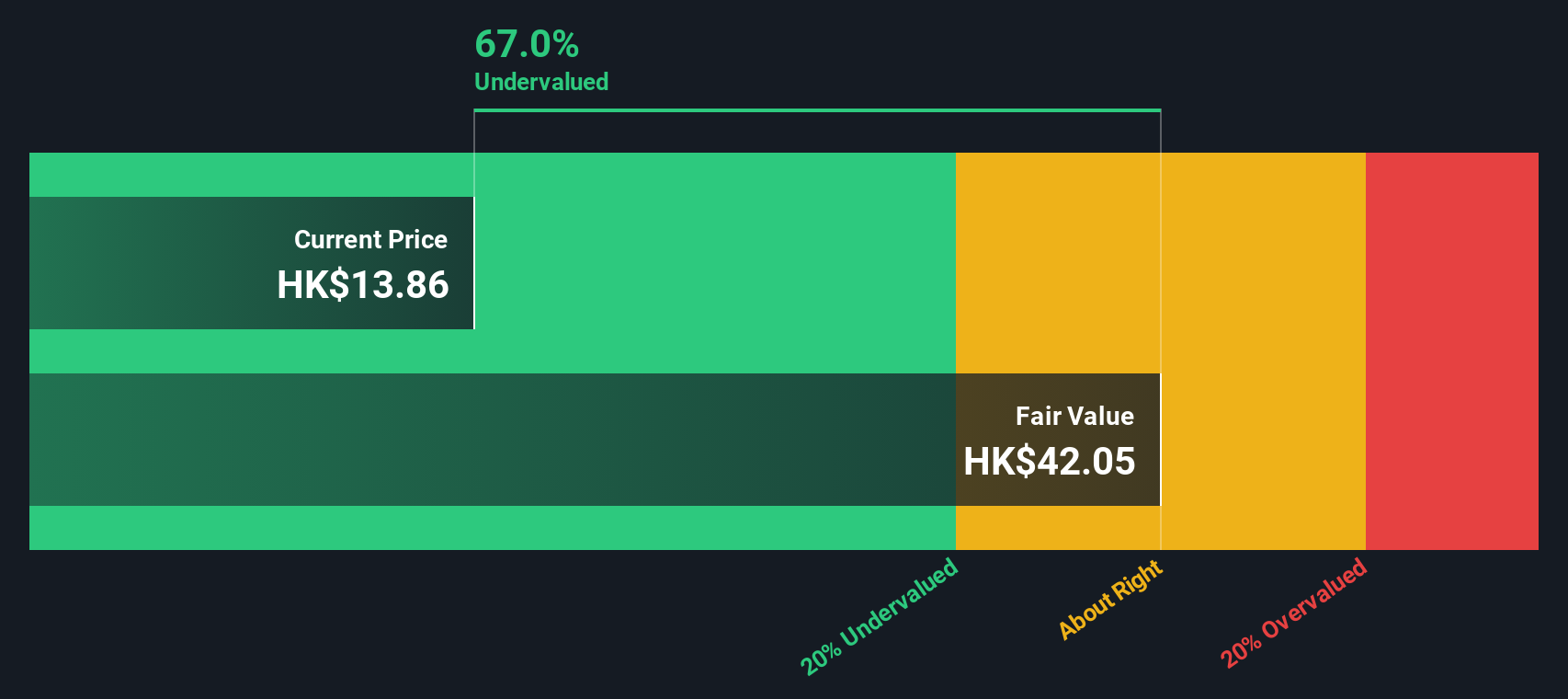

Overview: Hang Lung Group is a property investment and development company with operations primarily focused on property leasing in Hong Kong and Mainland China, boasting a market cap of HK$24.30 billion.

Operations: The company generates revenue primarily from property sales in Hong Kong and property leasing in both Hong Kong and Mainland China. For the period ending 2023-09-30, it reported a gross profit margin of 71.85% on a revenue of HK$10.94 billion, with net income at HK$2.89 billion.

PE: 7.6x

Hang Lung Group, a smaller company in the market, has seen its net profit margin drop from 27.2% to 16.9% over the past year and earnings have been declining by 12.2% annually over five years. Despite these challenges, insider confidence is evident with Wenbwo Chan purchasing 200,000 shares for HK$1.93 million recently. For H1 2024, sales increased to HK$6.38 billion from HK$5.53 billion last year, though net income fell to HK$888 million from HK$1.68 billion previously.

- Get an in-depth perspective on Hang Lung Group's performance by reading our valuation report here.

Evaluate Hang Lung Group's historical performance by accessing our past performance report.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer and distributor of plastic and rubber products with operations primarily in China, boasting a market cap of CN¥42.50 billion.

Operations: The company's revenue primarily comes from the Plastics & Rubber segment, amounting to CN¥29.13 billion. The gross profit margin has fluctuated, reaching 28.79% as of June 30, 2023. Operating expenses and non-operating expenses are significant cost components impacting net income margins, which were recorded at 6.58% for the same period.

PE: 6.9x

China Lesso Group Holdings, a small-cap stock, recently reported a decline in earnings for the first half of 2024, with sales dropping to CNY 13.56 billion from CNY 15.30 billion and net income falling to CNY 1.04 billion from CNY 1.49 billion year-over-year. Despite this, insider confidence remains strong; Luen Hei Wong purchased four million shares valued at over US$10 million between April and June 2024. The company's high debt level is offset by its forecasted annual earnings growth of over 10%.

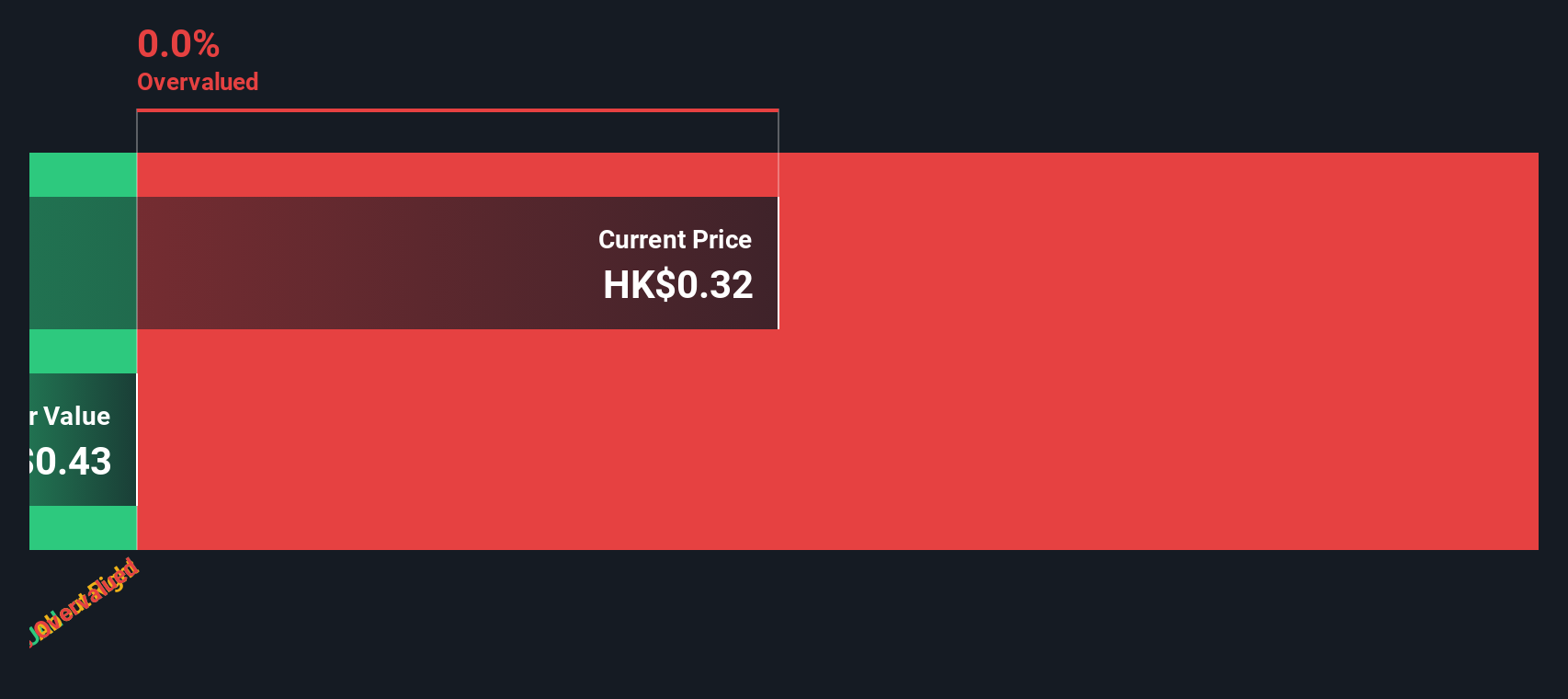

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment focuses on property development and property investment and management, with a market cap of approximately CN¥4.39 billion.

Operations: The company generates revenue primarily from Property Development (CN¥17.26 billion) and Property Investment and Management (CN¥1.23 billion). The gross profit margin has shown considerable variation, with recent figures at 10.57% as of December 31, 2023. Operating expenses have been rising, reaching CN¥677.456 million by June 30, 2024. Net income margins have fluctuated significantly over the periods reviewed, showing a negative trend in the latest data points.

PE: -2.6x

Gemdale Properties and Investment has recently faced financial challenges, reporting a net loss of CNY 2.18 billion for the half year ending June 30, 2024, compared to a net income of CNY 562 million the previous year. Despite this, insider confidence is evident with Non-Executive Director Lian Huat Loh purchasing 10 million shares valued at approximately US$2.6 million in August 2024. The company's aggregate contracted sales from January to August totaled RMB 12.43 billion across an area of roughly 944,400 square meters.

Next Steps

- Embark on your investment journey to our 176 Undervalued Small Caps With Insider Buying selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:10

Hang Lung Group

An investment holding company, operates as a property developer in Hong Kong and Mainland China.

Established dividend payer and fair value.

Market Insights

Community Narratives