Global markets have shown mixed signals recently, with U.S. stocks facing downward pressure due to tariff uncertainties and a cooling labor market, while European indices defy concerns by posting gains. In such volatile conditions, investors often look beyond traditional blue-chip stocks for opportunities that might offer resilience and growth potential. Penny stocks, although an outdated term, continue to represent smaller or newer companies that can surprise investors with their potential when backed by strong financial health.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.55 | MYR2.73B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £476.68M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.99 | £321.93M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.345 | MYR959.84M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,698 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sino-Ocean Group Holding (SEHK:3377)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino-Ocean Group Holding Limited is an investment holding company involved in property investment and development in the People's Republic of China, with a market capitalization of approximately HK$2.17 billion.

Operations: The company's revenue is primarily derived from property development across various regions in China, including CN¥8.39 billion from Eastern China, CN¥7.53 billion from the Bohai Rim Region, CN¥6.93 billion from Central China, CN¥5.66 billion from Southern China, and CN¥1.83 billion from Beijing; additionally, it earns revenue through property management (CN¥2.77 billion) and property investment (CN¥0.43 billion).

Market Cap: HK$2.17B

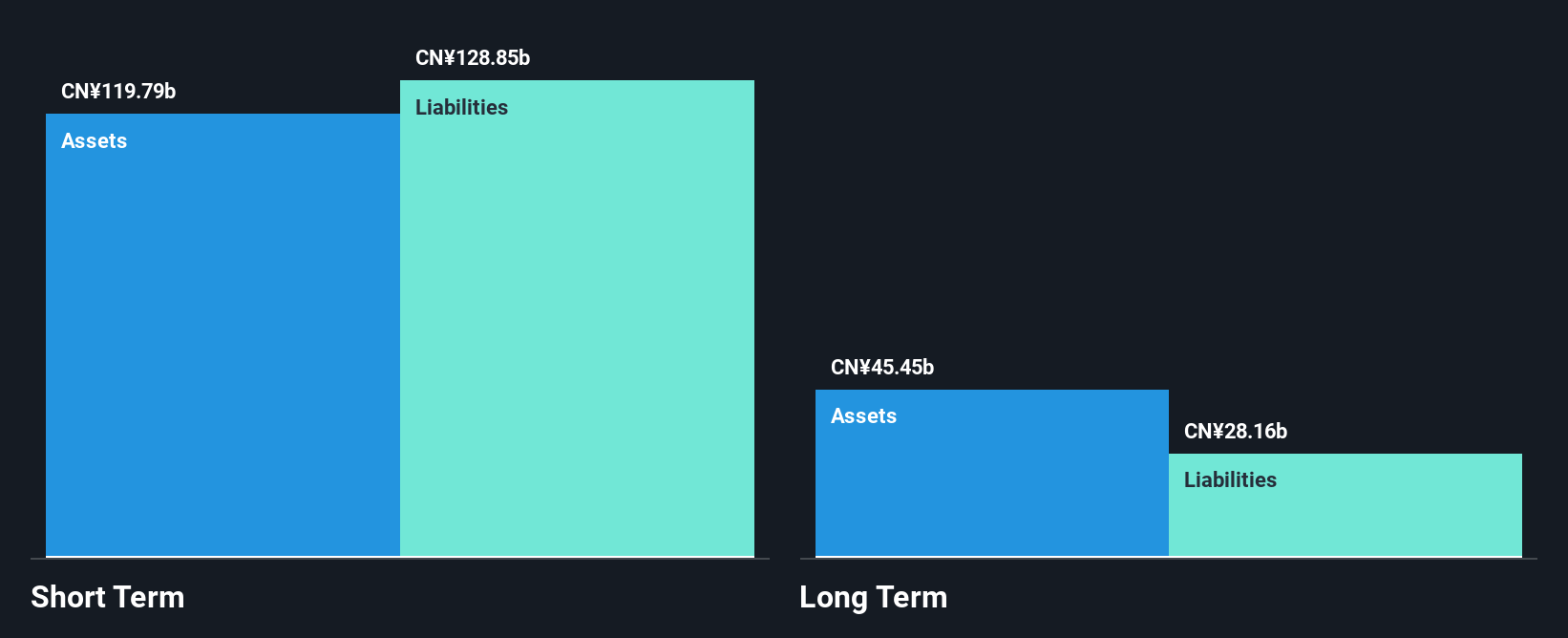

Sino-Ocean Group Holding, with a market cap of approximately HK$2.17 billion, has been navigating challenges typical for companies in the penny stock category. Despite being unprofitable with a negative return on equity and high net debt to equity ratio (666.9%), its short-term assets cover both short and long-term liabilities, providing some financial cushion. Recent board changes introduce experienced finance professionals which may influence strategic decisions positively. The company reported contracted sales of RMB35.16 billion for 2024, but its volatile share price and increasing losses over five years highlight ongoing risks in its operations within China's property sector.

- Get an in-depth perspective on Sino-Ocean Group Holding's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Sino-Ocean Group Holding's track record.

Yotrio Group (SZSE:002489)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yotrio Group Co., Ltd. is engaged in the research, development, manufacture, and sale of outdoor furniture products across China and various international markets, with a market cap of CN¥7.61 billion.

Operations: No specific revenue segments are reported for Yotrio Group Co., Ltd.

Market Cap: CN¥7.61B

Yotrio Group, with a market cap of CN¥7.61 billion, demonstrates financial resilience despite challenges in the penny stock category. The company's short-term assets (CN¥4.1B) comfortably cover both its short-term (CN¥2.5B) and long-term liabilities (CN¥82.6M), indicating solid liquidity management. Its net profit margin improved to 9.1% from 2.7% last year, showcasing operational efficiency gains, while earnings growth over the past year surged by a very large amount compared to industry trends, despite a five-year decline trend of 27.6%. However, its Return on Equity remains low at 10.9%, suggesting room for improvement in profitability metrics.

- Navigate through the intricacies of Yotrio Group with our comprehensive balance sheet health report here.

- Gain insights into Yotrio Group's historical outcomes by reviewing our past performance report.

Zhejiang Zhongcheng Packing Material (SZSE:002522)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Zhongcheng Packing Material Co., Ltd. operates in the packaging materials industry and has a market cap of approximately CN¥3.79 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: CN¥3.79B

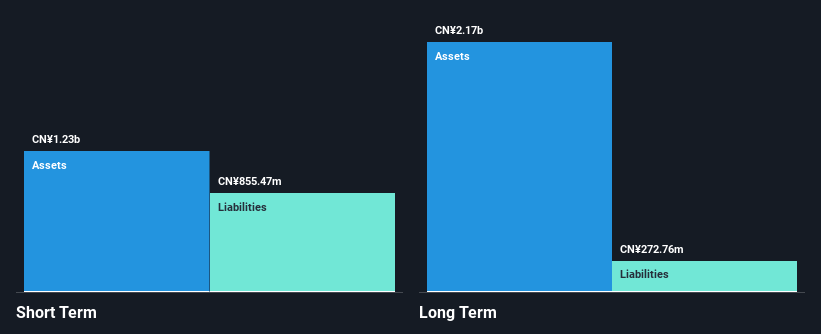

Zhejiang Zhongcheng Packing Material, with a market cap of CN¥3.79 billion, presents a mixed financial picture within the penny stock realm. The company has experienced negative earnings growth of 43% over the past year, contrasting with its stable weekly volatility and satisfactory net debt to equity ratio of 12.2%. Its short-term assets (CN¥1.2B) exceed both short-term (CN¥855.5M) and long-term liabilities (CN¥272.8M), highlighting effective liquidity management despite declining profit margins from 6.1% to 3.6%. Interest payments are well covered by EBIT at 4.2x, though Return on Equity remains low at -0.3%.

- Jump into the full analysis health report here for a deeper understanding of Zhejiang Zhongcheng Packing Material.

- Evaluate Zhejiang Zhongcheng Packing Material's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 5,698 Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002489

Yotrio Group

Researches, develops, manufactures, and sells outdoor furniture products in China, Europe, North and South America, Australia, Africa, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives