- Hong Kong

- /

- Real Estate

- /

- SEHK:3900

Greentown China (SEHK:3900) Valuation: Fresh Insights Following Latest Operating Results Release

Reviewed by Simply Wall St

Greentown China Holdings (SEHK:3900) just released its unaudited operating results, providing detailed data on September and year-to-date sales volumes, sales area, and contracted sales across its projects.

See our latest analysis for Greentown China Holdings.

Greentown China Holdings’ release of robust September and year-to-date operating figures comes after a period of notable price volatility. The stock is trading at HK$8.93, and recent sales news has helped sentiment recover from a 1-month share price return of -8.41%. Over the past year, the total shareholder return edged slightly lower by 0.87%, hinting that while momentum remains cautious, the market is quick to respond to operating updates that may shift the long-term outlook.

If you’re weighing other possibilities beyond property stocks, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether recent operational strength and a sharp discount to analyst targets indicate an undervalued opportunity, or if the market has already factored in all future growth prospects for Greentown China Holdings.

Price-to-Sales of 0.1x: Is it justified?

With Greentown China Holdings trading at a price-to-sales ratio of just 0.1x, the last close price of HK$8.93 suggests the shares are at a significant discount to both industry peers and the company’s own fundamentals.

The price-to-sales (P/S) ratio compares the company’s market value to its revenues, offering a useful lens when earnings are negative or volatile. In real estate, where reported profits can swing due to project cycles, the P/S ratio helps investors gauge value based on ongoing sales activity instead of temporary earnings.

For Greentown China Holdings, this ultra-low P/S multiple raises questions about whether the market is overly pessimistic about its future prospects. The company’s ratio not only undercuts the peer average of 0.3x but also stands well below the Hong Kong Real Estate industry average of 0.7x. In addition, it is far beneath the estimated Fair Price-to-Sales Ratio of 0.6x, suggesting there could be substantial upside if market views align more closely with underlying fundamentals.

Explore the SWS fair ratio for Greentown China Holdings

Result: Price-to-Sales of 0.1x (UNDERVALUED)

However, persistent revenue declines and a prolonged negative return trend may signal deeper concerns. These factors could limit any potential upside in the near term.

Find out about the key risks to this Greentown China Holdings narrative.

Another View: What Does the SWS DCF Model Say?

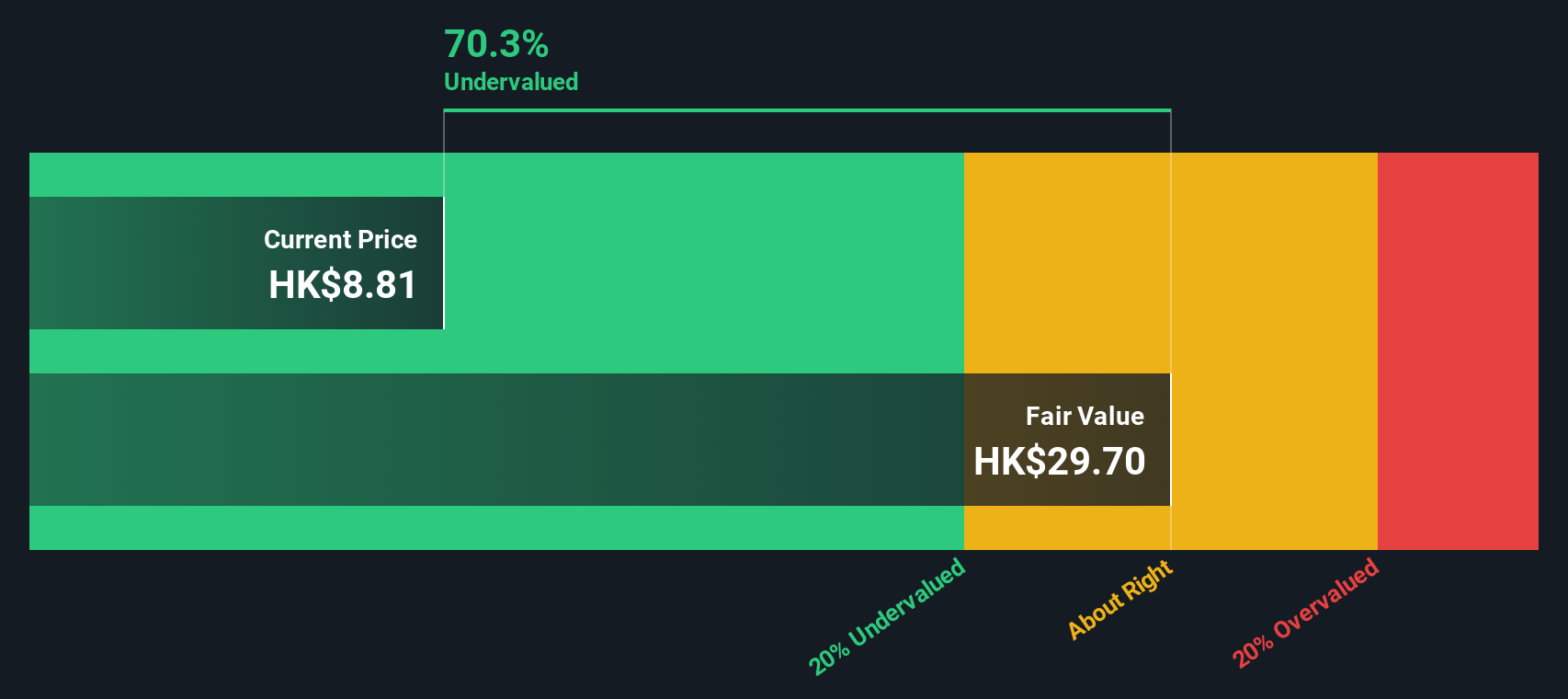

Looking at Greentown China Holdings through the lens of our DCF model, the share price appears even more deeply undervalued. While the market price sits at HK$8.93, the SWS DCF model estimates a fair value closer to HK$29.71, a striking 69.9% discount. This sizeable gap invites scrutiny. Does the market see risks the model does not, or is opportunity knocking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greentown China Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greentown China Holdings Narrative

If you’re curious to draw your own conclusions or want to interpret the numbers differently, making your own personalized assessment takes less than three minutes. Do it your way

A great starting point for your Greentown China Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio strategy and stay a step ahead with opportunities that won't wait. Use the Simply Wall Street Screener now and seize what others might miss.

- Capture unmatched growth by unlocking the potential of emerging technology leaders through these 24 AI penny stocks positioned to transform entire industries with artificial intelligence.

- Spot undervalued gems before the crowd by analyzing these 873 undervalued stocks based on cash flows based on fundamental cash flow metrics and market mispricing.

- Secure steady passive income by reviewing these 17 dividend stocks with yields > 3% for reliable yields higher than 3% and strong payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3900

Greentown China Holdings

Engages in the development for sale of residential properties in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives