Discover Hong Kong's Top 3 Undervalued Small Caps With Insider Buying In September 2024

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures, the Hong Kong market has seen a significant uptick, with the Hang Seng Index gaining 13% in recent weeks. This positive sentiment provides an opportune backdrop for investors looking at small-cap stocks that may be undervalued yet show promising insider activity. In such a dynamic environment, identifying good stocks often involves looking for companies with strong fundamentals and recent insider buying, which can signal confidence from those who know the business best.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.6x | 43.40% | ★★★★★☆ |

| Ferretti | 10.6x | 0.7x | 48.39% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.2x | 46.63% | ★★★★☆☆ |

| Meilleure Health International Industry Group | 26.0x | 9.6x | 20.94% | ★★★☆☆☆ |

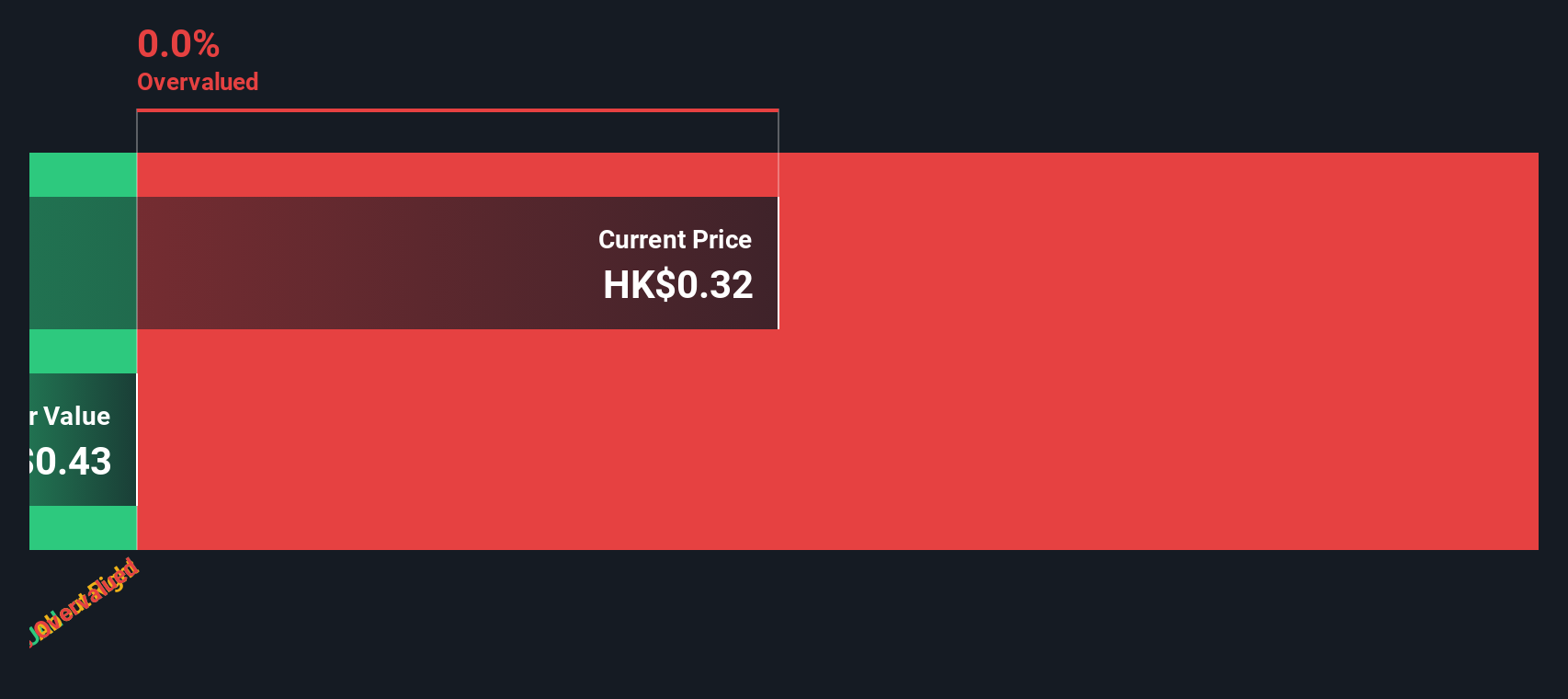

| China Lesso Group Holdings | 5.4x | 0.4x | -464.44% | ★★★☆☆☆ |

| Skyworth Group | 5.8x | 0.1x | -309.33% | ★★★☆☆☆ |

| Jinke Smart Services Group | NA | 0.9x | 41.12% | ★★★☆☆☆ |

| CN Logistics International Holdings | 19.2x | 0.4x | 25.34% | ★★★☆☆☆ |

| Ming Yuan Cloud Group Holdings | NA | 2.7x | 44.75% | ★★★☆☆☆ |

| Emperor International Holdings | NA | 0.8x | 32.06% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer and distributor of plastic and rubber products with operations primarily in the construction materials sector, boasting a market cap of CN¥37.50 billion.

Operations: The company generates revenue primarily from its Plastics & Rubber segment, with recent quarterly revenue reaching CN¥29.13 billion. The net income margin has shown variations, most recently at 6.58%.

PE: 5.4x

China Lesso Group Holdings, a Hong Kong small cap, recently reported a decline in sales and net income for the half year ending June 30, 2024. Sales fell to CNY 13.56 billion from CNY 15.30 billion last year, while net income dropped to CNY 1.04 billion from CNY 1.49 billion. Despite these challenges, insider confidence remains strong with Luen Hei Wong purchasing four million shares worth approximately US$10 million recently. This suggests potential for future growth despite current financial hurdles and high debt levels reliant on external borrowing sources.

- Take a closer look at China Lesso Group Holdings' potential here in our valuation report.

Learn about China Lesso Group Holdings' historical performance.

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment focuses on property development, investment, and management with a market cap of approximately CN¥5.24 billion.

Operations: The company's revenue primarily comes from Property Development (CN¥17.26 billion) and Property Investment and Management (CN¥1.23 billion). The gross profit margin has varied significantly, reaching a high of 41.63% in December 2018 but dropping to as low as -0.03% in June 2023, reflecting fluctuations in cost management and operational efficiency over time.

PE: -1.7x

Gemdale Properties and Investment, a Hong Kong small cap, recently reported significant insider confidence with Lian Huat Loh purchasing 10 million shares valued at approximately RMB 2.6 million in August 2024. Despite facing a net loss of RMB 2.18 billion for the first half of 2024 compared to a net income of RMB 562 million last year, the company achieved aggregate contracted sales of RMB 12.43 billion from January to August 2024. This combination of insider buying and strong sales figures suggests potential resilience amidst financial challenges.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ming Yuan Cloud Group Holdings specializes in providing cloud services and on-premise software solutions, with a market cap of approximately CN¥18.70 billion.

Operations: The company generates revenue primarily from Cloud Services (CN¥1.32 billion) and On-premise Software and Services (CN¥281.71 million). For the period ending September 2023, it reported a gross profit margin of 80.45% with net income margin showing a negative trend at -44.99%.

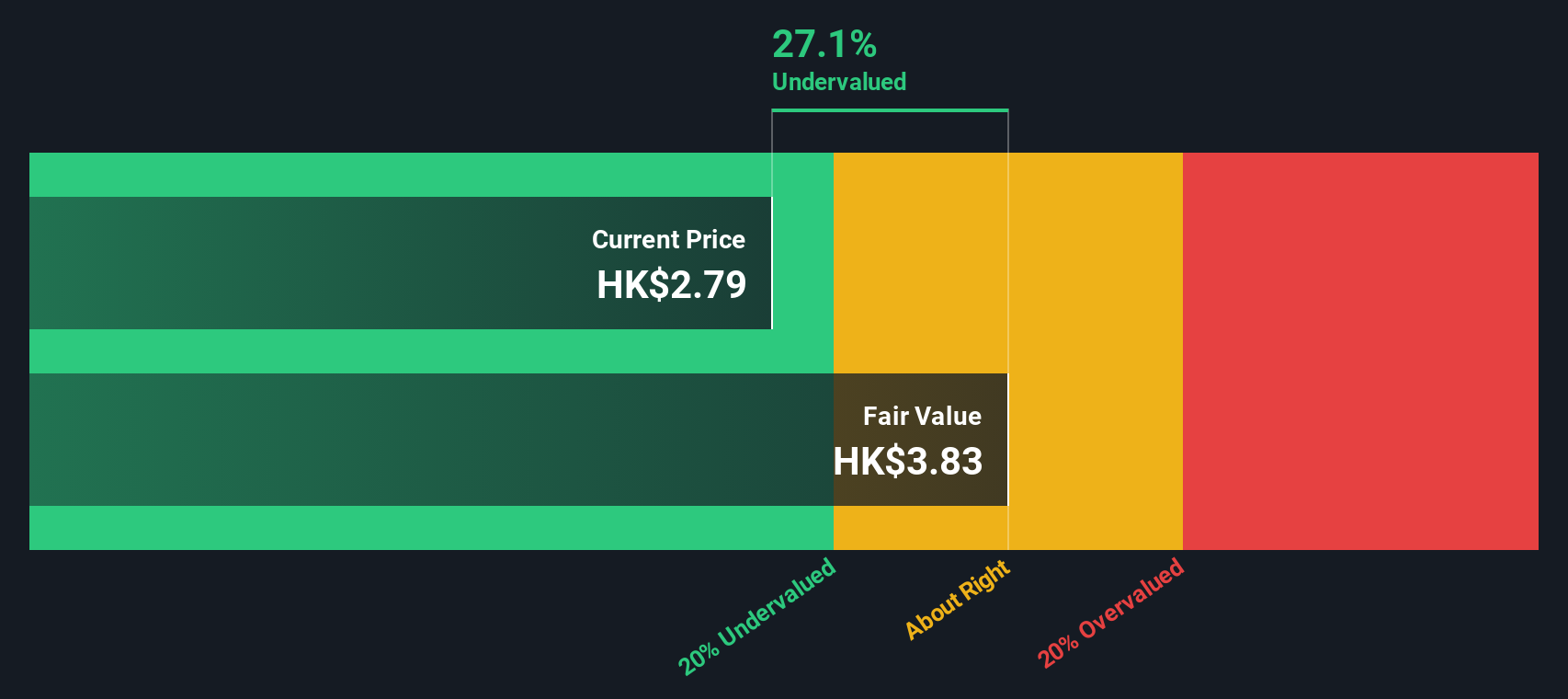

PE: -11.3x

Ming Yuan Cloud Group Holdings, a small cap in Hong Kong, has seen significant insider confidence with VP & Executive Director Xiaohui Chen purchasing 1 million shares valued at approximately CNY 2.53 million recently. Despite reporting a net loss of CNY 115.37 million for the half year ending June 30, 2024, compared to CNY 323.32 million last year, the company is undertaking share repurchases authorized by shareholders to potentially enhance earnings per share. With a forecasted annual earnings growth of over 74%, Ming Yuan Cloud's strategic moves and executive changes signal potential future value amidst its current undervalued status.

- Dive into the specifics of Ming Yuan Cloud Group Holdings here with our thorough valuation report.

Understand Ming Yuan Cloud Group Holdings' track record by examining our Past report.

Make It Happen

- Get an in-depth perspective on all 10 Undervalued SEHK Small Caps With Insider Buying by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:909

Ming Yuan Cloud Group Holdings

An investment holding company, provides software solutions for property developers in China.

Excellent balance sheet with reasonable growth potential.