- China

- /

- Consumer Durables

- /

- SHSE:603551

Undiscovered Gems with Strong Potential This February 2025

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, major indices have experienced volatility, with the S&P 500 reaching record highs before retreating due to economic uncertainties. In this environment, identifying stocks that exhibit resilience through strong fundamentals and growth potential becomes crucial for investors seeking opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Goldiam International | 0.67% | 12.04% | 14.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallantt Ispat | 15.54% | 34.24% | 41.38% | ★★★★★★ |

| Force Motors | 8.95% | 26.62% | 61.62% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.16% | -5.78% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 56.23% | 33.99% | 34.28% | ★★★★★★ |

| Rir Power Electronics | 21.19% | 21.54% | 38.94% | ★★★★★☆ |

| Nibe | 30.41% | 78.22% | 83.19% | ★★★★☆☆ |

| Western Carriers (India) | 34.72% | 9.79% | 14.42% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tomson Group (SEHK:258)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomson Group Limited is an investment holding company involved in property development and investment, hospitality and leisure, securities trading, and media and entertainment operations across Hong Kong, Macau, and Mainland China with a market capitalization of approximately HK$6.59 billion.

Operations: Revenue primarily comes from property investment and leisure activities, with property investment contributing HK$217.63 million and leisure generating HK$49.69 million. Securities trading adds HK$20.19 million to the revenue stream.

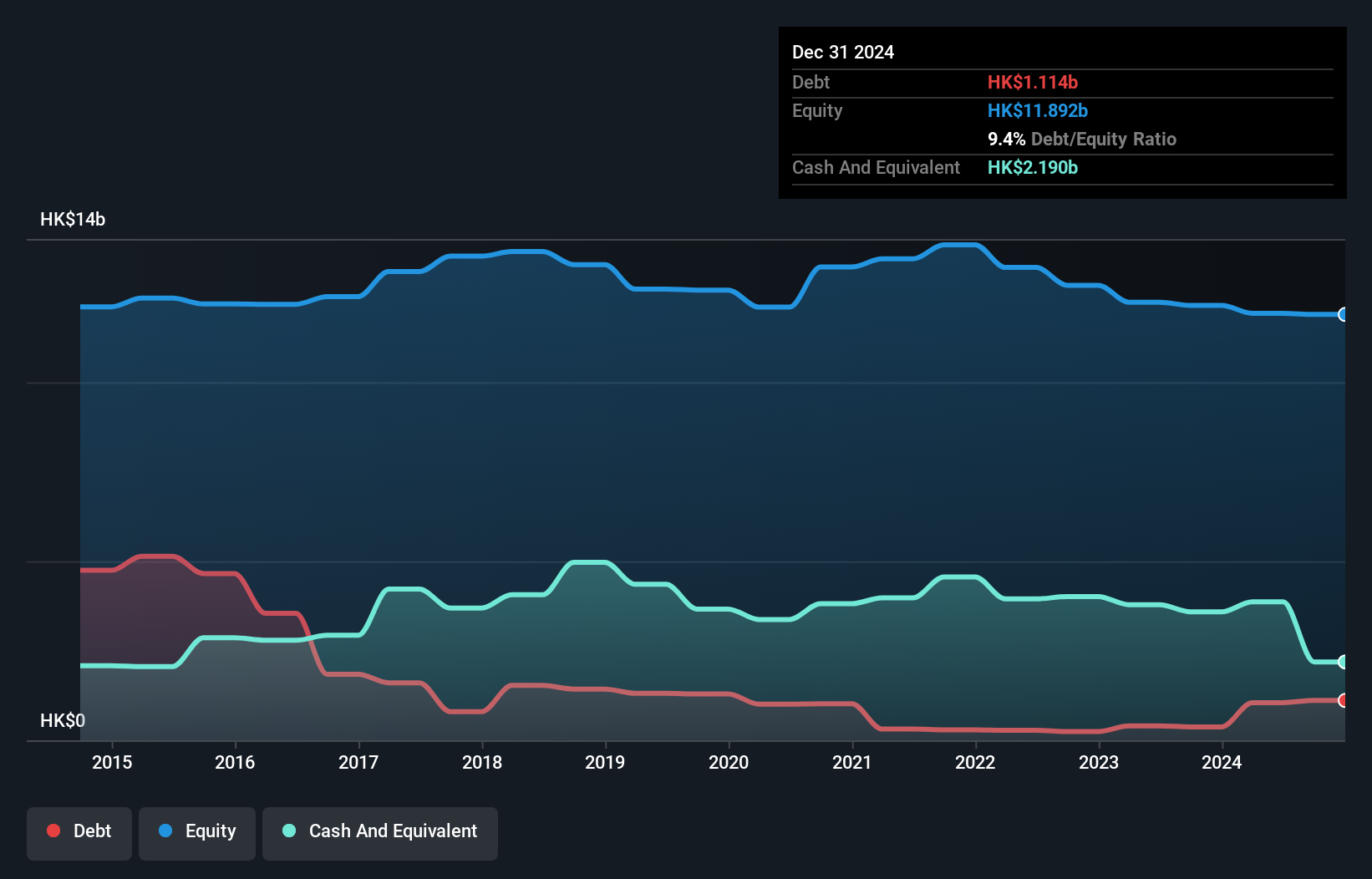

Tomson Group, a nimble player in the real estate sector, has seen its earnings skyrocket by an impressive 2337.4% over the past year, outpacing the industry average of -15.9%. Despite a historical decline in earnings at 23.6% annually over five years, Tomson's recent performance suggests potential for turnaround. The company boasts high-quality earnings and maintains more cash than its total debt, with a reduced debt-to-equity ratio from 10.4 to 8.8 over five years. While free cash flow remains negative, their ability to cover interest payments comfortably indicates financial stability amidst growth challenges.

- Take a closer look at Tomson Group's potential here in our health report.

Review our historical performance report to gain insights into Tomson Group's's past performance.

AUPU Intelligent Technology (SHSE:603551)

Simply Wall St Value Rating: ★★★★★☆

Overview: AUPU Intelligent Technology Corporation Limited focuses on the R&D, production, sales, and service of household products in China with a market capitalization of CN¥4.31 billion.

Operations: AUPU Intelligent Technology generates revenue primarily from the sales of household products in China. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

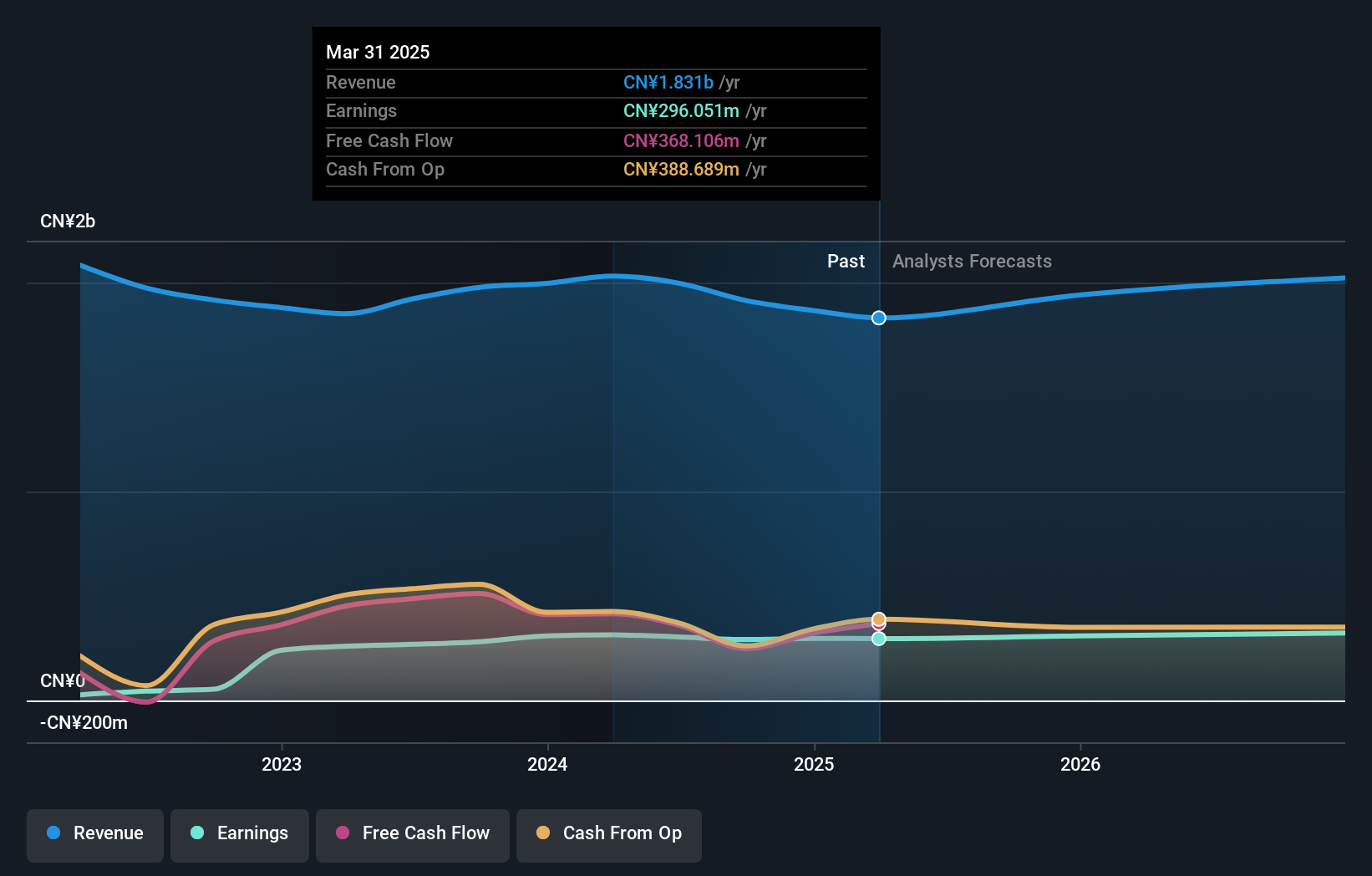

AUPU Intelligent Technology, a smaller player in the market, has been making waves with its recent performance. Over the past year, earnings grew by 3.6%, outpacing the Consumer Durables industry’s -0.4%. The company appears to be on solid financial footing, boasting more cash than total debt and maintaining a low debt-to-equity ratio of 0.08%. With a price-to-earnings ratio of 14.8x against the wider CN market's 38x, it seems undervalued relative to peers. Additionally, AUPU recently completed share buybacks totaling CNY 100.03 million for about 2.53% of shares outstanding, signaling confidence in its future prospects.

Alltek Technology (TWSE:3209)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alltek Technology Corporation functions as a communication components distributor and solution provider across Taiwan, China, and international markets, with a market cap of NT$9.40 billion.

Operations: Alltek Technology's primary revenue streams are derived from Alltek Technology Corp. and Alltek Group Corp along with Alltek Technology (H.K.) Limited, contributing NT$25.58 billion and NT$22.22 billion respectively. Gaosen Technology, Inc. adds a smaller portion to the revenue with NT$690.32 million.

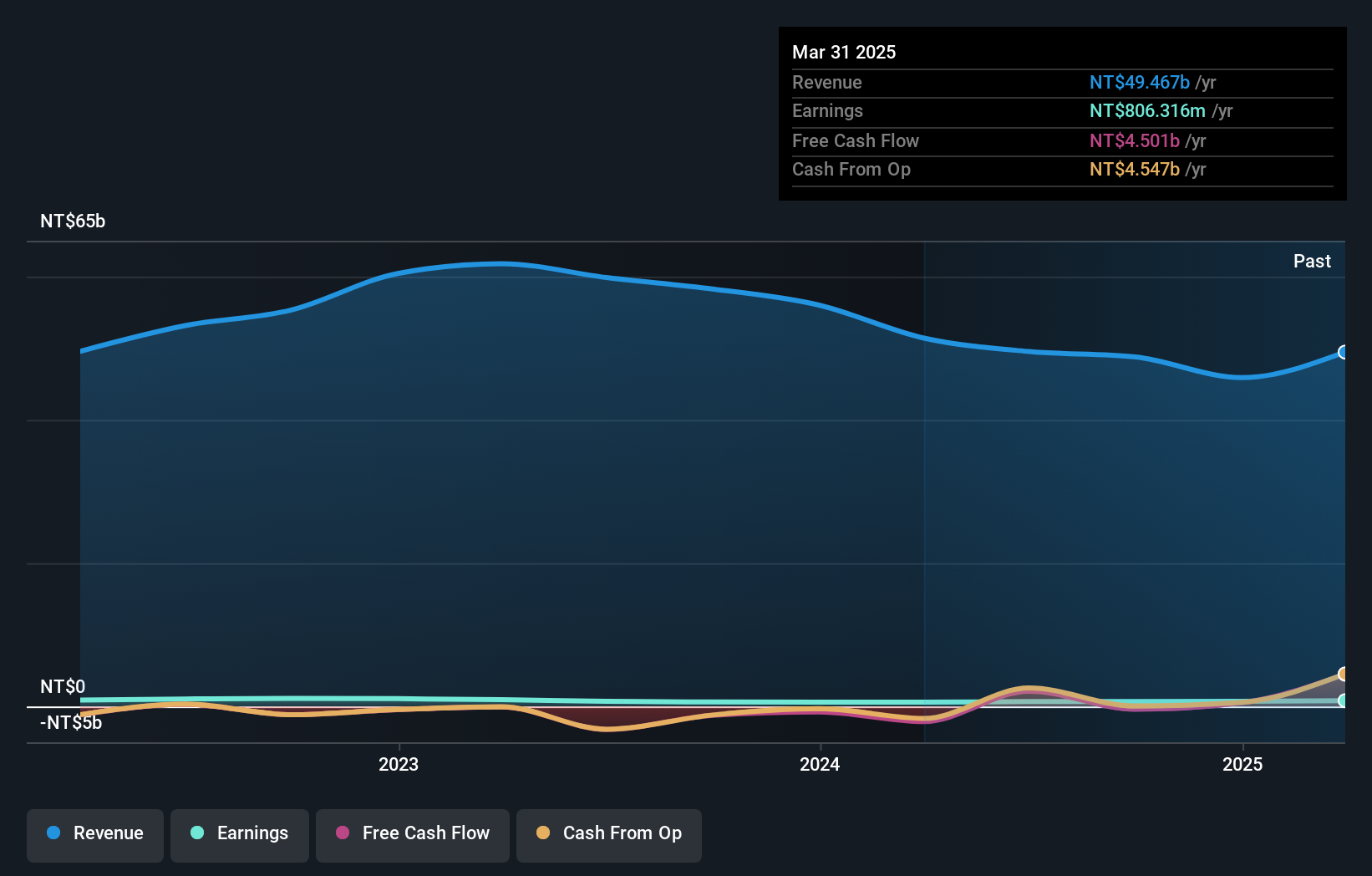

Alltek Technology, a small cap player in the electronics industry, has shown promising signs with its earnings growth of 8.9% over the past year, outpacing the industry's 7.8%. Its price-to-earnings ratio of 13.7x is notably below the TW market average of 21.7x, suggesting potential undervaluation. The company boasts high-quality past earnings and has effectively reduced its debt to equity ratio from 215.2% to 166.4% over five years, though its net debt to equity remains high at 154.3%. Despite these challenges, Alltek's EBIT covers interest payments well at a multiple of 3.5x.

- Navigate through the intricacies of Alltek Technology with our comprehensive health report here.

Gain insights into Alltek Technology's past trends and performance with our Past report.

Summing It All Up

- Click this link to deep-dive into the 4752 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603551

AUPU Intelligent Technology

Engages in the research and development, production, sales, and service of various household products in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives