- Hong Kong

- /

- Real Estate

- /

- SEHK:258

Three Undiscovered Gems in Hong Kong with Promising Potential

Reviewed by Simply Wall St

The recent rally in global markets, spurred by the U.S. Federal Reserve's first rate cut in over four years, has brought renewed interest to smaller-cap indexes, including those in Hong Kong. Amid this backdrop of economic optimism and investor enthusiasm, we explore three undiscovered gems within the Hong Kong market that show promising potential. In times of broad market rallies and favorable economic indicators, identifying stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, an investment holding company with a market cap of HK$12.31 billion, engages in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company reported a market cap of HK$12.31 billion.

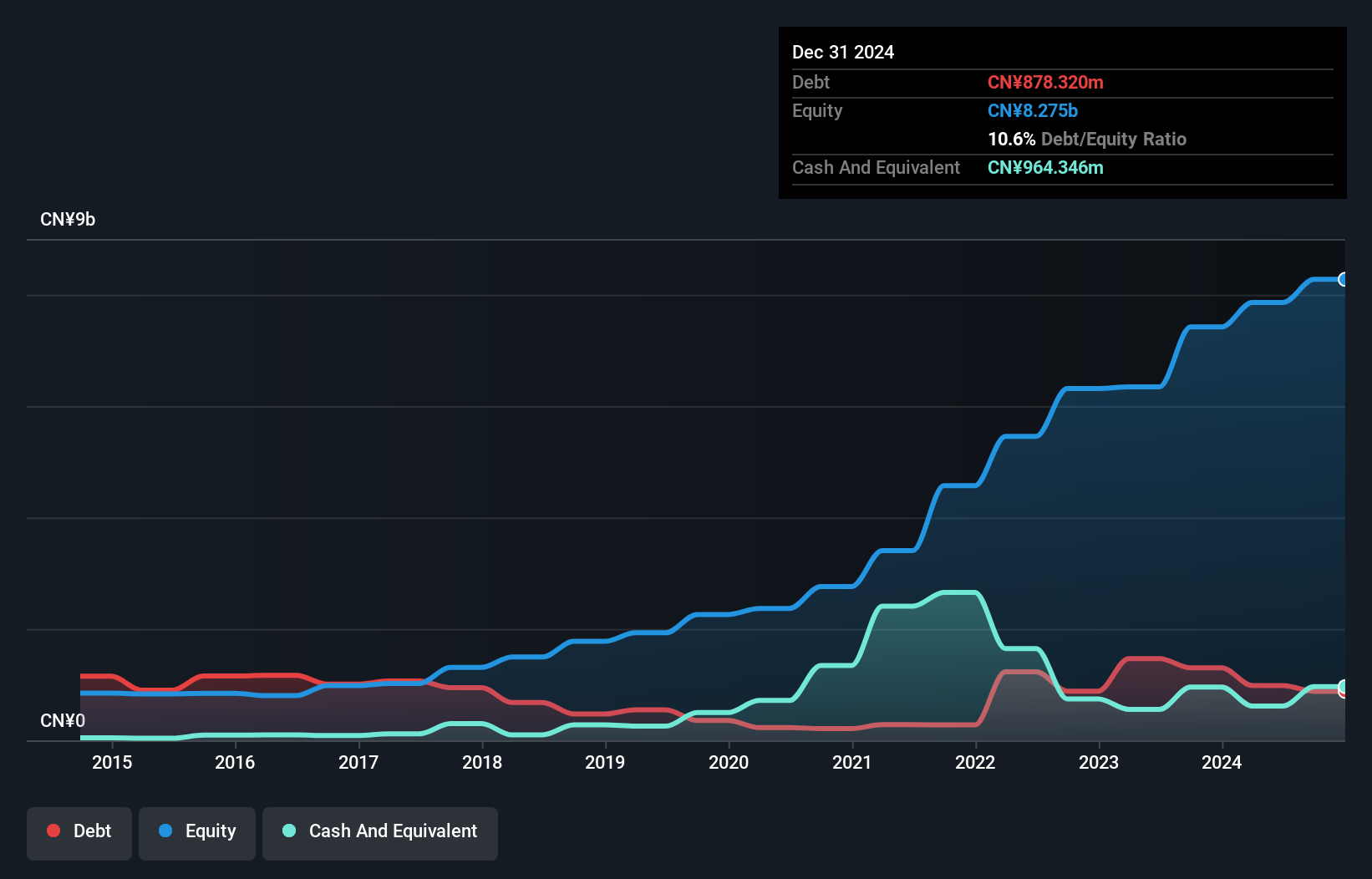

Kinetic Development Group has shown impressive earnings growth of 39.2% over the past year, significantly outpacing the Oil and Gas industry’s 4.6%. The company reported half-year sales of CNY 2.53 billion, up from CNY 1.49 billion a year ago, with net income rising to CNY 1.10 billion from CNY 570 million. Kinetic's debt management is strong, with a net debt to equity ratio of just 4.7%, and its EBIT covers interest payments by an impressive 163 times.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$7.47 billion.

Operations: The company generates revenue primarily from retail grocery stores, amounting to CN¥5.998 billion.

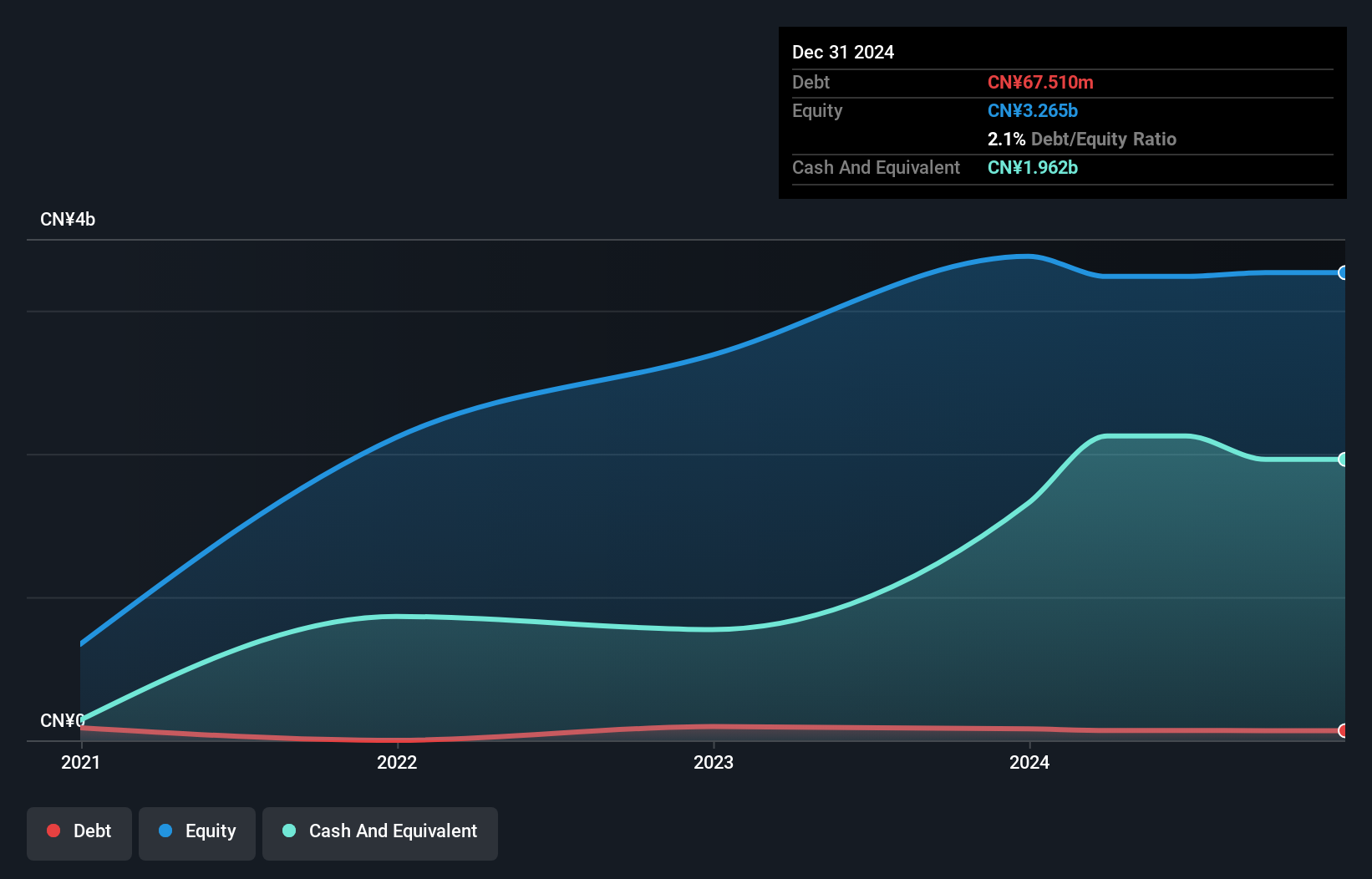

Guoquan Food (Shanghai) reported half-year sales of CNY 2.67 billion, down from CNY 2.76 billion last year, with net income at CNY 85.98 million compared to CNY 107.7 million previously. Basic earnings per share dropped to CNY 0.0313 from CNY 0.0403 a year ago, reflecting some challenges in the market environment. Despite this, the company is profitable and has more cash than total debt, indicating a strong financial position overall.

- Navigate through the intricacies of Guoquan Food (Shanghai) with our comprehensive health report here.

Evaluate Guoquan Food (Shanghai)'s historical performance by accessing our past performance report.

Tomson Group (SEHK:258)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomson Group Limited, with a market cap of HK$5.18 billion, is an investment holding company involved in property development and investment, hospitality and leisure, securities trading, and media and entertainment operations across Hong Kong, Macau, and Mainland China.

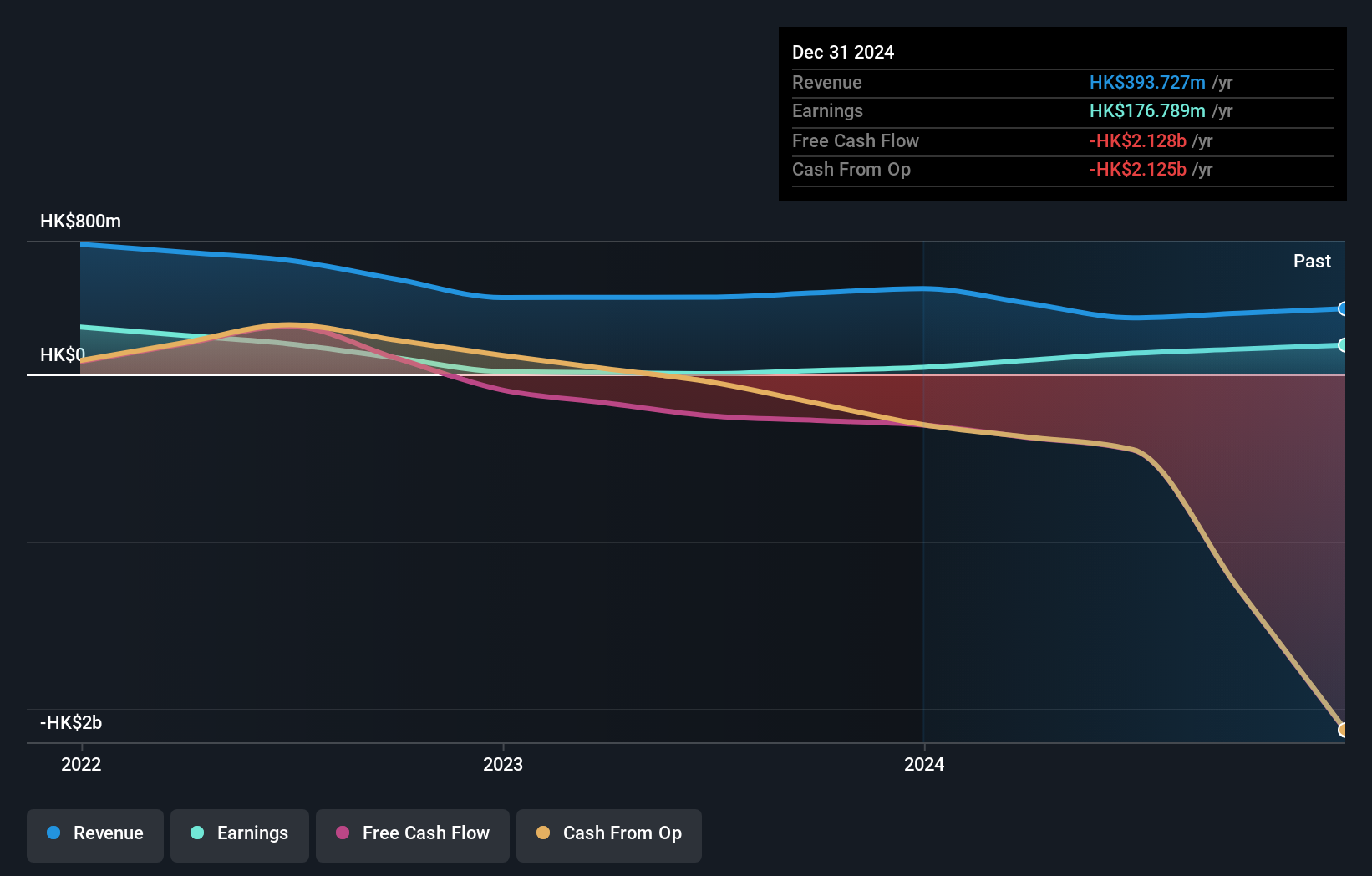

Operations: Tomson Group Limited generates revenue primarily from property investment (HK$217.63 million), followed by leisure (HK$49.69 million) and securities trading (HK$20.19 million).

Tomson Group reported a significant turnaround with net income soaring to HK$103.67 million for the half year ended June 30, 2024, from HK$19.39 million a year ago. Sales dipped to HK$129.57 million from HK$304.29 million in the same period last year, but earnings per share jumped to HK$0.0503 from HK$0.0098. The impressive profit increase is largely due to a forfeiture of deposit upon terminating an agreement related to a subsidiary disposal.

- Click here and access our complete health analysis report to understand the dynamics of Tomson Group.

Gain insights into Tomson Group's past trends and performance with our Past report.

Summing It All Up

- Dive into all 168 of the SEHK Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomson Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:258

Tomson Group

An investment holding company, engages in the property development and investment, hospitality and leisure, securities trading, and media and entertainment investment and operation businesses in Hong Kong, Macau, and Mainland China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives