- Hong Kong

- /

- Real Estate

- /

- SEHK:258

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Tomson Group Limited's (HKG:258) CEO For Now

Key Insights

- Tomson Group will host its Annual General Meeting on 5th of June

- Salary of HK$13.8m is part of CEO Feng Hsu's total remuneration

- Total compensation is 295% above industry average

- Tomson Group's total shareholder return over the past three years was 67% while its EPS was down 17% over the past three years

Tomson Group Limited (HKG:258) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 5th of June. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Tomson Group

How Does Total Compensation For Feng Hsu Compare With Other Companies In The Industry?

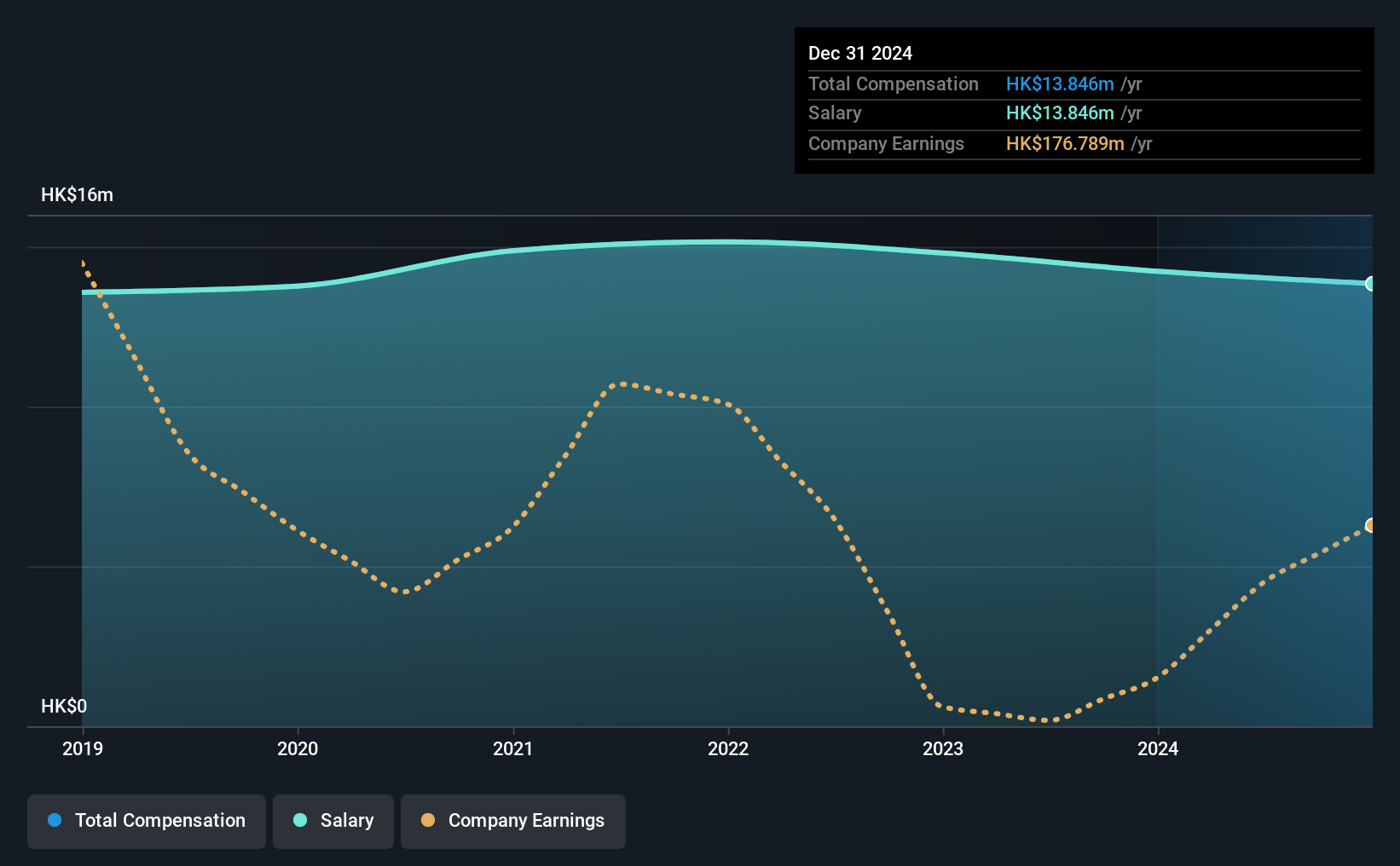

According to our data, Tomson Group Limited has a market capitalization of HK$5.7b, and paid its CEO total annual compensation worth HK$14m over the year to December 2024. That's mostly flat as compared to the prior year's compensation. Notably, the salary of HK$14m is the entirety of the CEO compensation.

In comparison with other companies in the Hong Kong Real Estate industry with market capitalizations ranging from HK$3.1b to HK$13b, the reported median CEO total compensation was HK$3.5m. Accordingly, our analysis reveals that Tomson Group Limited pays Feng Hsu north of the industry median. Moreover, Feng Hsu also holds HK$2.0b worth of Tomson Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$14m | HK$14m | 100% |

| Other | - | - | - |

| Total Compensation | HK$14m | HK$14m | 100% |

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. Speaking on a company level, Tomson Group prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Tomson Group Limited's Growth

Over the last three years, Tomson Group Limited has shrunk its earnings per share by 17% per year. It saw its revenue drop 23% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Tomson Group Limited Been A Good Investment?

Boasting a total shareholder return of 67% over three years, Tomson Group Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Tomson Group pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Tomson Group that you should be aware of before investing.

Important note: Tomson Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Tomson Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:258

Tomson Group

An investment holding company, engages in the property development and investment, hospitality and leisure, securities trading, and media and entertainment investment and operation businesses in Hong Kong, Macau, and Mainland China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives