- Hong Kong

- /

- Real Estate

- /

- SEHK:266

Tian Teck Land Limited (HKG:266) Pays A HK$0.05 Dividend In Just Three Days

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Tian Teck Land Limited (HKG:266) is about to go ex-dividend in just three days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase Tian Teck Land's shares on or after the 12th of December, you won't be eligible to receive the dividend, when it is paid on the 19th of January.

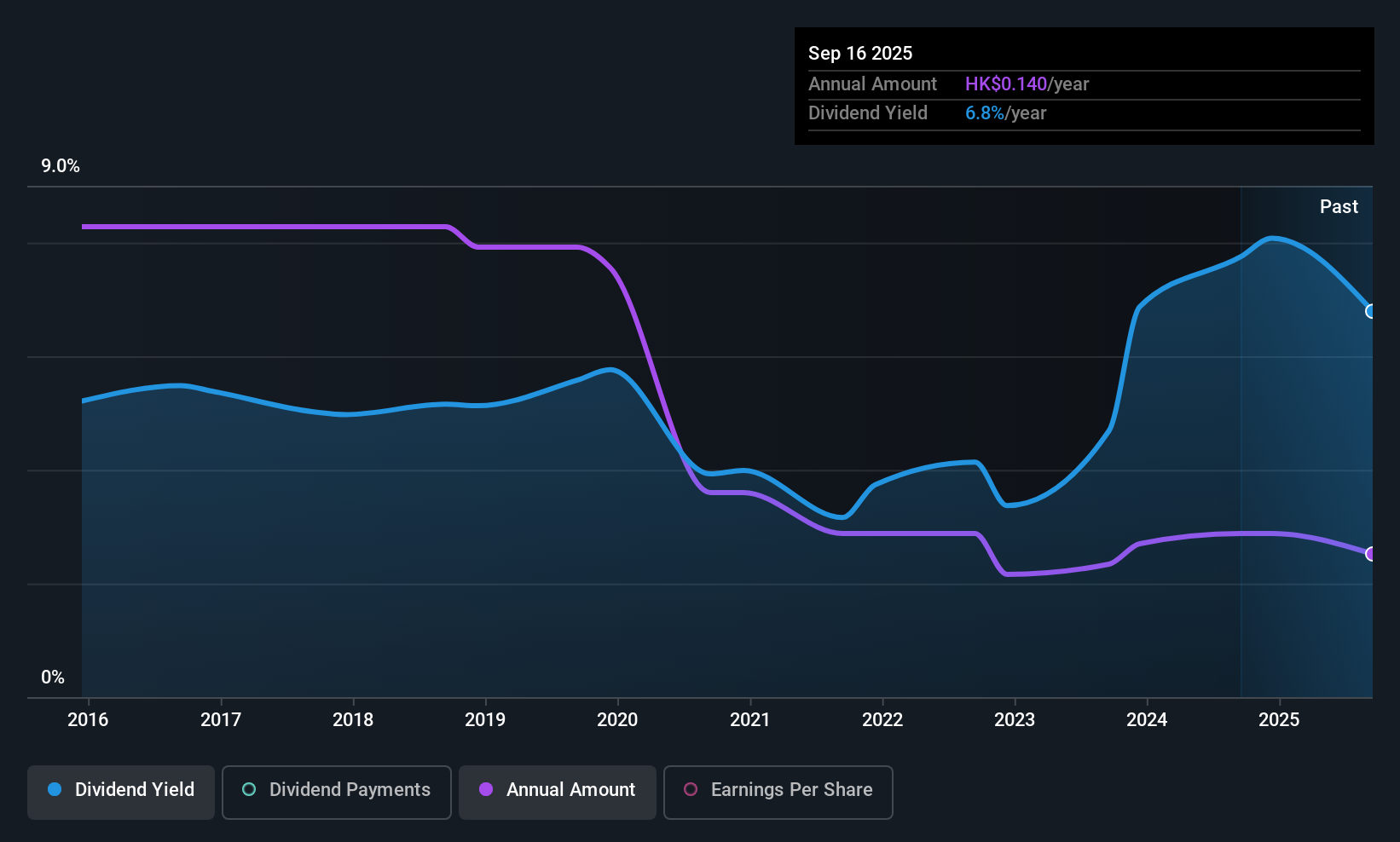

The company's upcoming dividend is HK$0.05 a share, following on from the last 12 months, when the company distributed a total of HK$0.14 per share to shareholders. Last year's total dividend payments show that Tian Teck Land has a trailing yield of 6.9% on the current share price of HK$2.04. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Tian Teck Land can afford its dividend, and if the dividend could grow.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Tian Teck Land reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If Tian Teck Land didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Dividends consumed 54% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

View our latest analysis for Tian Teck Land

Click here to see how much of its profit Tian Teck Land paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. Tian Teck Land was unprofitable last year, but at least the general trend suggests its earnings have been improving over the past five years. Even so, an unprofitable company whose business does not quickly recover is usually not a good candidate for dividend investors.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Tian Teck Land has seen its dividend decline 11% per annum on average over the past 10 years, which is not great to see.

We update our analysis on Tian Teck Land every 24 hours, so you can always get the latest insights on its financial health, here.

To Sum It Up

Is Tian Teck Land an attractive dividend stock, or better left on the shelf? It's hard to get used to Tian Teck Land paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. All things considered, we are not particularly enthused about Tian Teck Land from a dividend perspective.

So if you want to do more digging on Tian Teck Land, you'll find it worthwhile knowing the risks that this stock faces. In terms of investment risks, we've identified 1 warning sign with Tian Teck Land and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Tian Teck Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:266

Tian Teck Land

An investment holding company, engages in the property investment activities in the People’s Republic of China and Hong Kong.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026