Global markets have been navigating a tumultuous landscape marked by renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, which have led to fluctuations in major indices. Amid this backdrop, investors are paying close attention to the upcoming earnings season for insights into market direction. In such uncertain times, penny stocks—though often seen as remnants of past market eras—continue to hold potential for growth at accessible price points. These smaller or newer companies can offer significant opportunities when they possess strong financials and solid fundamentals, making them an intriguing option for those seeking value in today's complex economic environment.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.41 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.60 | MYR305.09M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.46 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.35 | SGD547.14M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.35 | MYR542.1M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.28 | SGD12.91B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5375 | $312.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.49M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,575 stocks from our Global Penny Stocks screener.

We'll examine a selection from our screener results.

Novautek Technologies Group (SEHK:519)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Novautek Technologies Group Limited is an investment holding company involved in resort and property development, as well as property investment in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$916.53 million.

Operations: The company's revenue is primarily derived from property development (HK$34.58 billion), property investment (HK$13.15 billion), AI robots (HK$1.41 billion), and investment holding (HK$809 million).

Market Cap: HK$916.53M

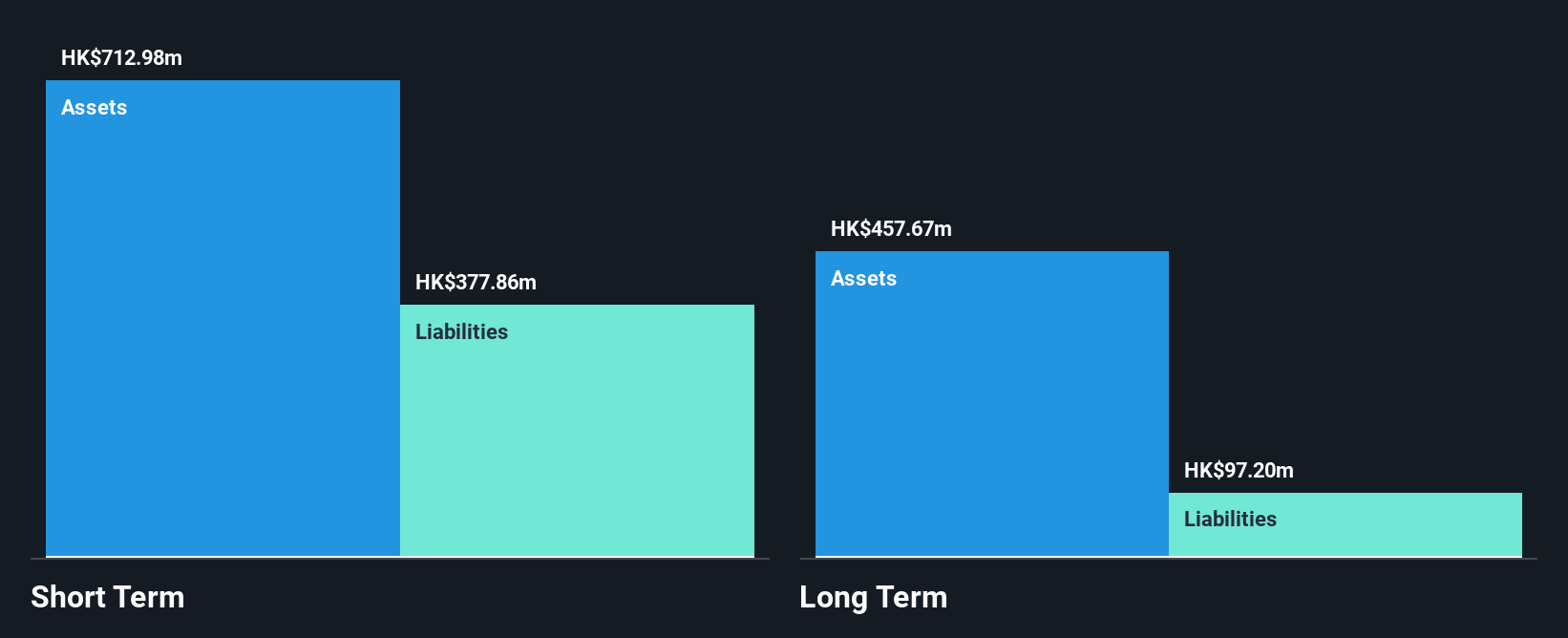

Novautek Technologies Group Limited has recently transitioned to profitability, reporting a net income of HK$9.05 million for the year ending June 2025, a significant improvement from the previous year's loss. The company's financial turnaround is partly due to increased fair value gains on investment properties and strategic asset disposals. Despite its low return on equity at 0.9%, Novautek's debt-to-equity ratio remains satisfactory at 9.5%. Recent strategic alliances in AI and robotics with Tsinghua University and Mach 1 AI Robotics are poised to enhance its market position, potentially driving future growth through innovation and expanded applications across various sectors.

- Get an in-depth perspective on Novautek Technologies Group's performance by reading our balance sheet health report here.

- Understand Novautek Technologies Group's track record by examining our performance history report.

Xiamen Hexing Packaging Printing (SZSE:002228)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xiamen Hexing Packaging Printing Co., Ltd. operates in the packaging and printing industry, with a market cap of CN¥3.86 billion.

Operations: The company generates CN¥10.93 billion in revenue from its packaging manufacturing industry segment.

Market Cap: CN¥3.86B

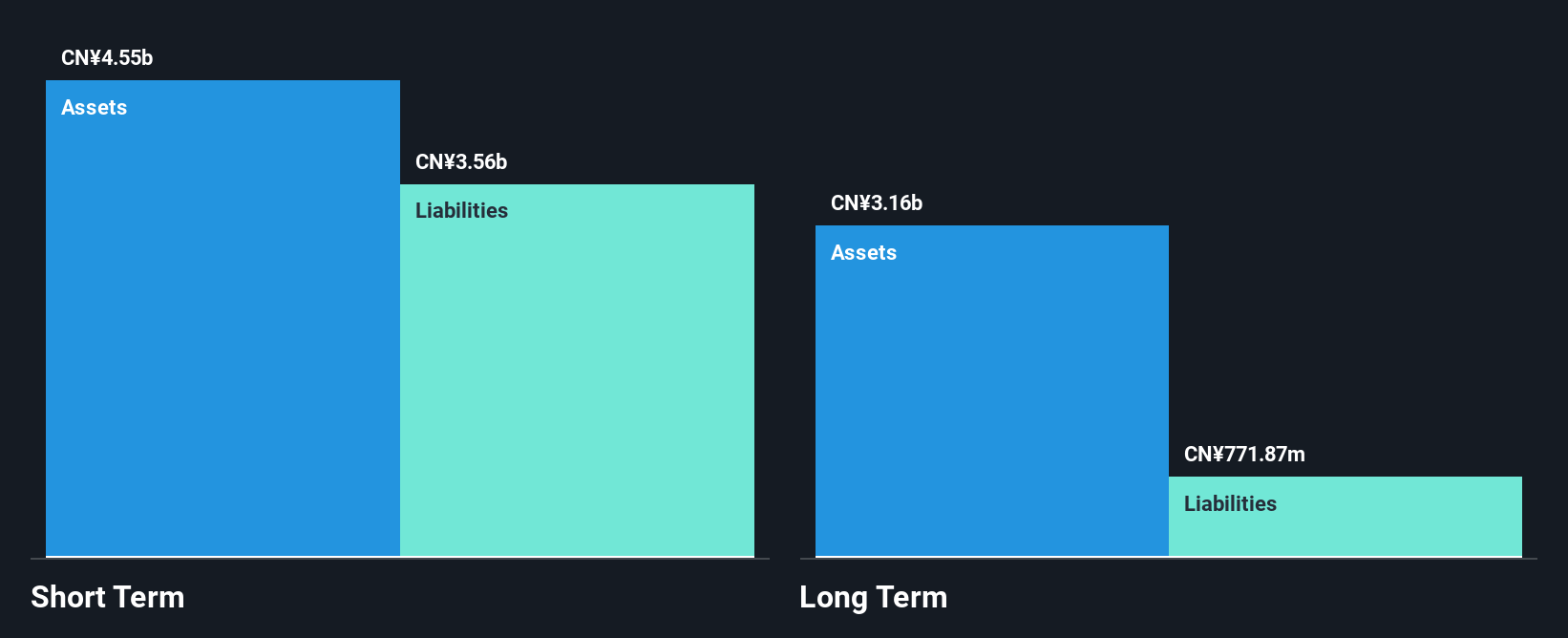

Xiamen Hexing Packaging Printing Co., Ltd. has demonstrated stable performance with its recent half-year earnings showing a net income increase to CN¥115.2 million from CN¥88.02 million the previous year, despite a slight revenue decline. The company's price-to-earnings ratio of 32.7x is attractive compared to the broader Chinese market average, suggesting potential value for investors in this segment. Its financial stability is underscored by short-term assets exceeding both long and short-term liabilities, though its dividend yield of 5.26% isn't well supported by earnings or cash flow, indicating potential sustainability concerns for income-focused investors.

- Unlock comprehensive insights into our analysis of Xiamen Hexing Packaging Printing stock in this financial health report.

- Gain insights into Xiamen Hexing Packaging Printing's outlook and expected performance with our report on the company's earnings estimates.

Beijing Haixin Energy TechnologyLtd (SZSE:300072)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beijing Haixin Energy Technology Co., Ltd. operates in the energy technology sector and has a market cap of CN¥8.60 billion.

Operations: Revenue segments for the company are not reported.

Market Cap: CN¥8.6B

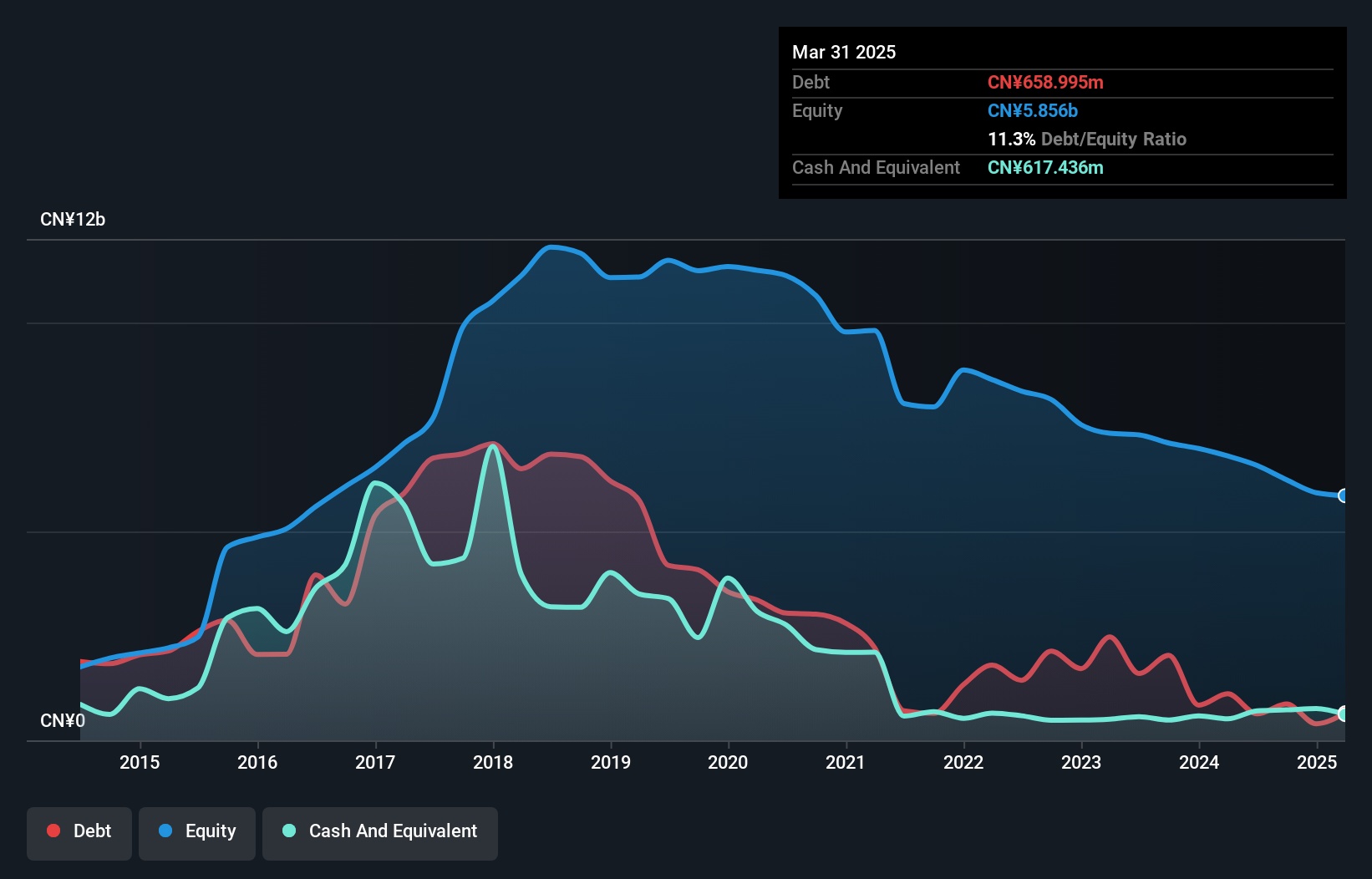

Beijing Haixin Energy Technology Co., Ltd. has shown improvement in its financial health despite being currently unprofitable, with a reduced net loss of CN¥35.38 million for the half-year ended June 2025 compared to CN¥325.96 million a year ago. The company's strong liquidity position is highlighted by short-term assets of CN¥3.5 billion exceeding both short-term and long-term liabilities, while having more cash than total debt further strengthens its balance sheet. Although earnings are forecasted to grow significantly, the management's relatively short tenure and negative operating cash flow present challenges that investors should consider carefully.

- Take a closer look at Beijing Haixin Energy TechnologyLtd's potential here in our financial health report.

- Learn about Beijing Haixin Energy TechnologyLtd's future growth trajectory here.

Where To Now?

- Unlock more gems! Our Global Penny Stocks screener has unearthed 3,572 more companies for you to explore.Click here to unveil our expertly curated list of 3,575 Global Penny Stocks.

- Ready For A Different Approach? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Haixin Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300072

Beijing Haixin Energy TechnologyLtd

Beijing Haixin Energy Technology Co.,Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026