- Hong Kong

- /

- Real Estate

- /

- SEHK:258

Undiscovered Gems In Hong Kong And 3 Small Caps With Promising Potential

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has experienced a notable uptick, buoyed by global economic developments and a positive sentiment shift following the U.S. Federal Reserve's rate cut. This environment presents an opportune moment to explore small-cap stocks that have promising potential yet remain under the radar. Identifying good stocks in this climate involves looking for companies with strong fundamentals and growth prospects that can capitalize on favorable economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Morimatsu International Holdings (SEHK:2155)

Simply Wall St Value Rating: ★★★★★★

Overview: Morimatsu International Holdings Company Limited designs, manufactures, installs, operates, and maintains process equipment and systems for chemical, polymerization, and bio-reactions in China and internationally with a market cap of HK$5.67 billion.

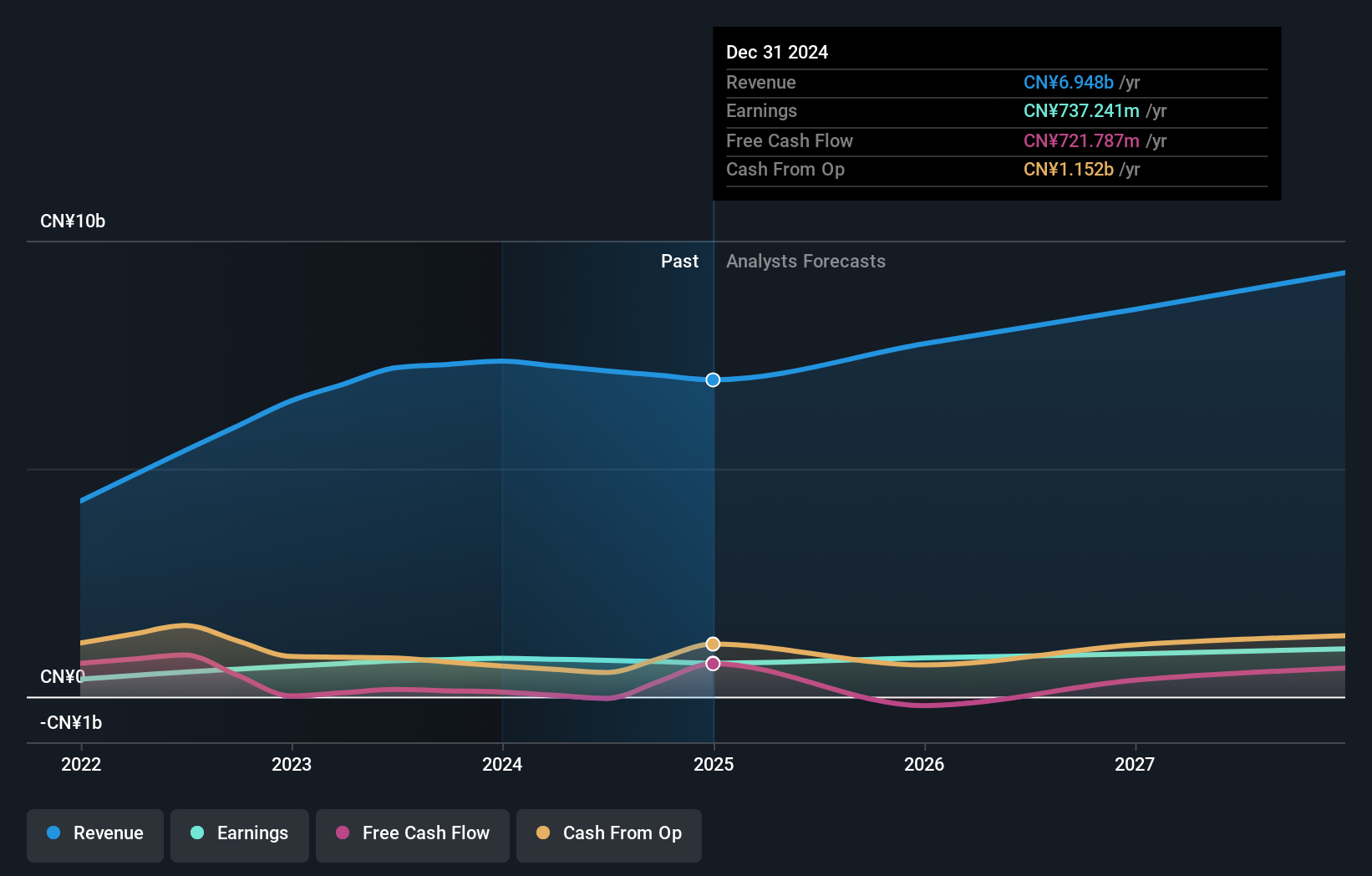

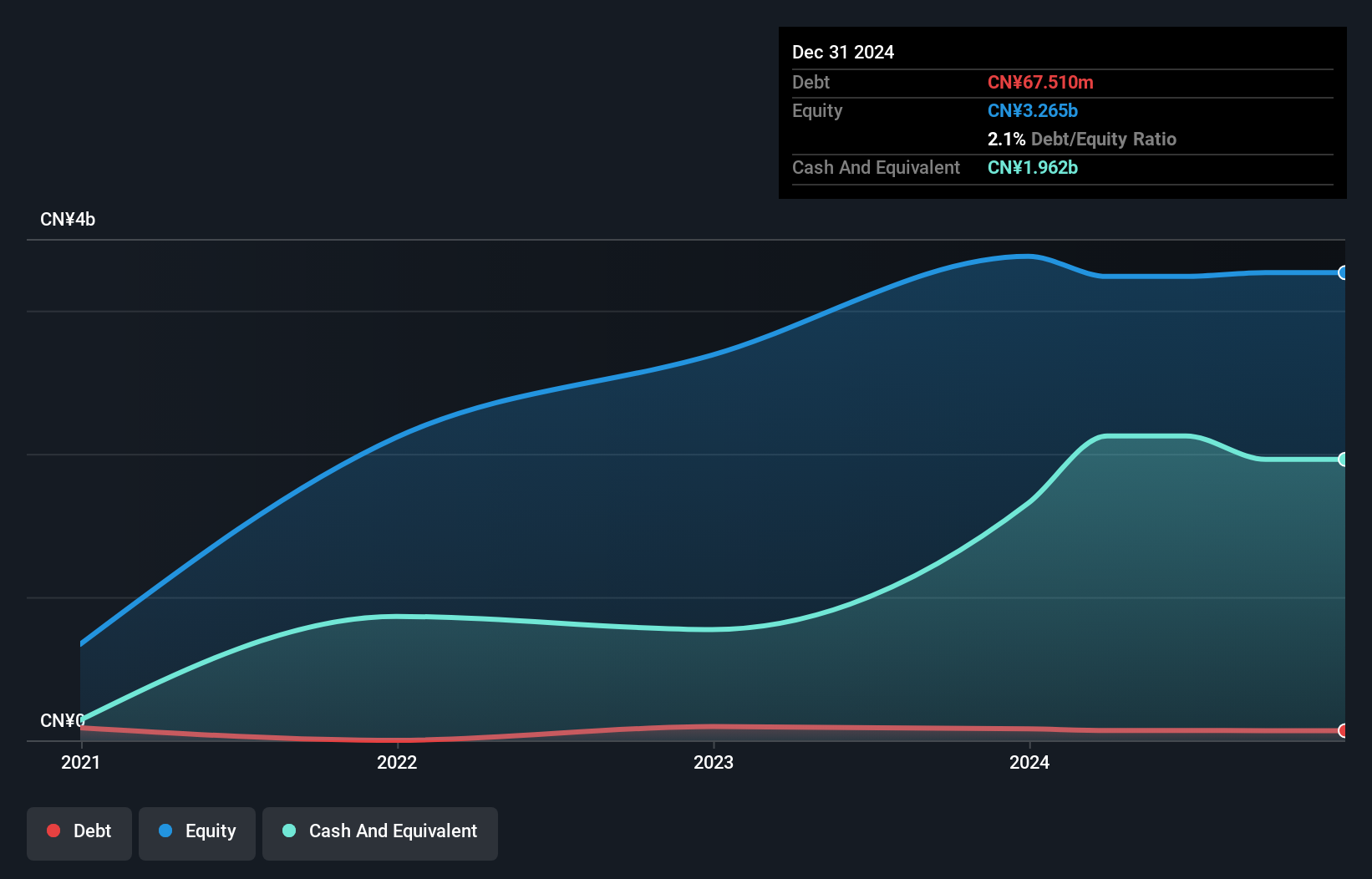

Operations: Morimatsu International Holdings generates revenue primarily from the production and sales of various pressure equipment, amounting to CN¥7.15 billion. The company has a market cap of HK$5.67 billion.

Morimatsu International Holdings has shown a robust financial profile, with earnings growing 35.1% annually over the past five years and a reduction in its debt-to-equity ratio from 54.2% to 5.7%. Despite these strengths, recent half-year results indicated sales of CNY 3.48 billion and net income of CNY 375.89 million, which were lower than the previous year's figures. The company initiated share repurchases on August 21, potentially enhancing net asset value per share and earnings per share moving forward.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$6.98 billion.

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily through retail sales in grocery stores, amounting to CN¥5.998 billion. The company has a market capitalization of HK$6.98 billion.

Guoquan Food (Shanghai) reported half-year sales of CNY 2.67 billion, down from CNY 2.76 billion the previous year, with net income at CNY 85.98 million compared to CNY 107.7 million last year. The company’s basic earnings per share dropped to CNY 0.0313 from CNY 0.0403 a year ago, and it approved a final cash dividend of RMB 0.0521 per share for the prior fiscal year in June's AGM meeting, expected for payment by August-end.

- Get an in-depth perspective on Guoquan Food (Shanghai)'s performance by reading our health report here.

Learn about Guoquan Food (Shanghai)'s historical performance.

Tomson Group (SEHK:258)

Simply Wall St Value Rating: ★★★★★☆

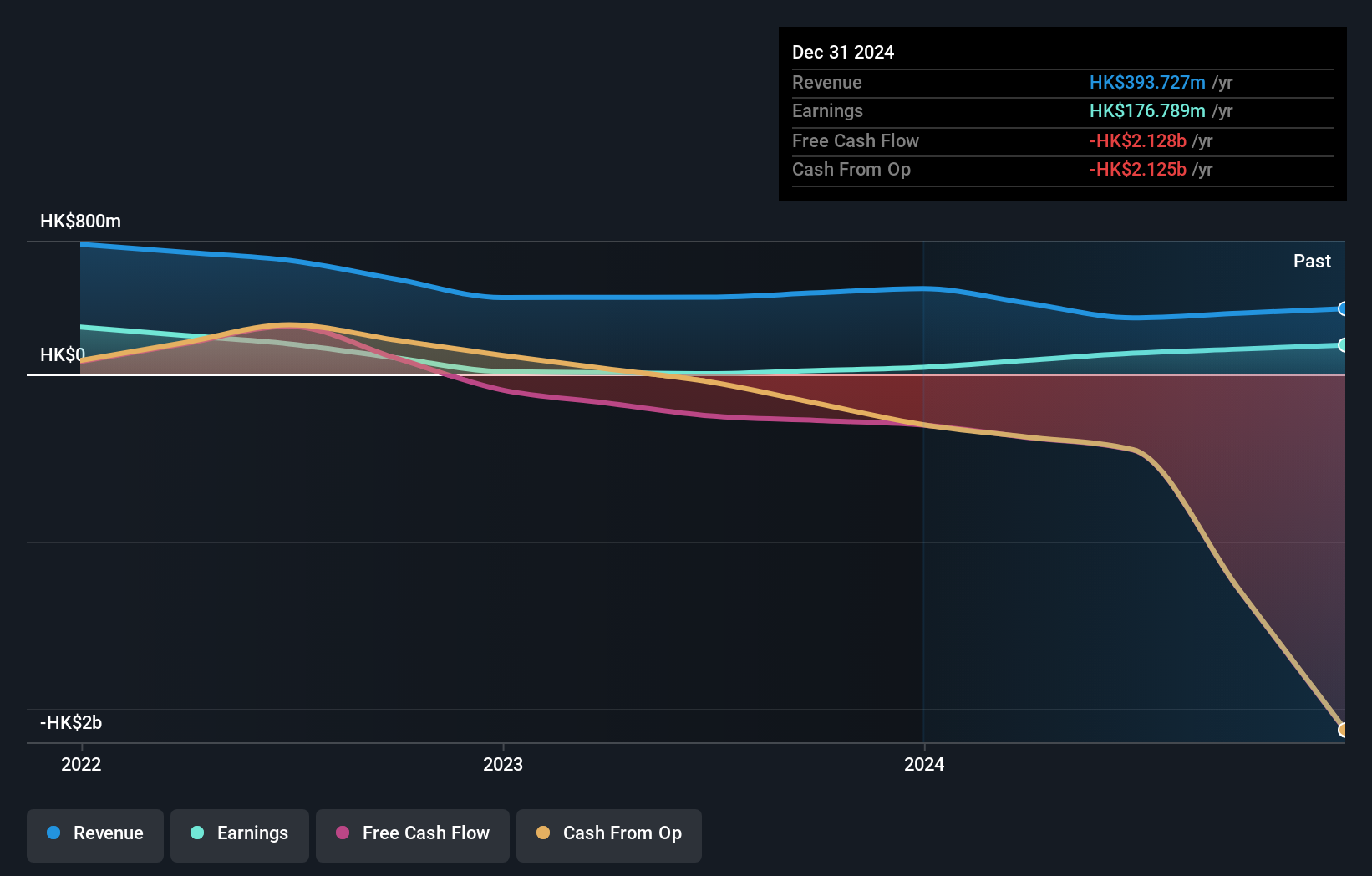

Overview: Tomson Group Limited is an investment holding company involved in property development and investment, hospitality and leisure, securities trading, and media and entertainment operations across Hong Kong, Macau, and Mainland China with a market cap of HK$4.94 billion.

Operations: Tomson Group generates revenue primarily from property investment (HK$217.63 million), leisure (HK$49.69 million), and securities trading (HK$20.19 million) across Hong Kong, Macau, and Mainland China.

Tomson Group has shown remarkable earnings growth of 2337% over the past year, with net income reaching HK$103.67 million for the half-year ending June 2024, up from HK$19.39 million a year ago. The company repurchased shares in 2024 and reduced its debt-to-equity ratio from 10.4% to 8.8% over five years. Despite a large one-off loss of HK$71.8 million impacting recent results, Tomson's profitability and interest coverage remain strong indicators of its financial health in the real estate sector.

- Navigate through the intricacies of Tomson Group with our comprehensive health report here.

Assess Tomson Group's past performance with our detailed historical performance reports.

Taking Advantage

- Dive into all 170 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomson Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:258

Tomson Group

An investment holding company, engages in the property development and investment, hospitality and leisure, securities trading, and media and entertainment investment and operation businesses in Hong Kong, Macau, and Mainland China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives