- Hong Kong

- /

- Real Estate

- /

- SEHK:2869

We Think The Compensation For Greentown Service Group Co. Ltd.'s (HKG:2869) CEO Looks About Right

Key Insights

- Greentown Service Group's Annual General Meeting to take place on 21st of June

- CEO Keli Jin's total compensation includes salary of CN¥1.67m

- The total compensation is 34% less than the average for the industry

- Over the past three years, Greentown Service Group's EPS fell by 6.4% and over the past three years, the total loss to shareholders 67%

Performance at Greentown Service Group Co. Ltd. (HKG:2869) has been rather uninspiring recently and shareholders may be wondering how CEO Keli Jin plans to fix this. At the next AGM coming up on 21st of June, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for Greentown Service Group

Comparing Greentown Service Group Co. Ltd.'s CEO Compensation With The Industry

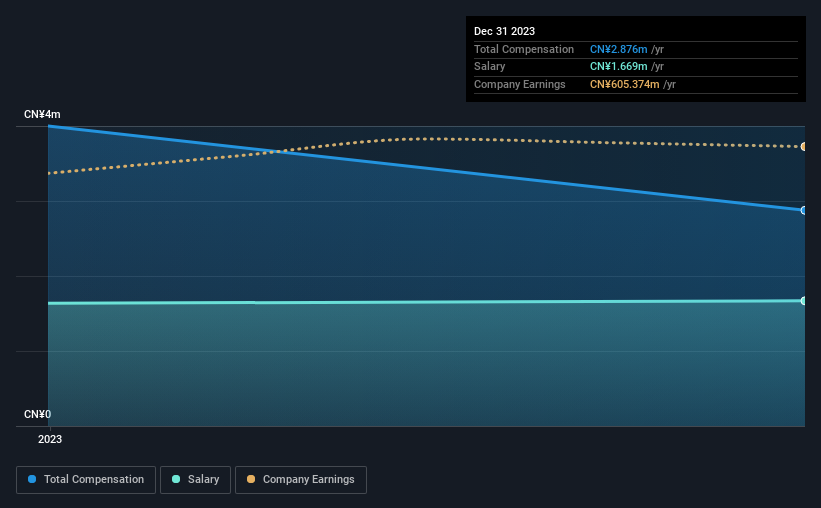

Our data indicates that Greentown Service Group Co. Ltd. has a market capitalization of HK$12b, and total annual CEO compensation was reported as CN¥2.9m for the year to December 2023. That's a notable decrease of 28% on last year. We note that the salary of CN¥1.67m makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the Hong Kong Real Estate industry with market capitalizations ranging between HK$7.8b and HK$25b had a median total CEO compensation of CN¥4.4m. In other words, Greentown Service Group pays its CEO lower than the industry median. Furthermore, Keli Jin directly owns HK$16m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.7m | CN¥1.6m | 58% |

| Other | CN¥1.2m | CN¥2.4m | 42% |

| Total Compensation | CN¥2.9m | CN¥4.0m | 100% |

Speaking on an industry level, nearly 77% of total compensation represents salary, while the remainder of 23% is other remuneration. Greentown Service Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Greentown Service Group Co. Ltd.'s Growth Numbers

Greentown Service Group Co. Ltd. has reduced its earnings per share by 6.4% a year over the last three years. In the last year, its revenue is up 17%.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Greentown Service Group Co. Ltd. Been A Good Investment?

The return of -67% over three years would not have pleased Greentown Service Group Co. Ltd. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. The downward trend in share price performance may be attributable to the the fact that earnings growth has gone backwards. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Greentown Service Group that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2869

Greentown Service Group

Provides residential property management services in the People's Republic of China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026